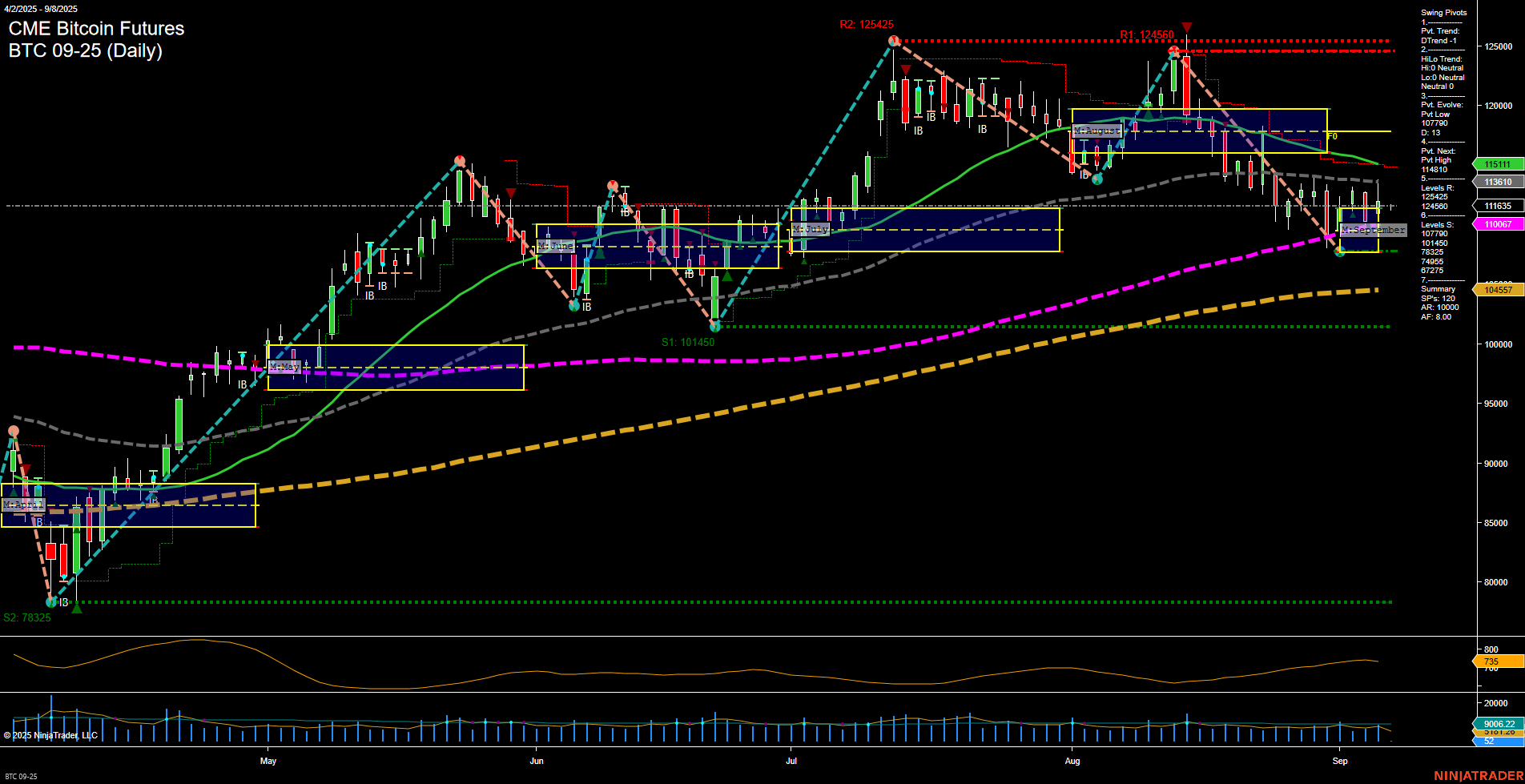

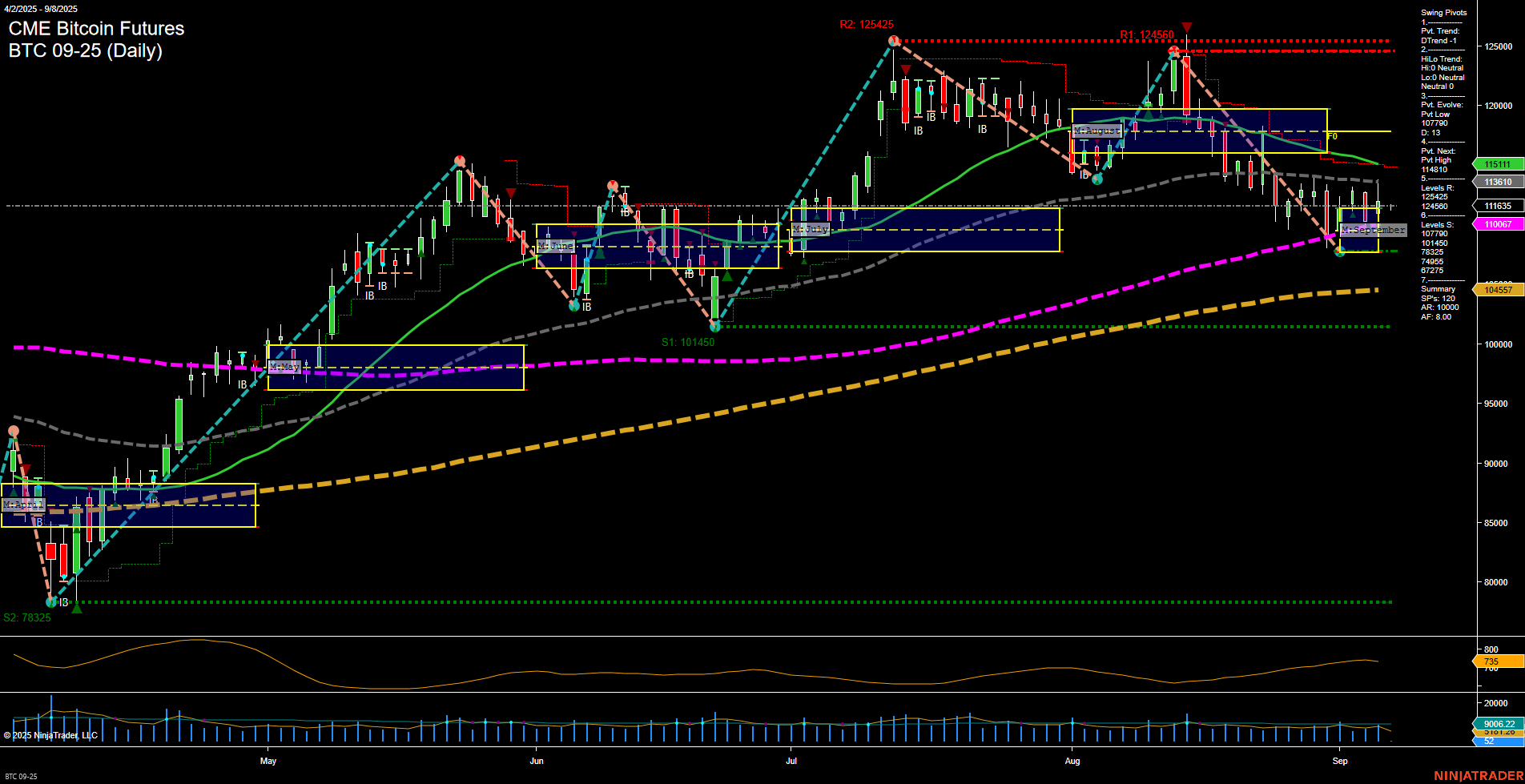

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Sep-07 18:03 CT

Price Action

- Last: 111635,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 111635,

- 4. Pvt. Next: Pvt high 115111,

- 5. Levels R: 124550, 115111, 113510,

- 6. Levels S: 110067, 104557, 101450, 78325.

Daily Benchmarks

- (Short-Term) 5 Day: 111635 Down Trend,

- (Short-Term) 10 Day: 113510 Down Trend,

- (Intermediate-Term) 20 Day: 115111 Down Trend,

- (Intermediate-Term) 55 Day: 113510 Down Trend,

- (Long-Term) 100 Day: 110067 Up Trend,

- (Long-Term) 200 Day: 104557 Up Trend.

Additional Metrics

Recent Trade Signals

- 02 Sep 2025: Long BTC 09-25 @ 111810 Signals.USAR-MSFG

- 02 Sep 2025: Long BTC 09-25 @ 110890 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

BTC CME futures are currently in a corrective phase on the daily chart, with price action showing medium-sized bars and slow momentum. The short-term trend is bearish, as indicated by the WSFG and swing pivot trend, with price trading below the weekly NTZ and all short-term and intermediate-term moving averages trending down. However, the intermediate and long-term outlooks remain bullish, supported by the MSFG and YSFG trends, as well as the 100-day and 200-day moving averages, which are still in uptrends. The market recently established a swing low at 111635, with the next key resistance at 115111 and major resistance at 124550. Support levels are clustered around 110067 and 104557. Recent trade signals have triggered long entries, suggesting potential for a reversal or at least a stabilization phase. Volatility remains moderate, and volume is steady, indicating a possible transition from a pullback to a base-building phase. The overall structure suggests a market in consolidation after a pullback, with the potential for renewed upside if resistance levels are reclaimed.

Chart Analysis ATS AI Generated: 2025-09-07 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.