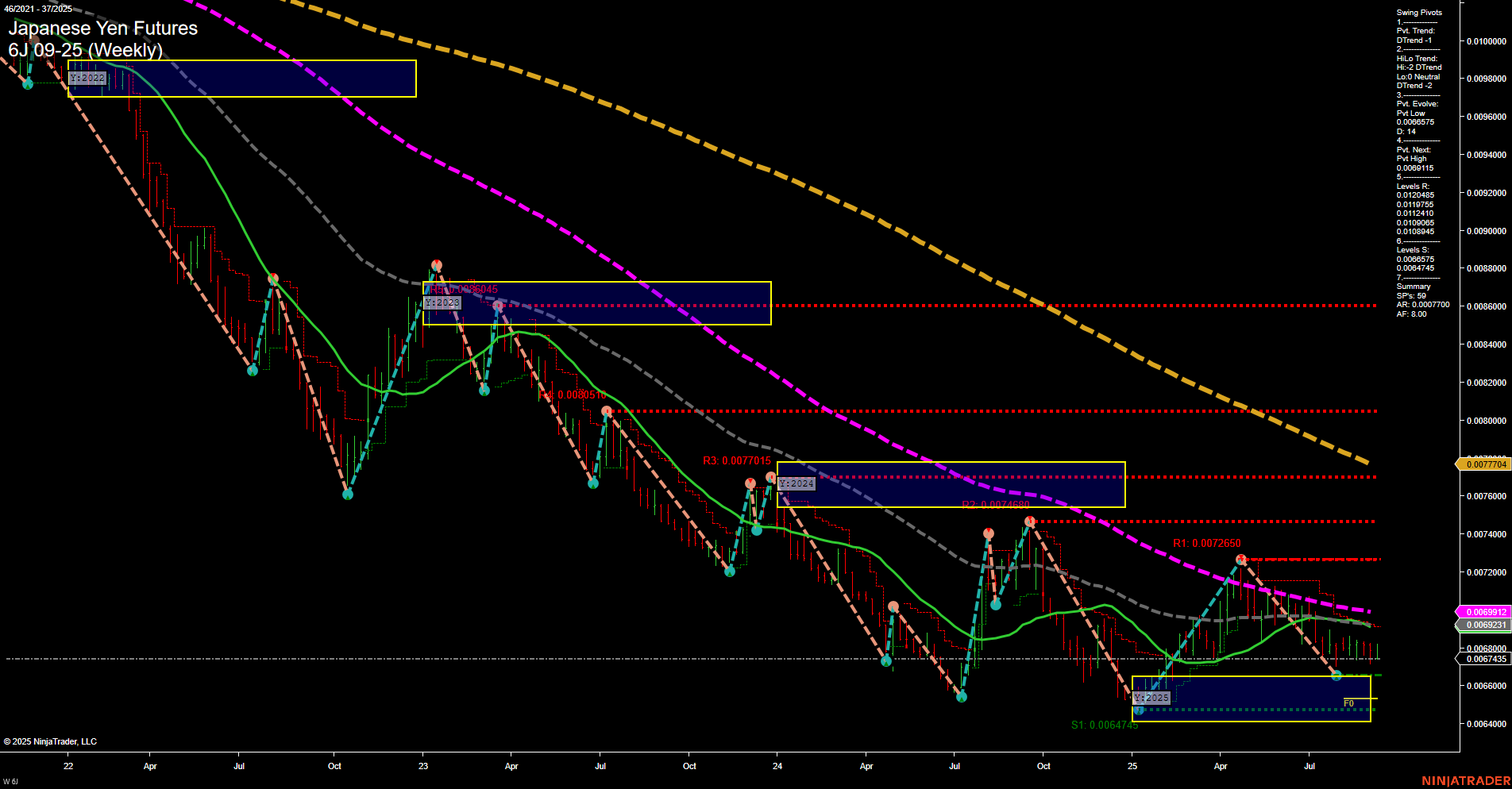

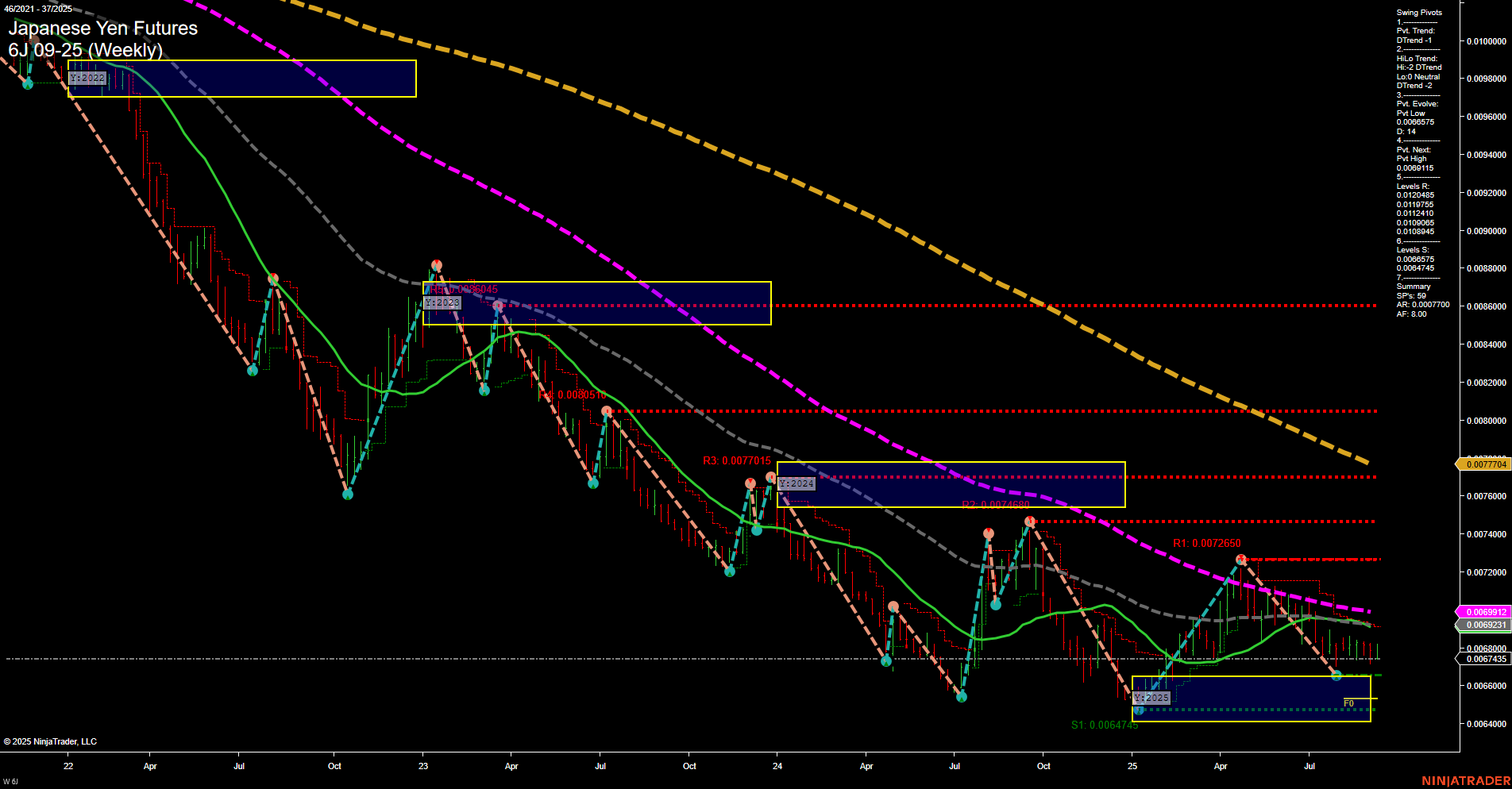

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Sep-07 18:02 CT

Price Action

- Last: 0.0068080,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -58%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0064745,

- 4. Pvt. Next: Pvt High 0.0072605,

- 5. Levels R: 0.0080515, 0.0077015, 0.0072650, 0.0071495, 0.0071260, 0.0070195, 0.0068865,

- 6. Levels S: 0.0064745, 0.0064745, 0.0004745.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0069321 Down Trend,

- (Intermediate-Term) 10 Week: 0.0069691 Down Trend,

- (Long-Term) 20 Week: 0.0069508 Down Trend,

- (Long-Term) 55 Week: 0.0072600 Down Trend,

- (Long-Term) 100 Week: 0.0069912 Down Trend,

- (Long-Term) 200 Week: 0.0077704 Down Trend.

Recent Trade Signals

- 05 Sep 2025: Long 6J 09-25 @ 0.0068065 Signals.USAR.TR120

- 05 Sep 2025: Short 6J 09-25 @ 0.0067525 Signals.USAR-MSFG

- 01 Sep 2025: Short 6J 09-25 @ 0.006804 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart continues to reflect a dominant bearish structure in both the short- and intermediate-term timeframes, as evidenced by the persistent downtrends in the WSFG and MSFG grids, as well as the swing pivot trends. Price remains below the NTZ center on both the weekly and monthly session grids, reinforcing the downward bias. All key moving averages (5, 10, 20, 55, 100, and 200 week) are trending down, with price trading below these benchmarks, confirming sustained selling pressure and a lack of bullish momentum. The most recent swing pivot is a low at 0.0064745, with the next significant resistance at 0.0072605, and multiple resistance levels stacked above current price, suggesting any rallies may face overhead supply. The long-term YSFG grid shows a slight upward trend, but this is not yet supported by price action or moving averages, keeping the long-term outlook neutral for now. Recent trade signals are mixed, with a short-term long signal but two short signals in line with the prevailing trend. Overall, the chart suggests a market in a prolonged downtrend, with any bounces likely to be corrective within a broader bearish context. Volatility appears subdued, and the market is consolidating near recent lows, with no clear signs of reversal at this stage.

Chart Analysis ATS AI Generated: 2025-09-07 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.