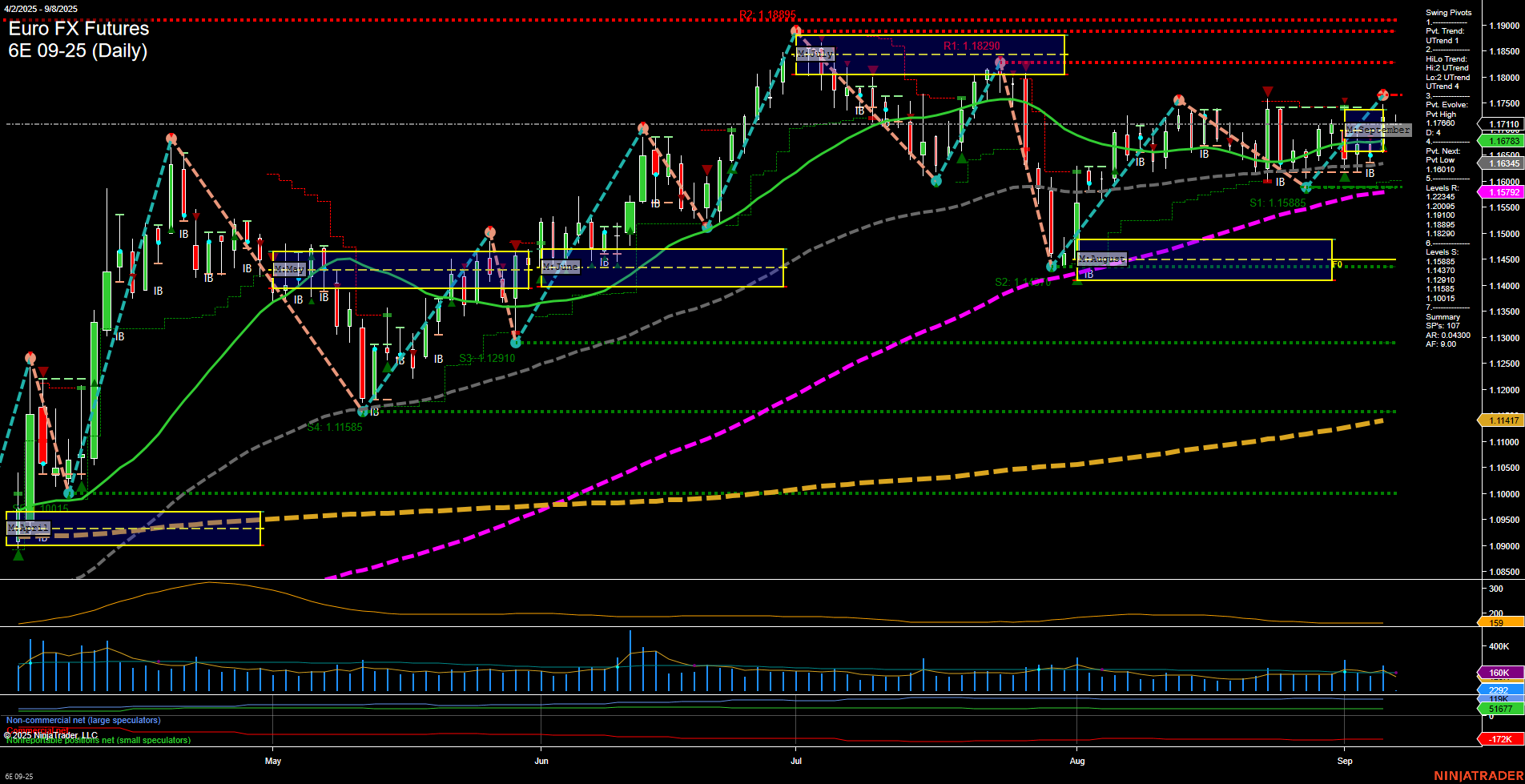

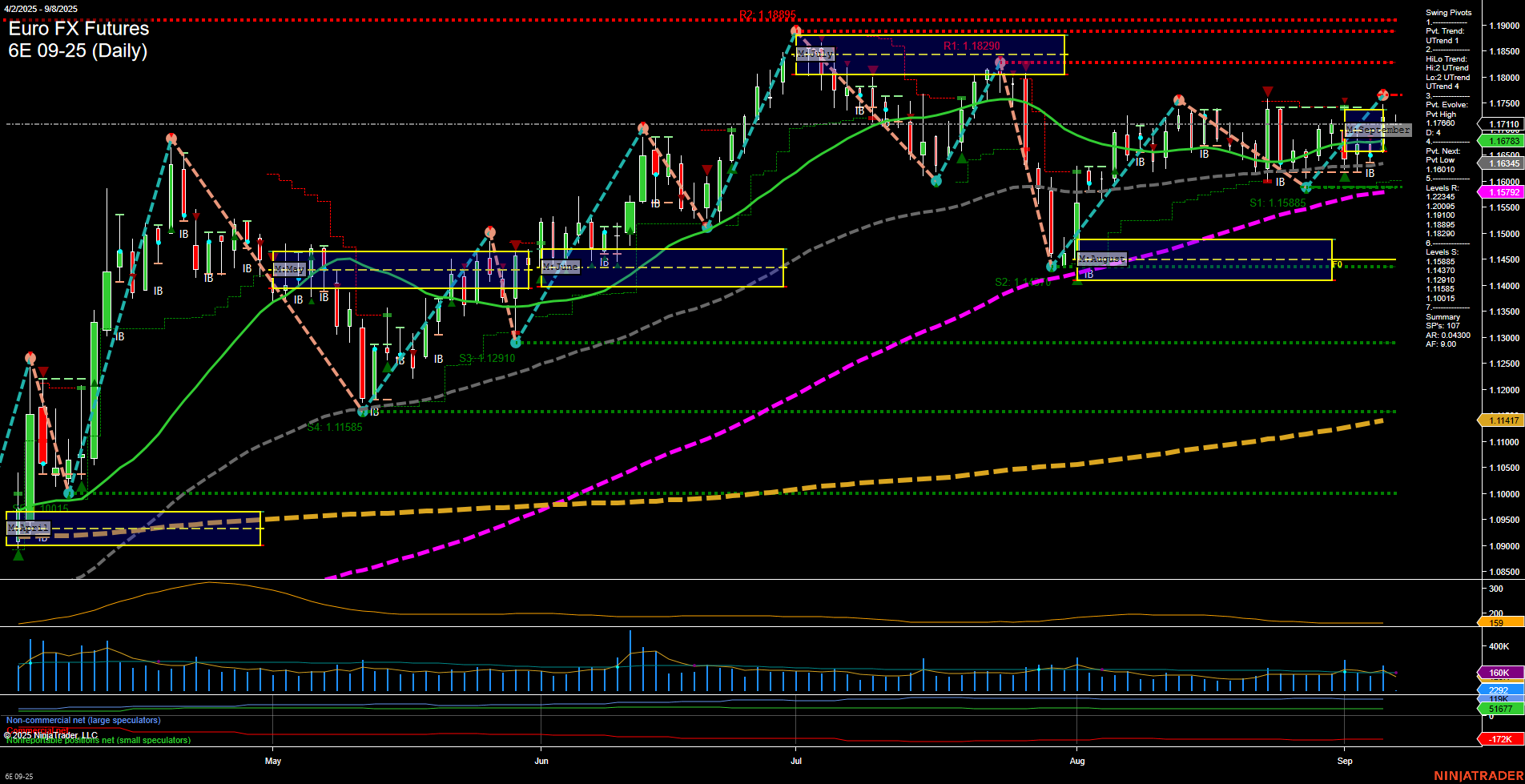

6E Euro FX Futures Daily Chart Analysis: 2025-Sep-07 18:01 CT

Price Action

- Last: 1.1673,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 85%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1.1711,

- 4. Pvt. Next: Pvt Low 1.1563,

- 5. Levels R: 1.18895, 1.18290, 1.17110,

- 6. Levels S: 1.15885, 1.12910, 1.11585, 1.11417.

Daily Benchmarks

- (Short-Term) 5 Day: 1.1673 Up Trend,

- (Short-Term) 10 Day: 1.1601 Up Trend,

- (Intermediate-Term) 20 Day: 1.1579 Up Trend,

- (Intermediate-Term) 55 Day: 1.1492 Up Trend,

- (Long-Term) 100 Day: 1.1437 Up Trend,

- (Long-Term) 200 Day: 1.1142 Up Trend.

Additional Metrics

Recent Trade Signals

- 05 Sep 2025: Long 6E 09-25 @ 1.1724 Signals.USAR-WSFG

- 05 Sep 2025: Long 6E 09-25 @ 1.1765 Signals.USAR-MSFG

- 05 Sep 2025: Long 6E 09-25 @ 1.1694 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in a broad uptrend across all timeframes, with the price currently consolidating just below recent swing highs. Short-term and intermediate-term trends have shifted to uptrends, confirmed by both swing pivot structure and all benchmark moving averages trending higher. The price is trading just below the NTZ/F0% levels for both the weekly and monthly session fib grids, suggesting some near-term resistance and a possible pause or minor retracement. However, the long-term yearly grid remains strongly bullish, with price well above its annual F0% level. Recent trade signals have triggered new long entries, indicating renewed bullish momentum after a period of sideways action. Volatility (ATR) and volume (VOLMA) are moderate, supporting the view of a healthy, active market. The chart structure shows a series of higher lows and higher highs, with key support levels well below current price, and resistance at prior swing highs. Overall, the technical landscape favors the bulls, with the potential for further upside if the market can break above the immediate resistance zone.

Chart Analysis ATS AI Generated: 2025-09-07 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.