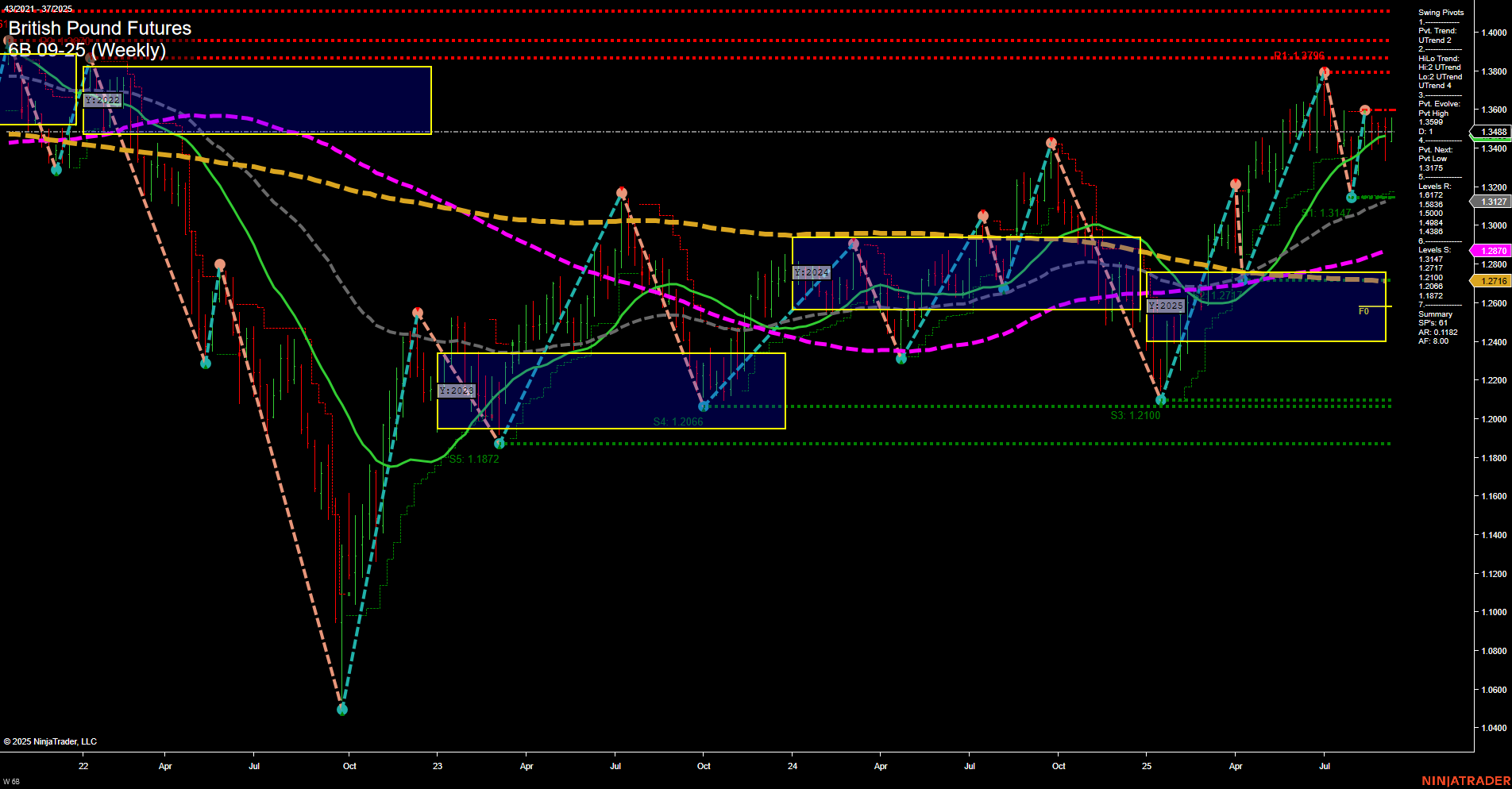

The British Pound Futures (6B) weekly chart shows a market in transition. Price action is currently consolidating after a strong rally, with medium-sized bars and average momentum. Short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both down, with price below their respective NTZ/F0% levels, indicating some near-term weakness or corrective action. However, the long-term (YSFG) trend remains up, with price well above the yearly NTZ/F0% and a strong 51% reading, suggesting the broader bullish structure is intact. Swing pivot analysis highlights an uptrend in both short-term and intermediate-term pivots, with the next significant resistance at 1.3715 and major support clustered around 1.3142–1.2870. All benchmark moving averages from 5-week to 200-week are trending up, reinforcing the underlying bullish bias on higher timeframes. Recent trade signals have triggered long entries, aligning with the prevailing uptrend in the benchmarks. Overall, the market is experiencing a short-term pause or pullback within a larger bullish trend. The structure suggests a period of consolidation or minor retracement before a potential continuation higher, with key resistance and support levels to watch for breakout or reversal signals. The technical landscape remains constructive for bulls on intermediate and long-term horizons, while short-term traders may see choppy or range-bound conditions as the market digests recent gains.