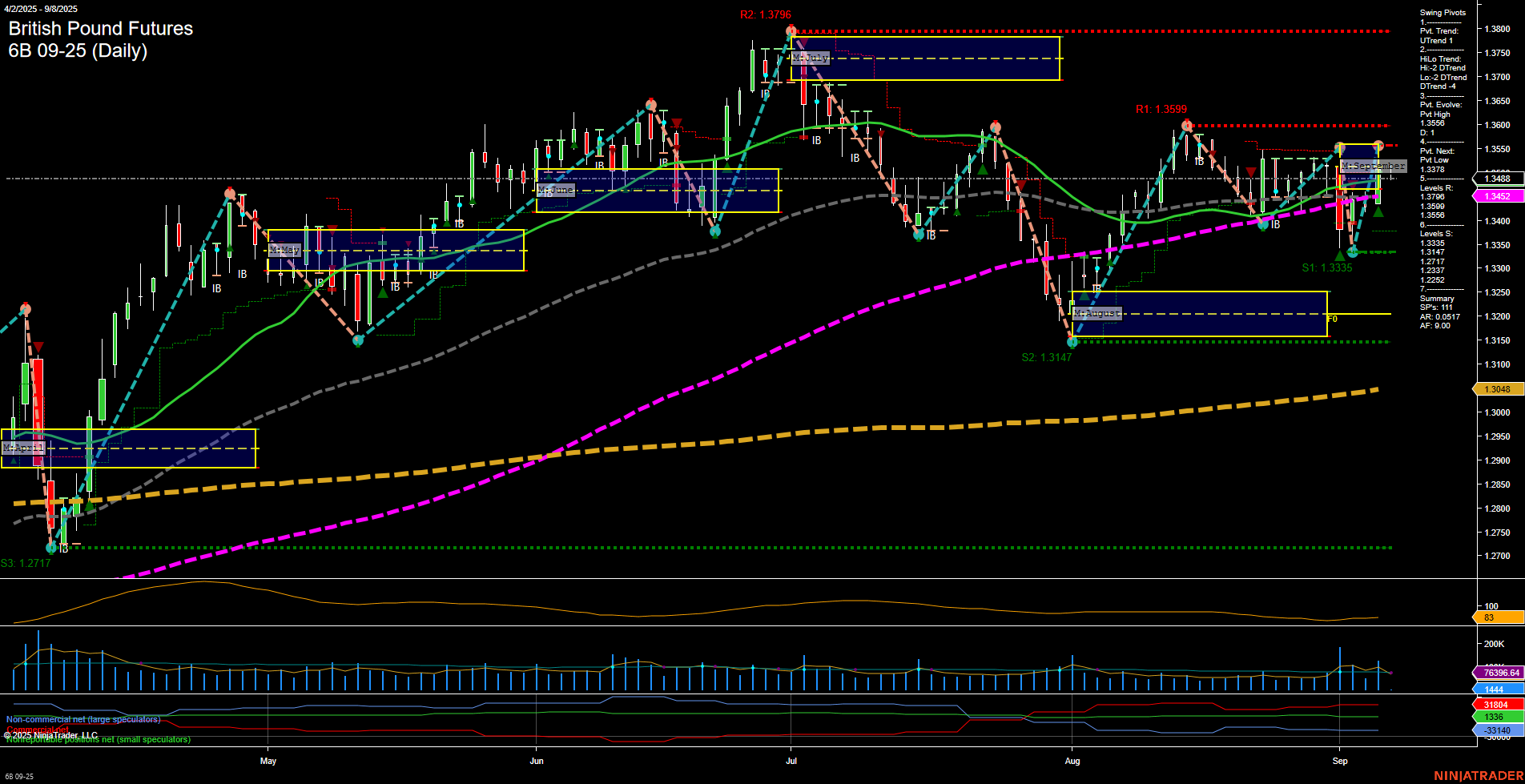

The British Pound Futures (6B) daily chart shows a market in transition. Price action is currently consolidating near 1.3488, with medium-sized bars and average momentum, suggesting neither strong buying nor selling pressure in the immediate term. The short-term Weekly Session Fib Grid (WSFG) and Monthly Session Fib Grid (MSFG) both indicate a downward trend, with price trading below their respective NTZ/F0% levels, reflecting short- and intermediate-term bearishness. However, the long-term Yearly Session Fib Grid (YSFG) remains in an uptrend, with price above the annual NTZ/F0%, highlighting underlying bullish structure. Swing pivots show a short-term uptrend (UTrend) but an intermediate-term downtrend (DTrend), with the most recent pivot high at 1.3506 and the next potential pivot low at 1.3378. Resistance is layered above at 1.3599 and 1.3506, while support sits at 1.3335 and lower. All benchmark moving averages (from 5-day to 200-day) are trending up, indicating that the broader trend remains constructive despite recent pullbacks. ATR and volume metrics suggest moderate volatility and healthy participation. Recent trade signals have triggered long entries, but the mixed trend signals across timeframes point to a market at a crossroads. In summary, the short-term outlook is neutral as the market digests recent moves, the intermediate-term is bearish due to prevailing downward pressure, while the long-term remains bullish, supported by higher lows and rising moving averages. This environment may favor range-bound or mean-reverting strategies until a decisive breakout or breakdown occurs.