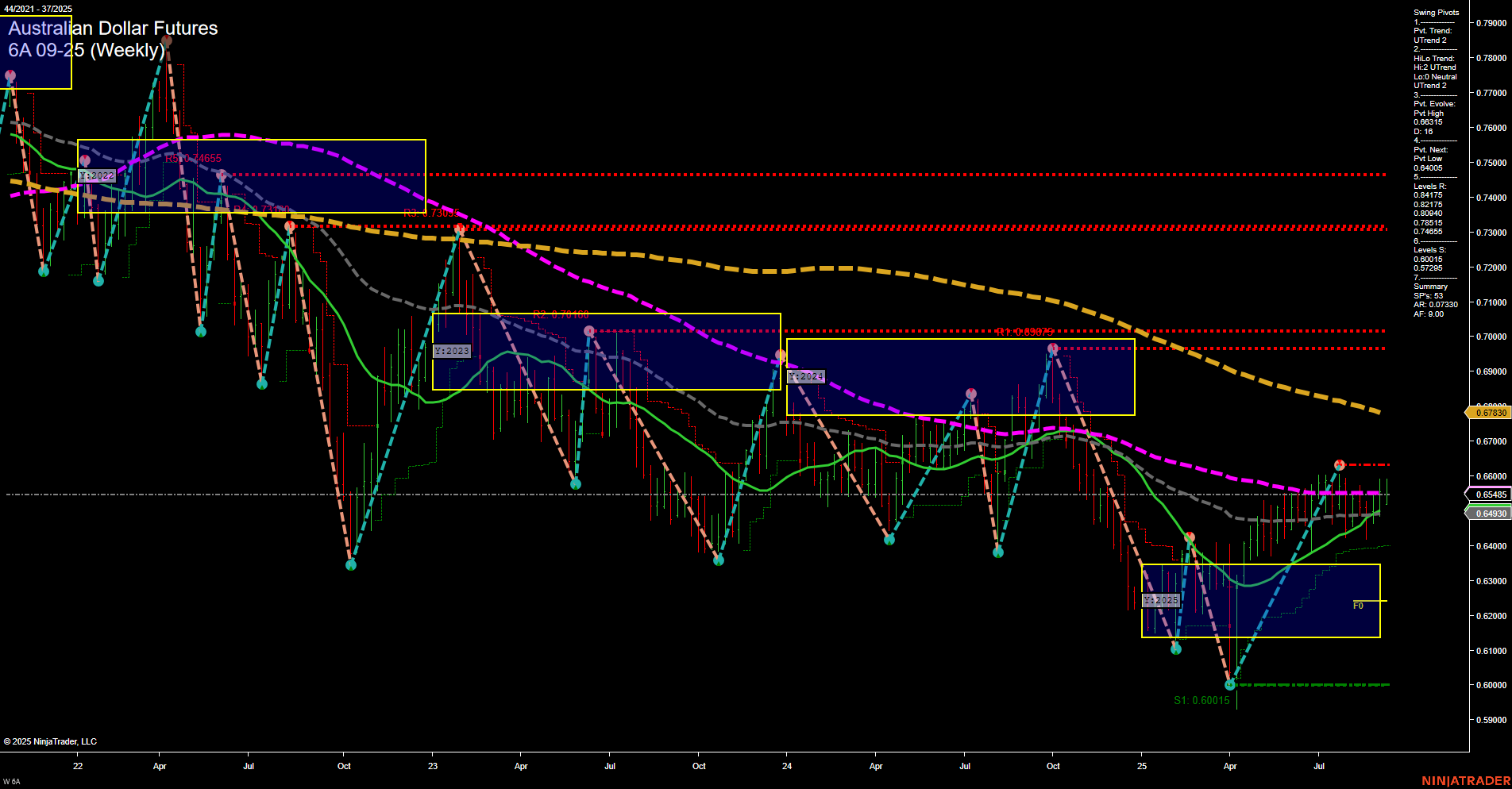

The 6A Australian Dollar Futures weekly chart shows a recent shift in momentum, with price action moving off the lows and establishing a series of higher lows and higher highs, as indicated by the swing pivot uptrend in both short- and intermediate-term metrics. The last price is trading above the 5, 10, and 20-week moving averages, all of which are in uptrends, supporting the bullish tone in the short and intermediate term. However, the longer-term 55, 100, and 200-week moving averages remain in downtrends, and price is still below these key resistance levels, suggesting that the broader trend is still neutral and has not yet confirmed a full reversal. Recent trade signals have all been to the long side, aligning with the current upward momentum. The price is approaching significant resistance levels around 0.65415 to 0.67830, which could act as barriers if the rally continues. The only major support level is at 0.60015, marking the recent swing low. The overall structure suggests a market in recovery mode, with potential for further upside if resistance levels are broken, but with the need for confirmation from longer-term trend indicators before a sustained bullish trend can be established. The environment appears to be transitioning from consolidation to a possible trend continuation, but the long-term outlook remains cautious until key resistance levels are decisively cleared.