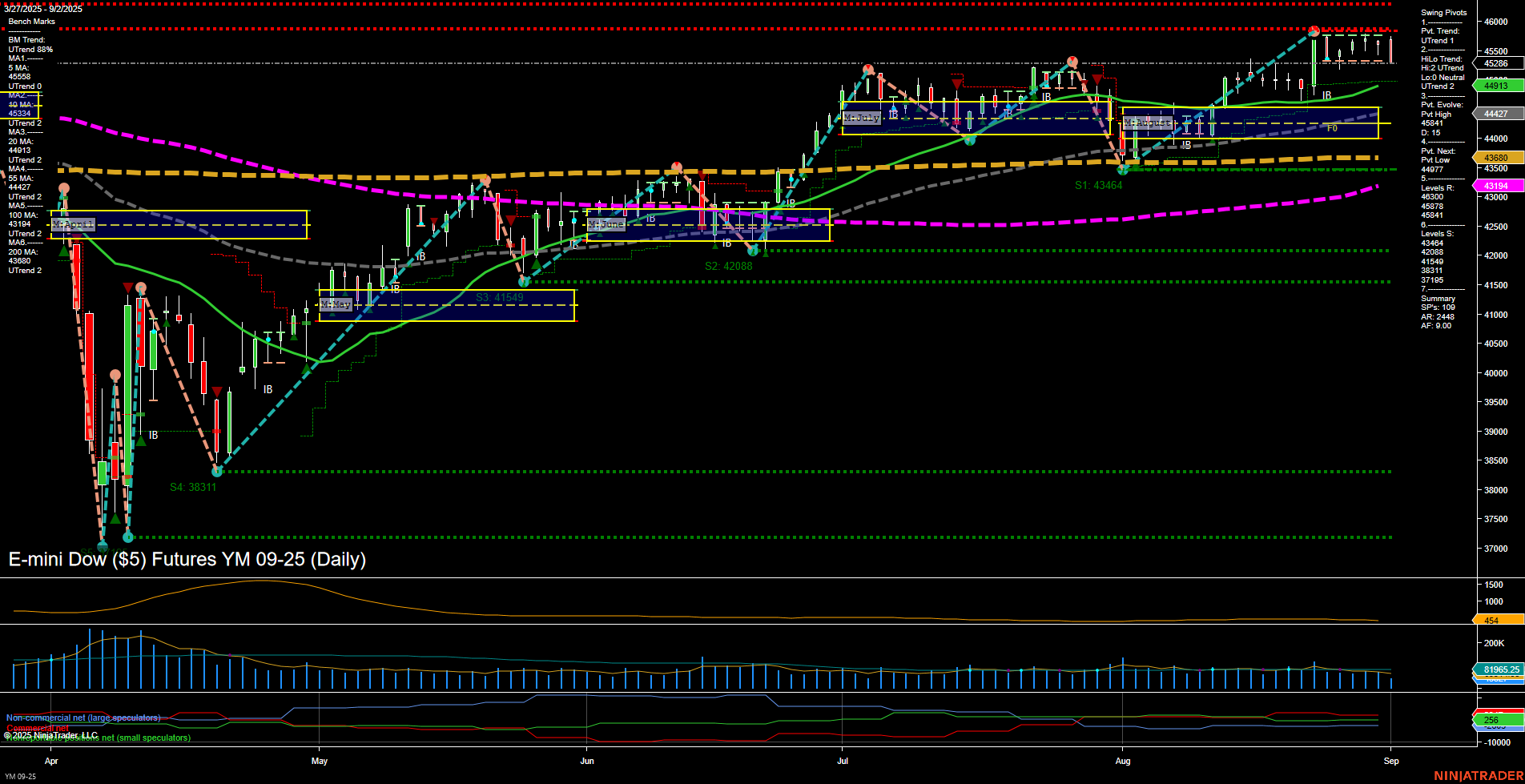

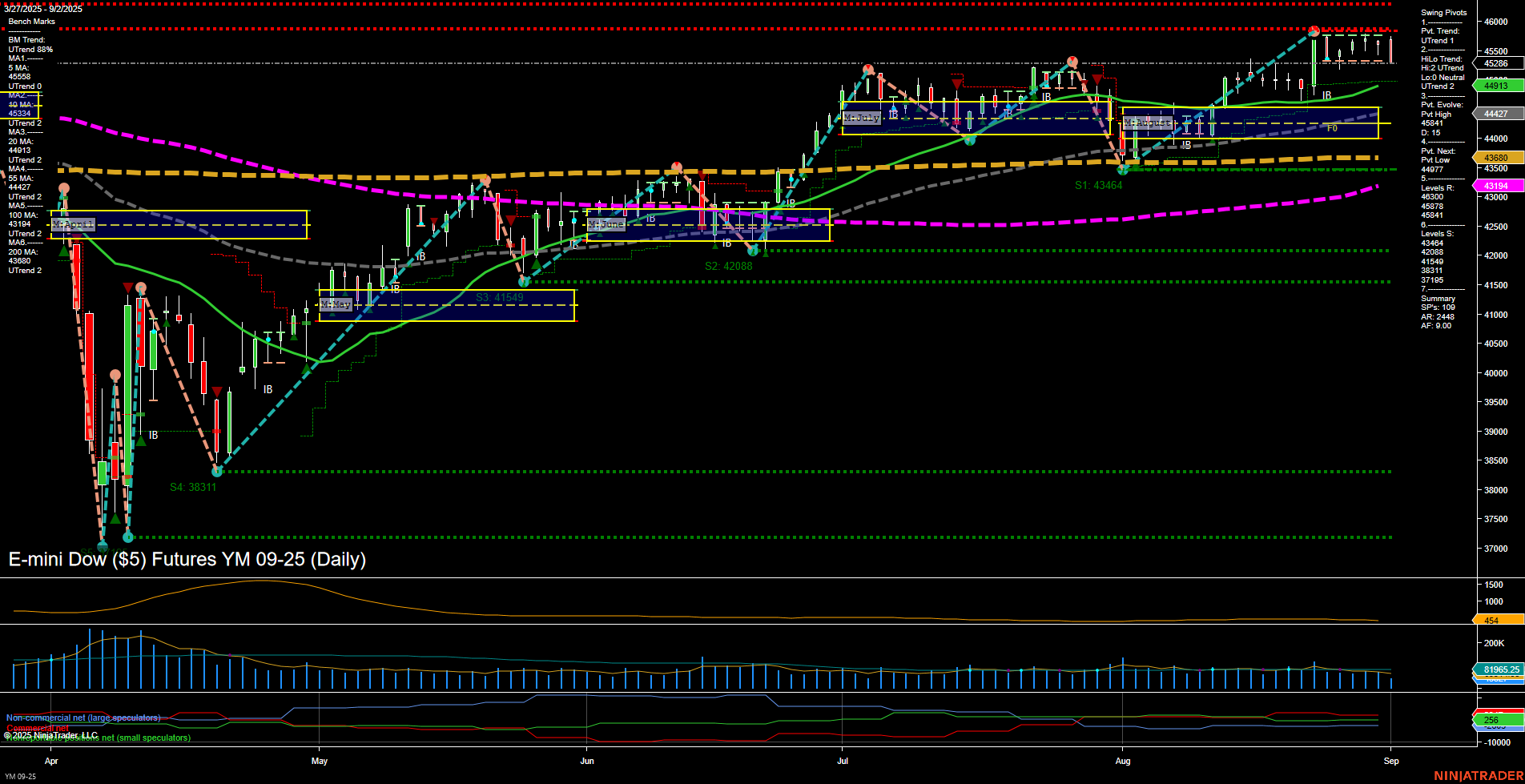

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Sep-02 07:19 CT

Price Action

- Last: 44913,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -34%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -13%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 45041,

- 4. Pvt. Next: Pvt Low 44077,

- 5. Levels R: 45500, 45286, 45041, 44638, 44077,

- 6. Levels S: 43464, 42088, 41549, 38311, 37165.

Daily Benchmarks

- (Short-Term) 5 Day: 45331 Down Trend,

- (Short-Term) 10 Day: 45374 Down Trend,

- (Intermediate-Term) 20 Day: 44913 Neutral,

- (Intermediate-Term) 55 Day: 44123 Up Trend,

- (Long-Term) 100 Day: 43194 Up Trend,

- (Long-Term) 200 Day: 41965 Up Trend.

Additional Metrics

Recent Trade Signals

- 02 Sep 2025: Short YM 09-25 @ 45312 Signals.USAR-MSFG

- 02 Sep 2025: Short YM 09-25 @ 45312 Signals.USAR.TR120

- 29 Aug 2025: Short YM 09-25 @ 45586 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow is currently experiencing a short-term pullback, with price action showing medium-sized bars and average momentum. Both the weekly and monthly session fib grids indicate a downward trend, with price trading below their respective NTZ/F0% levels. The short-term swing pivot trend has shifted to down, and the 5- and 10-day moving averages confirm this with a downtrend. However, the intermediate-term HiLo trend remains up, and the 20-day moving average is neutral, suggesting a pause or potential consolidation phase. Long-term structure remains bullish, supported by the 55-, 100-, and 200-day moving averages trending higher and the yearly fib grid trend up. Recent trade signals have triggered short entries, reflecting the current short-term weakness. Key support levels to watch are 43464 and 42088, while resistance is clustered near recent highs. Volatility is moderate, and volume remains healthy. The market appears to be in a corrective phase within a broader uptrend, with the potential for further downside in the short term before a possible resumption of the longer-term bullish trend.

Chart Analysis ATS AI Generated: 2025-09-02 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.