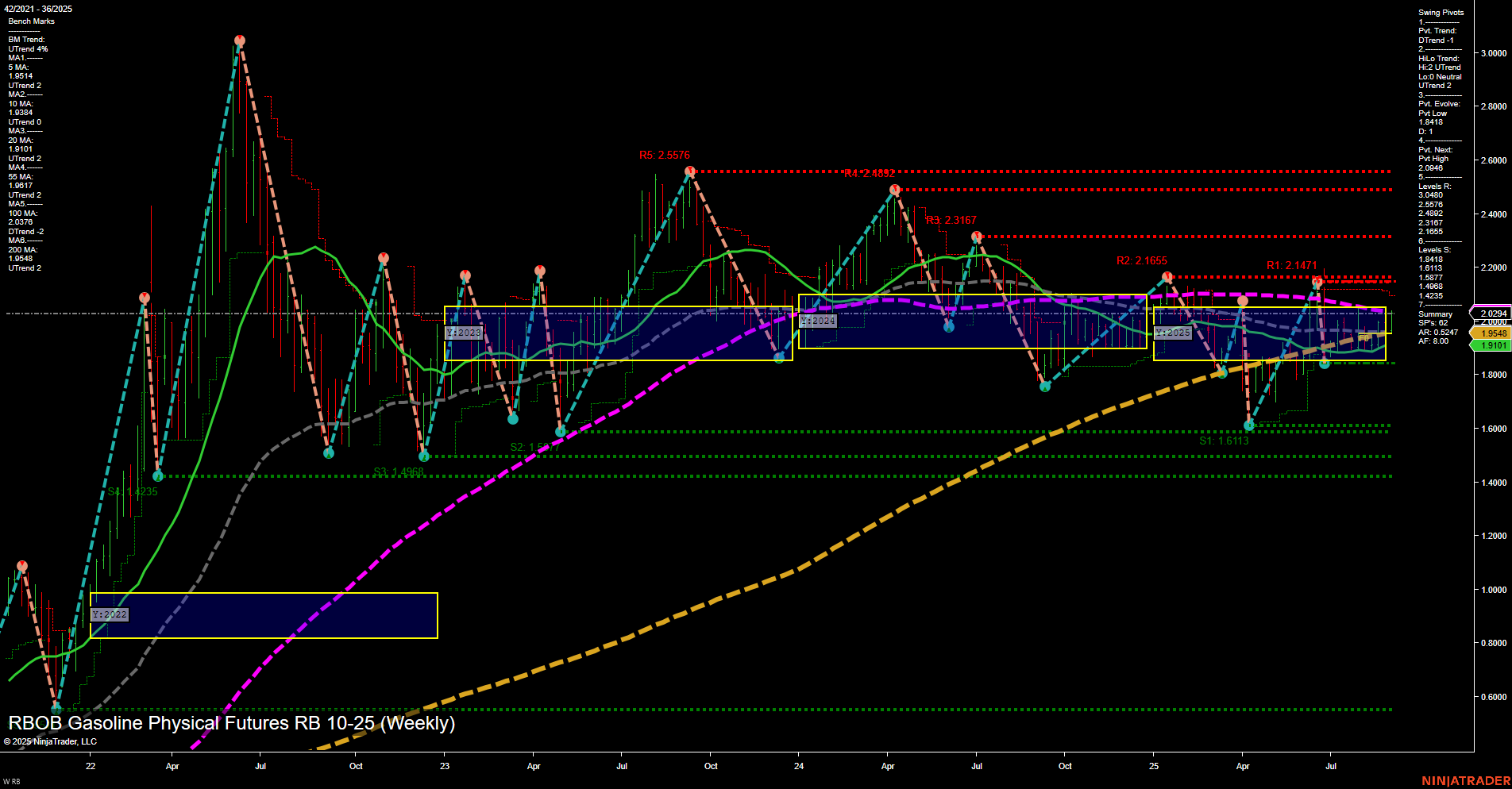

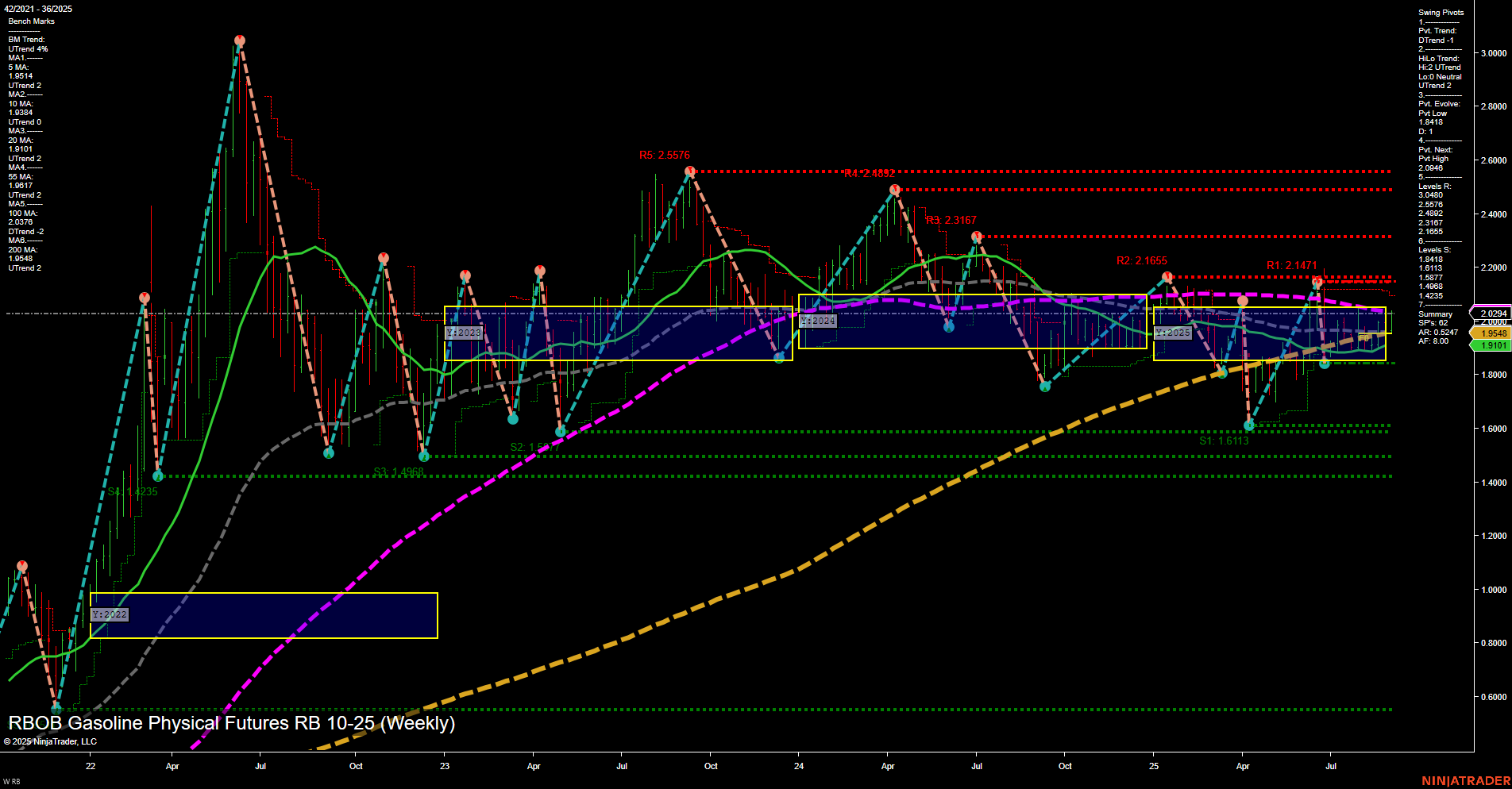

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Sep-02 07:14 CT

Price Action

- Last: 2.0934,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 78%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 30%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.8418,

- 4. Pvt. Next: Pvt high 2.2046,

- 5. Levels R: 2.5576, 2.4582, 2.3167, 2.1655, 2.1471,

- 6. Levels S: 1.1613, 1.4205, 1.6177, 1.8191, 1.9235.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.9641 Up Trend,

- (Intermediate-Term) 10 Week: 1.9111 Up Trend,

- (Long-Term) 20 Week: 1.9948 Up Trend,

- (Long-Term) 55 Week: 2.0578 Down Trend,

- (Long-Term) 100 Week: 2.0578 Down Trend,

- (Long-Term) 200 Week: 1.9648 Up Trend.

Recent Trade Signals

- 02 Sep 2025: Long RB 10-25 @ 2.0045 Signals.USAR-MSFG

- 01 Sep 2025: Long RB 10-25 @ 1.9776 Signals.USAR-WSFG

- 28 Aug 2025: Long RB 10-25 @ 1.9835 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures weekly chart shows a constructive technical structure for swing traders. Price is currently above all key Fibonacci grid centers (WSFG, MSFG, YSFG), with the NTZ yellow box acting as a consolidation zone that has recently been resolved to the upside. Momentum is average, and the bars are medium-sized, indicating steady but not explosive movement. The short-term swing pivot trend is down, but the intermediate-term HiLo trend is up, suggesting a possible transition phase or a pullback within a broader uptrend. All short- and intermediate-term moving averages are trending up, and recent trade signals have triggered long entries, confirming bullish momentum. Resistance levels are well-defined above, with the next major pivot high at 2.2046, while support is layered below, starting at 1.9235. The long-term trend remains bullish, supported by price holding above the 200-week moving average and the yearly session grid. Overall, the market is in a bullish phase across all timeframes, with the potential for further upside if resistance levels are breached, though some consolidation or minor pullbacks may occur as price approaches key resistance.

Chart Analysis ATS AI Generated: 2025-09-02 07:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.