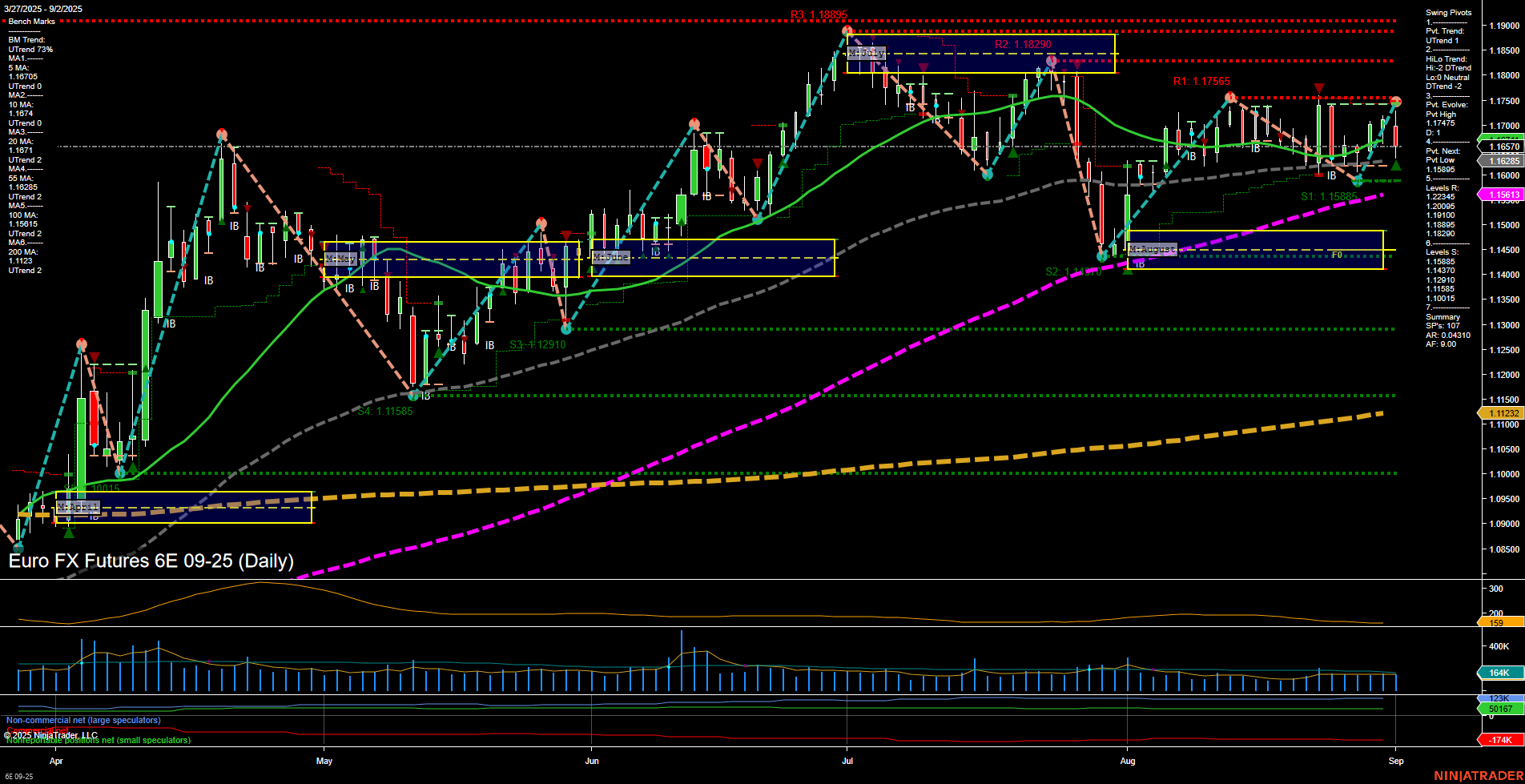

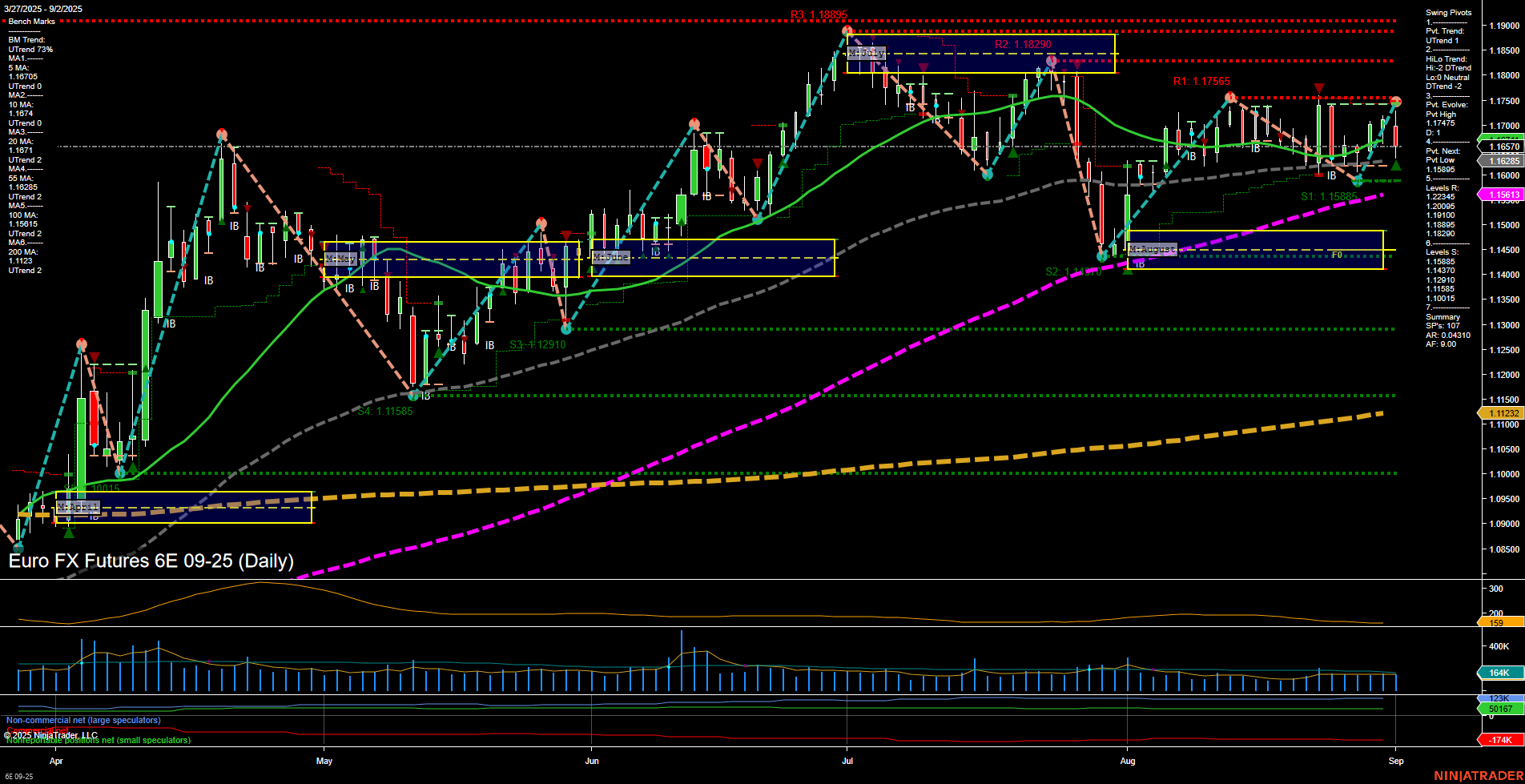

6E Euro FX Futures Daily Chart Analysis: 2025-Sep-02 07:01 CT

Price Action

- Last: 1.16570,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -27%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 81%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.15885,

- 4. Pvt. Next: Pvt high 1.17415,

- 5. Levels R: 1.18895, 1.18290, 1.17565, 1.17415, 1.16285,

- 6. Levels S: 1.15885, 1.16000, 1.14370, 1.12910, 1.11585, 1.11232, 1.10015.

Daily Benchmarks

- (Short-Term) 5 Day: 1.16705 Down Trend,

- (Short-Term) 10 Day: 1.16704 Down Trend,

- (Intermediate-Term) 20 Day: 1.16871 Down Trend,

- (Intermediate-Term) 55 Day: 1.16285 Up Trend,

- (Long-Term) 100 Day: 1.15115 Up Trend,

- (Long-Term) 200 Day: 1.11232 Up Trend.

Additional Metrics

Recent Trade Signals

- 02 Sep 2025: Short 6E 09-25 @ 1.1648 Signals.USAR.TR120

- 02 Sep 2025: Short 6E 09-25 @ 1.16565 Signals.USAR-MSFG

- 01 Sep 2025: Long 6E 09-25 @ 1.1716 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart currently reflects a market in transition. Short- and intermediate-term trends are bearish, as confirmed by both the WSFG and MSFG grids, with price action below key NTZ levels and a series of lower highs and lower lows. The most recent swing pivots reinforce this downside bias, with the current trend and HiLo trend both pointing down, and the next significant resistance levels well above current price. Short-term moving averages (5, 10, 20-day) are all trending down, further supporting the bearish outlook in the near term, while the 55, 100, and 200-day averages remain in uptrends, indicating that the longer-term structure is still constructive. Volatility (ATR) and volume (VOLMA) are moderate, suggesting steady but not extreme activity. Recent trade signals have shifted to short, aligning with the prevailing short-term momentum. However, the long-term YSFG remains bullish, with price still above the annual NTZ, hinting at underlying strength that could reassert if the current pullback finds support. Overall, the market is in a corrective phase within a larger uptrend, with the potential for further downside in the short term before any significant recovery or trend continuation.

Chart Analysis ATS AI Generated: 2025-09-02 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.