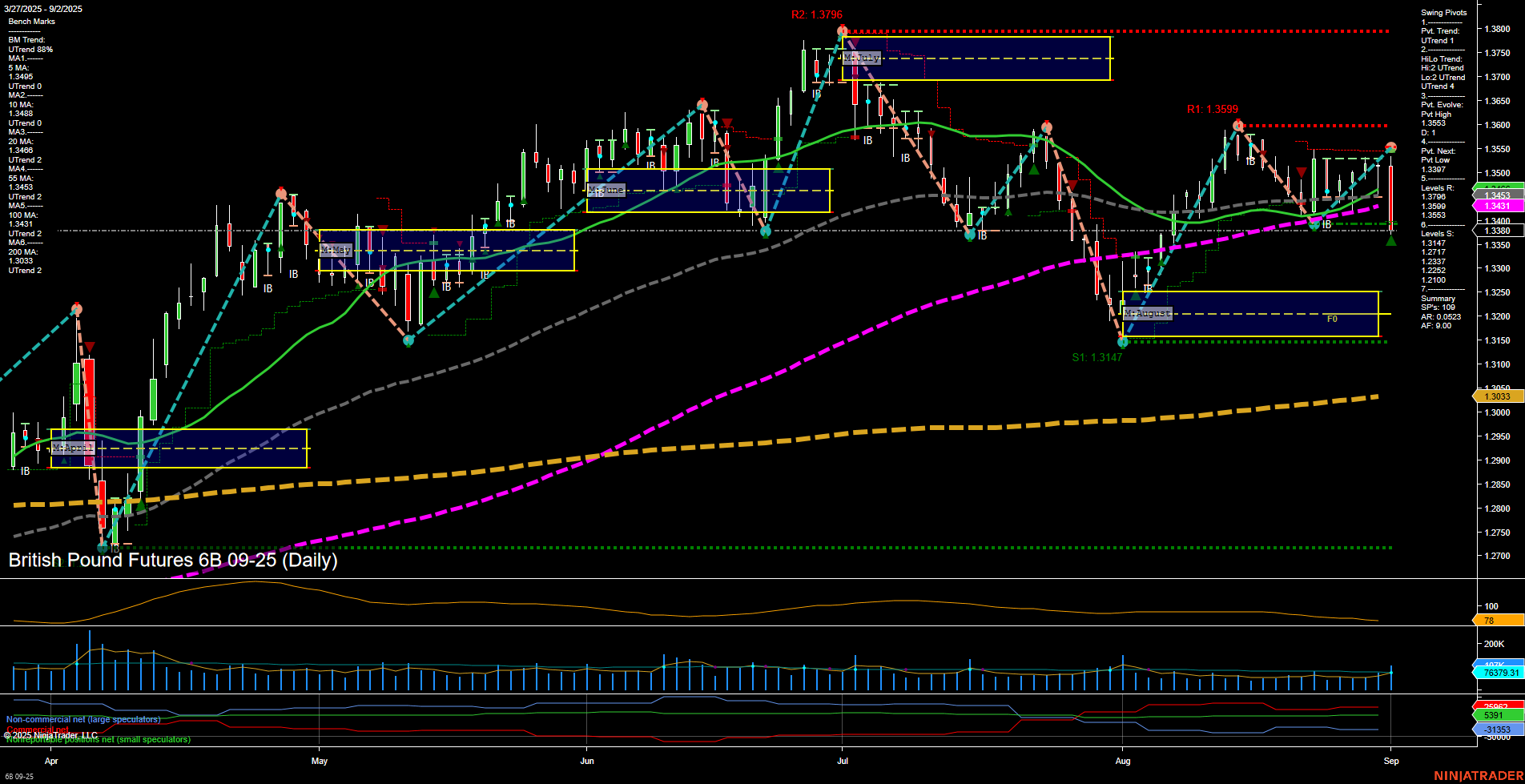

The British Pound Futures (6B) daily chart shows a market in transition. Short-term price action is mixed, with the most recent swing pivot indicating an uptrend, but both the 5-day and 10-day moving averages are trending down, suggesting some short-term weakness or consolidation. The weekly and monthly session fib grids (WSFG and MSFG) both show price below their respective NTZ/F0% levels and are trending down, reinforcing a bearish bias for the short and intermediate term. However, the yearly session fib grid (YSFG) remains positive, with price above the annual NTZ/F0% and the long-term trend up, supported by all major long-term moving averages (20, 55, 100, 200 day) in uptrends. Swing pivots highlight a recent pivot low at 1.3387, with resistance at 1.3538 and higher at 1.3599 and 1.3796, while support is seen at 1.3387 and 1.3147. The ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals show both short and long entries, reflecting the choppy, range-bound nature of the current environment. Overall, the market is consolidating after a recent pullback, with short-term indecision, intermediate-term bearishness, but a structurally bullish long-term outlook. This setup often precedes a larger directional move as the market resolves the current consolidation phase.