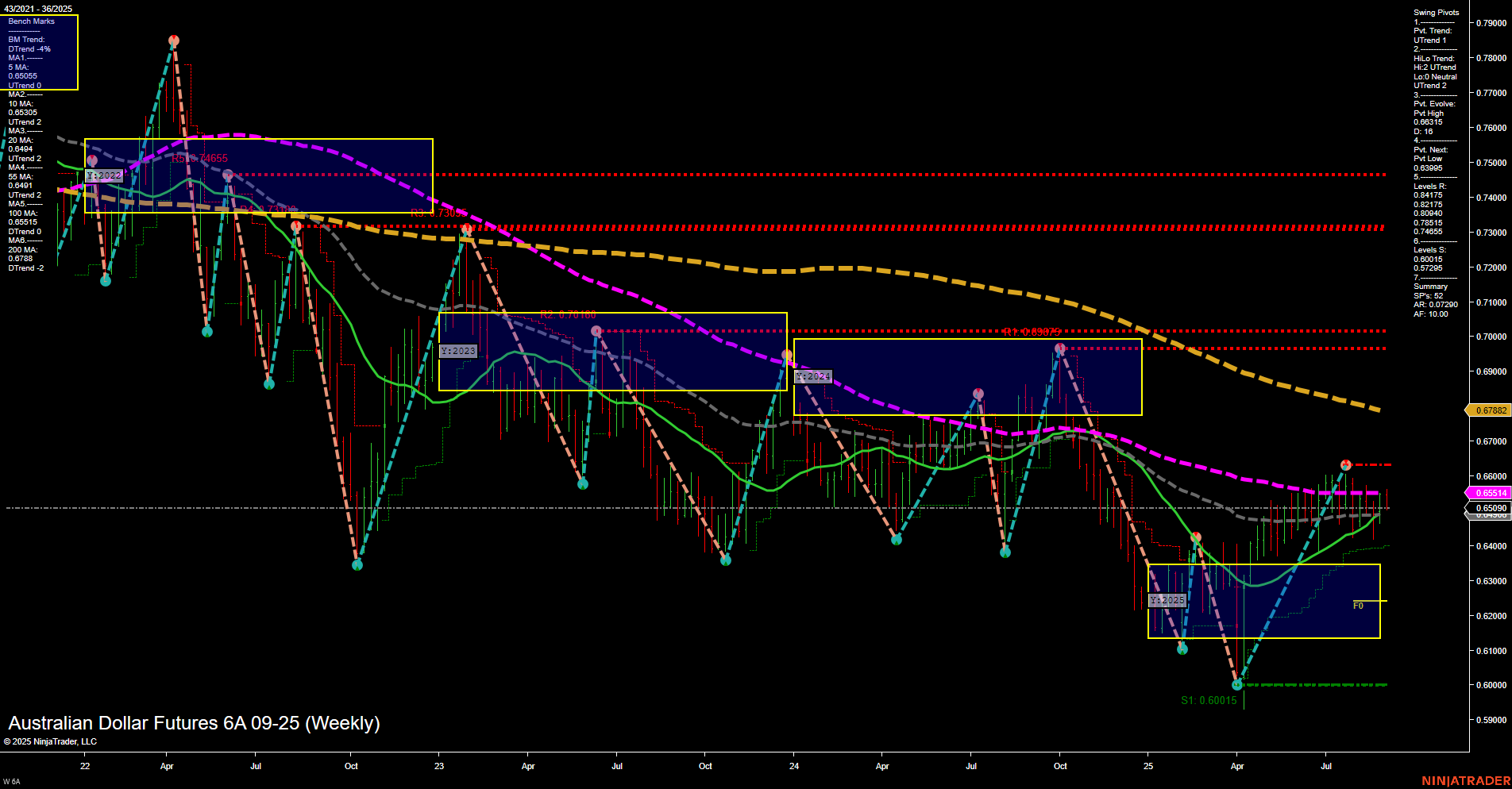

The Australian Dollar Futures (6A) weekly chart shows a market in transition. Price action is consolidating near 0.65591, with medium-sized bars and average momentum, reflecting a pause after a recent upward swing. Both the short-term and intermediate-term swing pivot trends are up, supported by rising 5, 10, and 20-week moving averages. However, the long-term trend remains bearish, as the 55, 100, and 200-week moving averages are still trending down and positioned above current price, acting as significant resistance. Swing resistance levels are clustered at 0.65915, 0.68095, and 0.69079, while support is found at 0.63415 and 0.60015. The market is currently trading within a neutral zone on the session fib grids, indicating indecision and a lack of clear directional bias in the short and long term. Recent trade signals are mixed, with both short and long entries triggered in the same week, highlighting the choppy and range-bound nature of the current environment. Overall, the chart suggests a market attempting to recover from a prolonged downtrend, with short- and intermediate-term bullish momentum facing strong long-term resistance. The price is consolidating below major moving averages, and the next directional move will likely be determined by a breakout above resistance or a breakdown below support. Swing traders should be attentive to potential reversals or continuation patterns as the market tests these key levels.