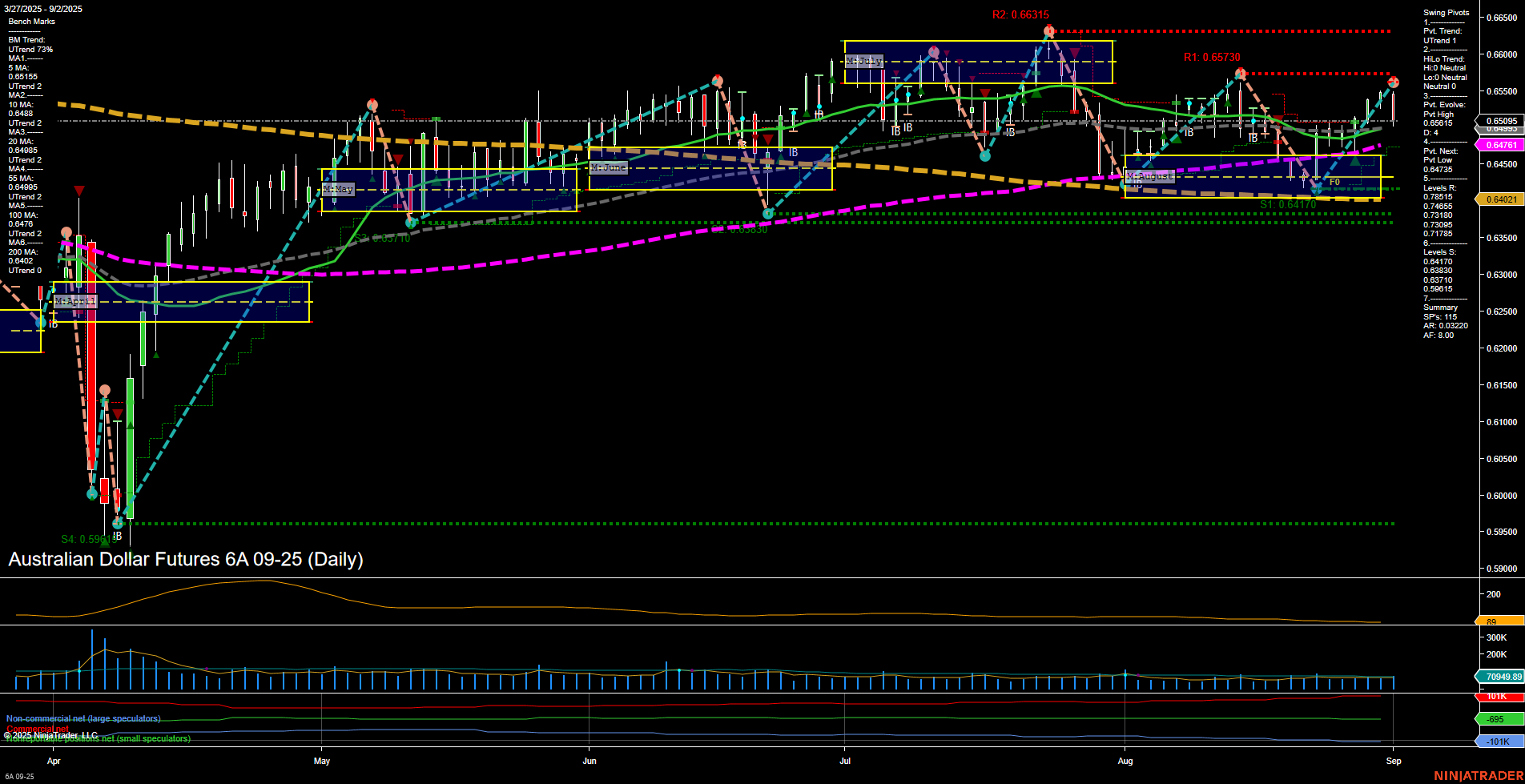

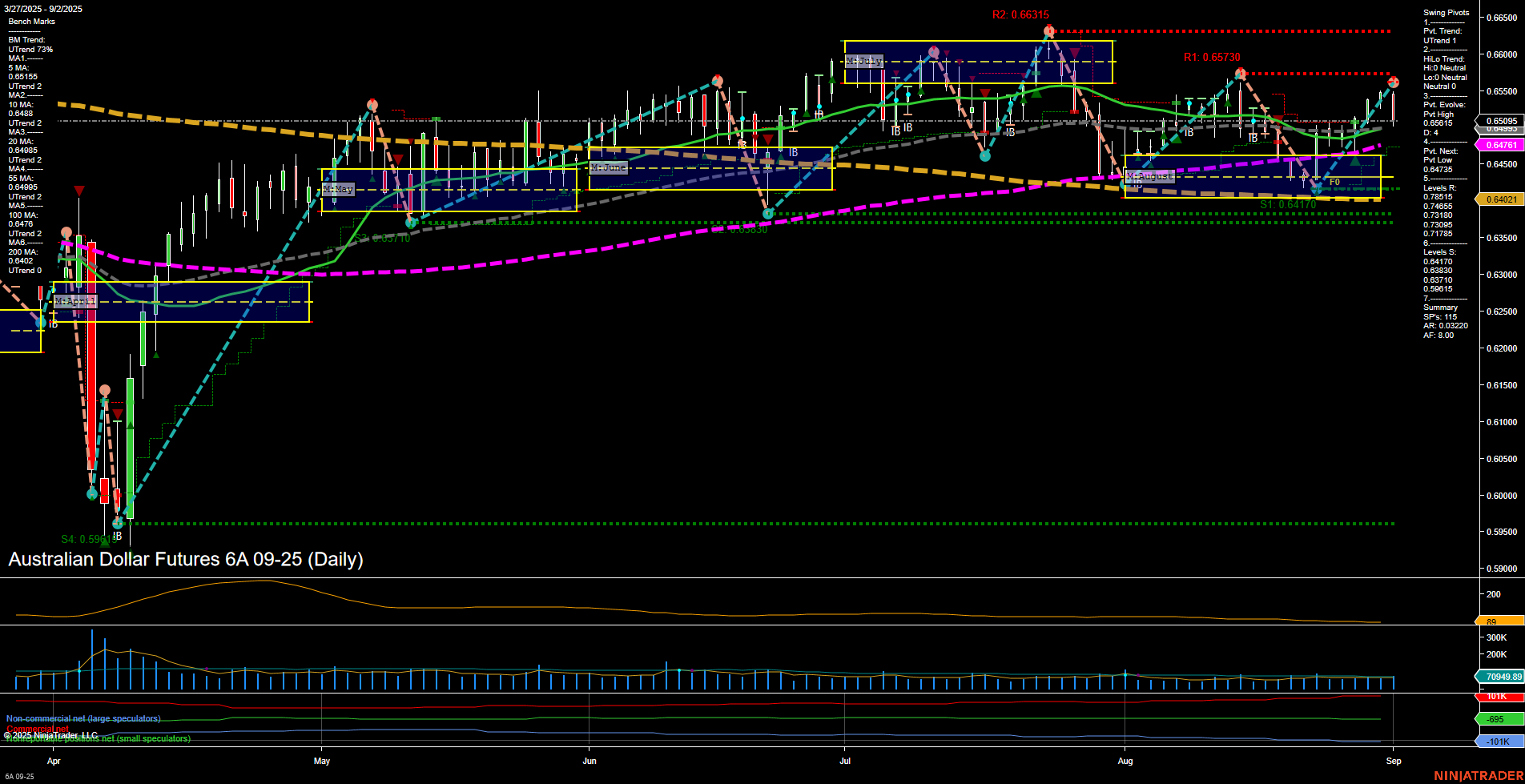

6A Australian Dollar Futures Daily Chart Analysis: 2025-Sep-02 07:00 CT

Price Action

- Last: 0.65095,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 0.65415,

- 4. Pvt. Next: Pvt Low 0.64751,

- 5. Levels R: 0.66315, 0.65730, 0.65415,

- 6. Levels S: 0.64751, 0.64170, 0.63910, 0.63830, 0.63015.

Daily Benchmarks

- (Short-Term) 5 Day: 0.65155 Up Trend,

- (Short-Term) 10 Day: 0.64888 Up Trend,

- (Intermediate-Term) 20 Day: 0.64761 Up Trend,

- (Intermediate-Term) 55 Day: 0.64021 Up Trend,

- (Long-Term) 100 Day: 0.64640 Up Trend,

- (Long-Term) 200 Day: 0.64204 Up Trend.

Additional Metrics

- ATR: 110,

- VOLMA: 70949.89.

Recent Trade Signals

- 02 Sep 2025: Short 6A 09-25 @ 0.6513 Signals.USAR.TR120

- 02 Sep 2025: Short 6A 09-25 @ 0.65065 Signals.USAR-MSFG

- 02 Sep 2025: Long 6A 09-25 @ 0.65585 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The Australian Dollar Futures (6A) daily chart is currently showing a neutral to slightly bullish structure. Price action is consolidating near 0.6510, with medium-sized bars and average momentum, indicating a lack of strong directional conviction. Both the weekly and monthly session fib grids (WSFG, MSFG) are neutral, suggesting no clear bias from session-based support/resistance zones. Swing pivots show a short-term uptrend, but the intermediate-term trend is neutral, with the most recent pivot evolving to a high at 0.65415 and the next key support at 0.64751. Resistance levels are stacked above at 0.65415, 0.65730, and 0.66315, while support is layered below, indicating a range-bound environment. All benchmark moving averages (from 5-day to 200-day) are in uptrends, supporting a longer-term bullish undertone despite the current consolidation. ATR and volume metrics are moderate, reflecting stable but not excessive volatility. Recent trade signals are mixed, with both short and long entries triggered, reinforcing the neutral short-term outlook. Overall, the market is in a consolidation phase with a bullish bias on the longer timeframes, awaiting a catalyst for a decisive breakout or breakdown.

Chart Analysis ATS AI Generated: 2025-09-02 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.