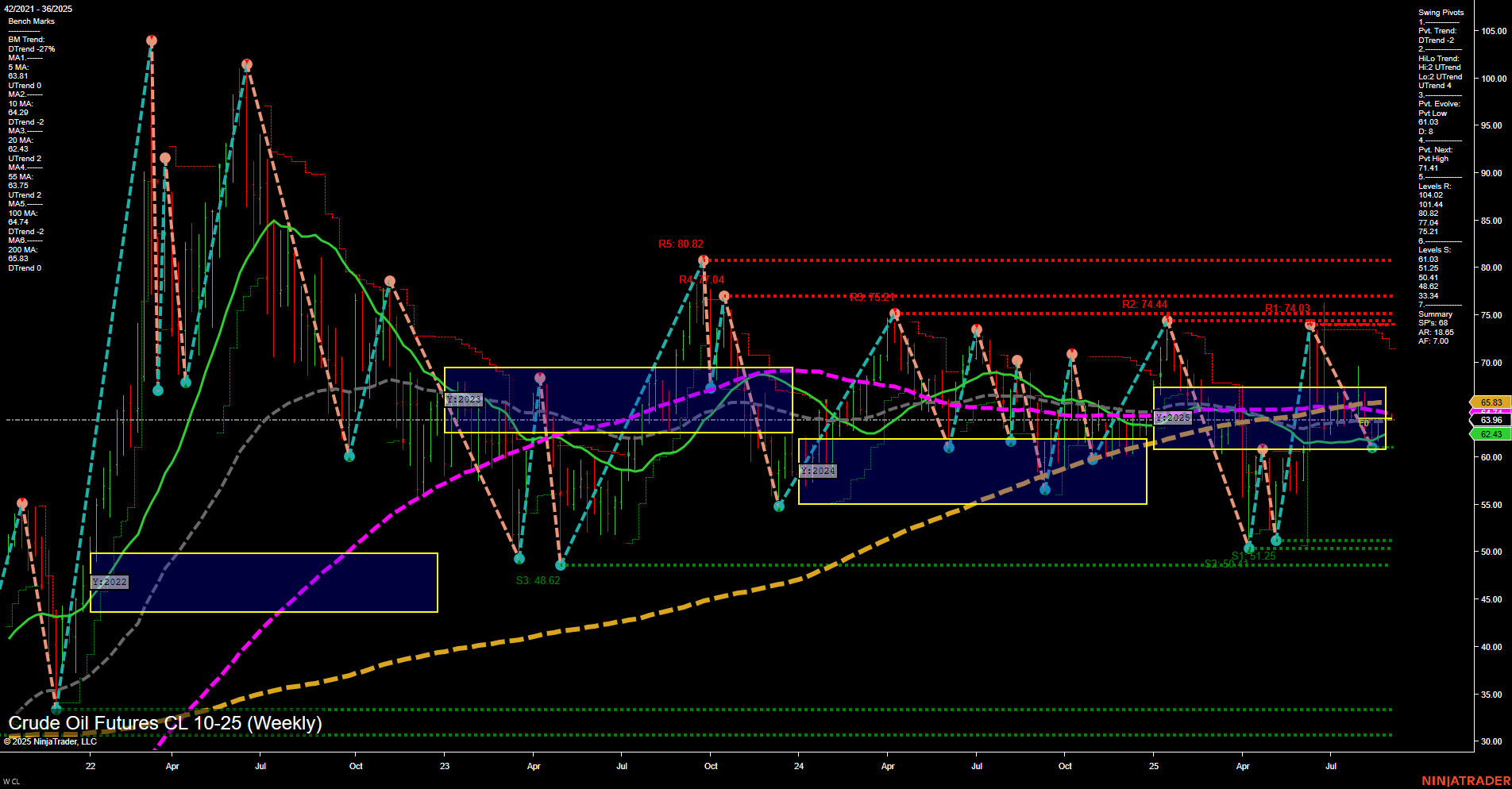

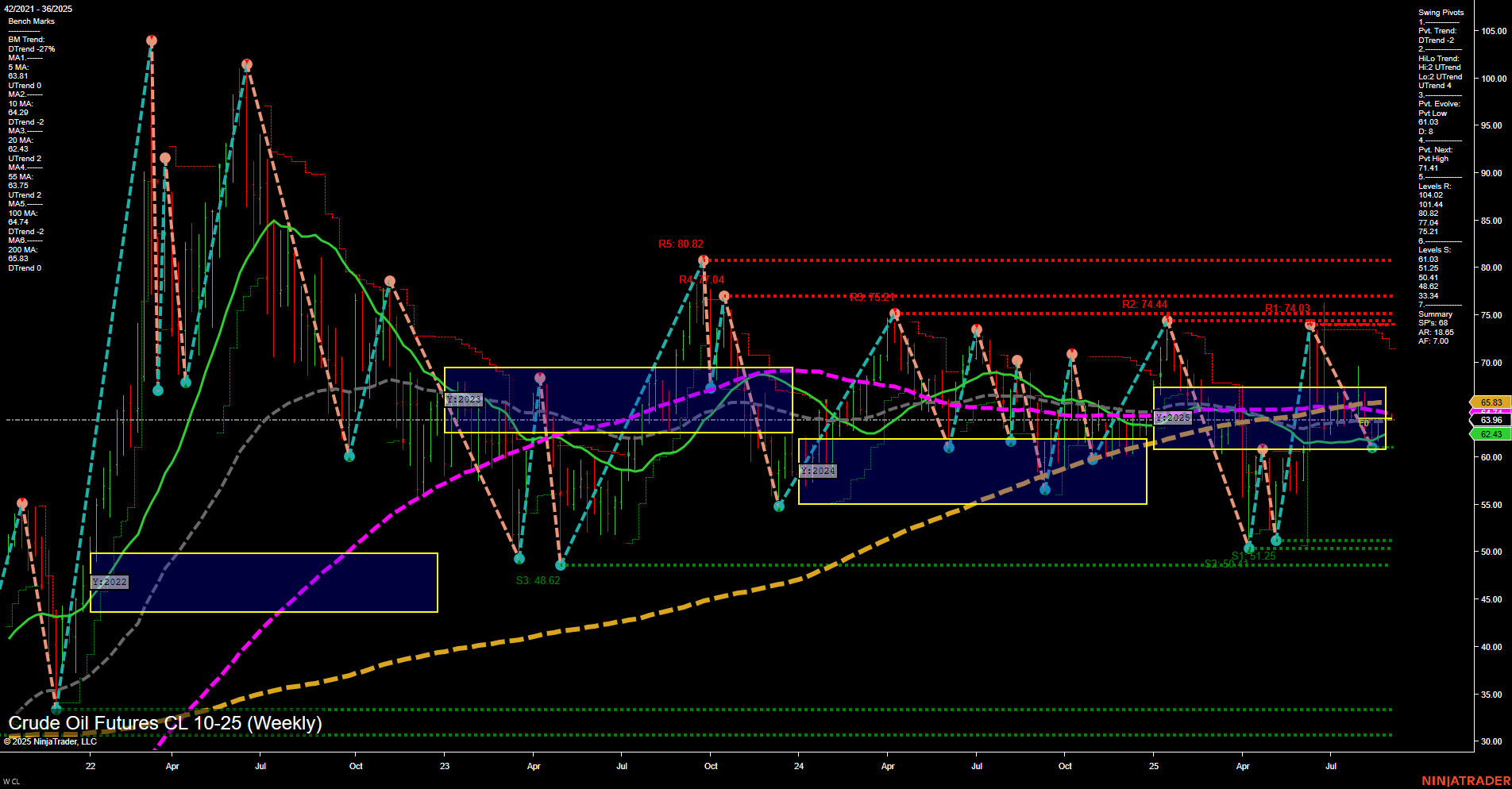

CL Crude Oil Futures Weekly Chart Analysis: 2025-Aug-31 18:02 CT

Price Action

- Last: 63.96,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -39%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 61.08,

- 4. Pvt. Next: Pvt high 71.51,

- 5. Levels R: 101.04, 90.44, 80.82, 75.24, 74.44, 71.51,

- 6. Levels S: 61.08, 55.25, 50.41, 48.62, 39.24, 33.23.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 63.31 Down Trend,

- (Intermediate-Term) 10 Week: 62.43 Down Trend,

- (Long-Term) 20 Week: 63.96 Down Trend,

- (Long-Term) 55 Week: 65.83 Down Trend,

- (Long-Term) 100 Week: 67.75 Down Trend,

- (Long-Term) 200 Week: 66.83 Down Trend.

Recent Trade Signals

- 29 Aug 2025: Long CL 10-25 @ 64.26 Signals.USAR-WSFG

- 28 Aug 2025: Long CL 10-25 @ 64.08 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Crude oil futures are currently trading in a slow momentum environment with medium-sized weekly bars, reflecting a period of indecision and consolidation. The short-term trend is bearish, as indicated by the WSFG and swing pivot direction, with price action below the NTZ and all key moving averages trending down. Intermediate-term signals are mixed: while the monthly session fib grid is bearish, the HiLo swing trend is up, suggesting some underlying support or a potential for a counter-trend rally. Long-term structure remains weak, with all major moving averages (20, 55, 100, 200 week) in a downtrend and price sitting below these benchmarks, reinforcing a bearish bias. Key resistance levels are clustered well above current price, while support is found at 61.08 and lower. Recent trade signals have triggered long entries, hinting at a possible short-term bounce or mean reversion attempt, but the broader context remains pressured. Overall, the market is in a corrective or consolidative phase within a larger downtrend, with volatility subdued and no clear breakout or reversal pattern yet established.

Chart Analysis ATS AI Generated: 2025-08-31 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.