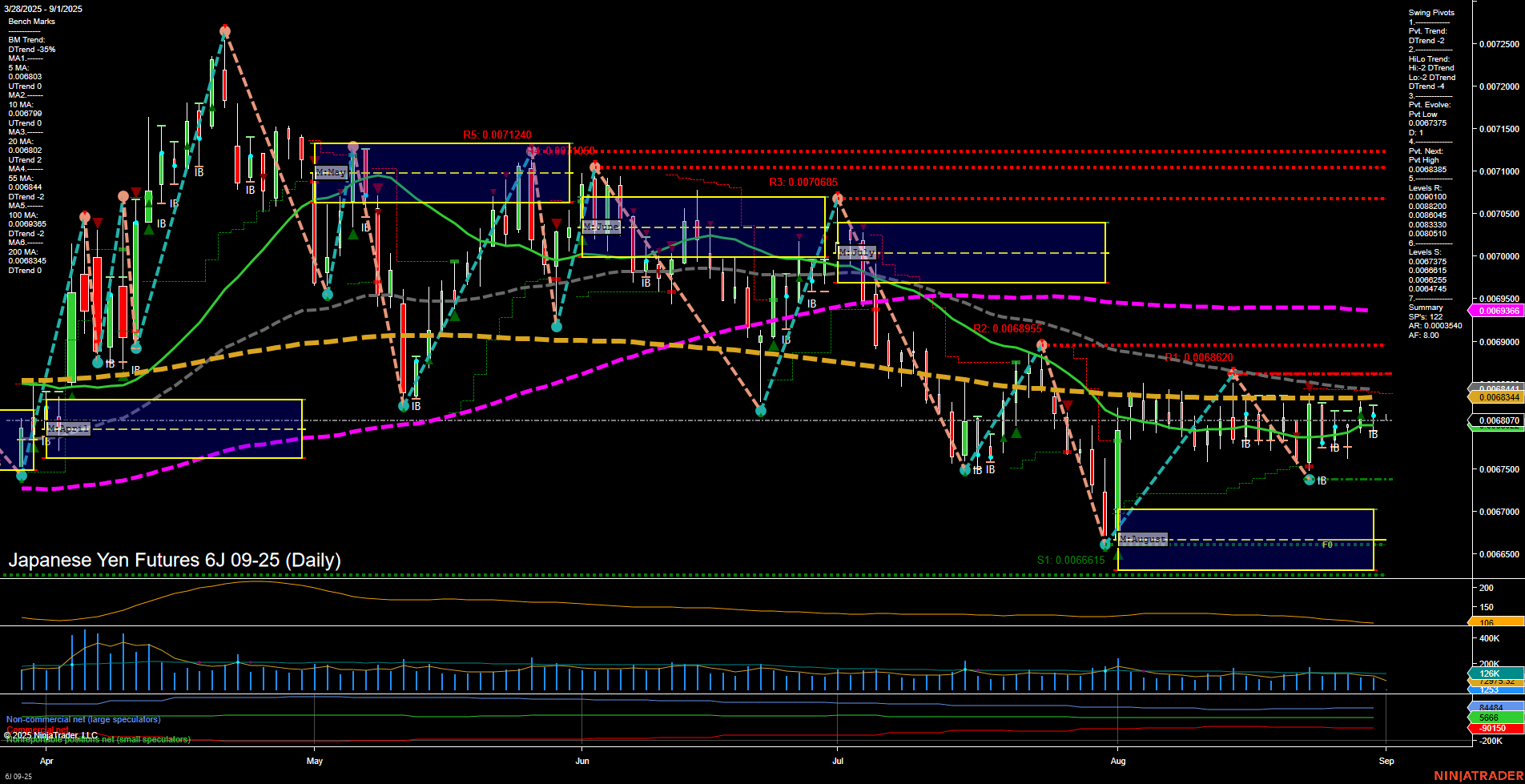

The 6J Japanese Yen futures daily chart shows a market in a corrective phase, with short-term price action characterized by small bars and slow momentum, indicating a lack of strong directional conviction. The weekly session fib grid (WSFG) trend is down, with price trading below the NTZ center, reinforcing a bearish short-term outlook. Swing pivots confirm this, with both short-term and intermediate-term trends in a downtrend, and the next key resistance at 0.0068385 and support at 0.0067375. Daily benchmarks show most moving averages (5, 10, 55, 100, 200) trending down, except for the 20-day MA, which is slightly up, suggesting some intermediate-term stabilization but not enough to shift the broader trend. The monthly and yearly session fib grids (MSFG, YSFG) are both up, with price above their NTZ centers, hinting at underlying longer-term support, but this is not yet reflected in the swing structure or short-term price action. ATR and volume metrics are moderate, indicating average volatility and participation. Recent trade signals show mixed short-term direction, with a quick reversal from long to short, reflecting the choppy and indecisive nature of the current market. Overall, the chart suggests a market in consolidation with a bearish bias in the short and long term, while the intermediate-term remains neutral as the market digests recent moves and awaits a clearer breakout or breakdown.