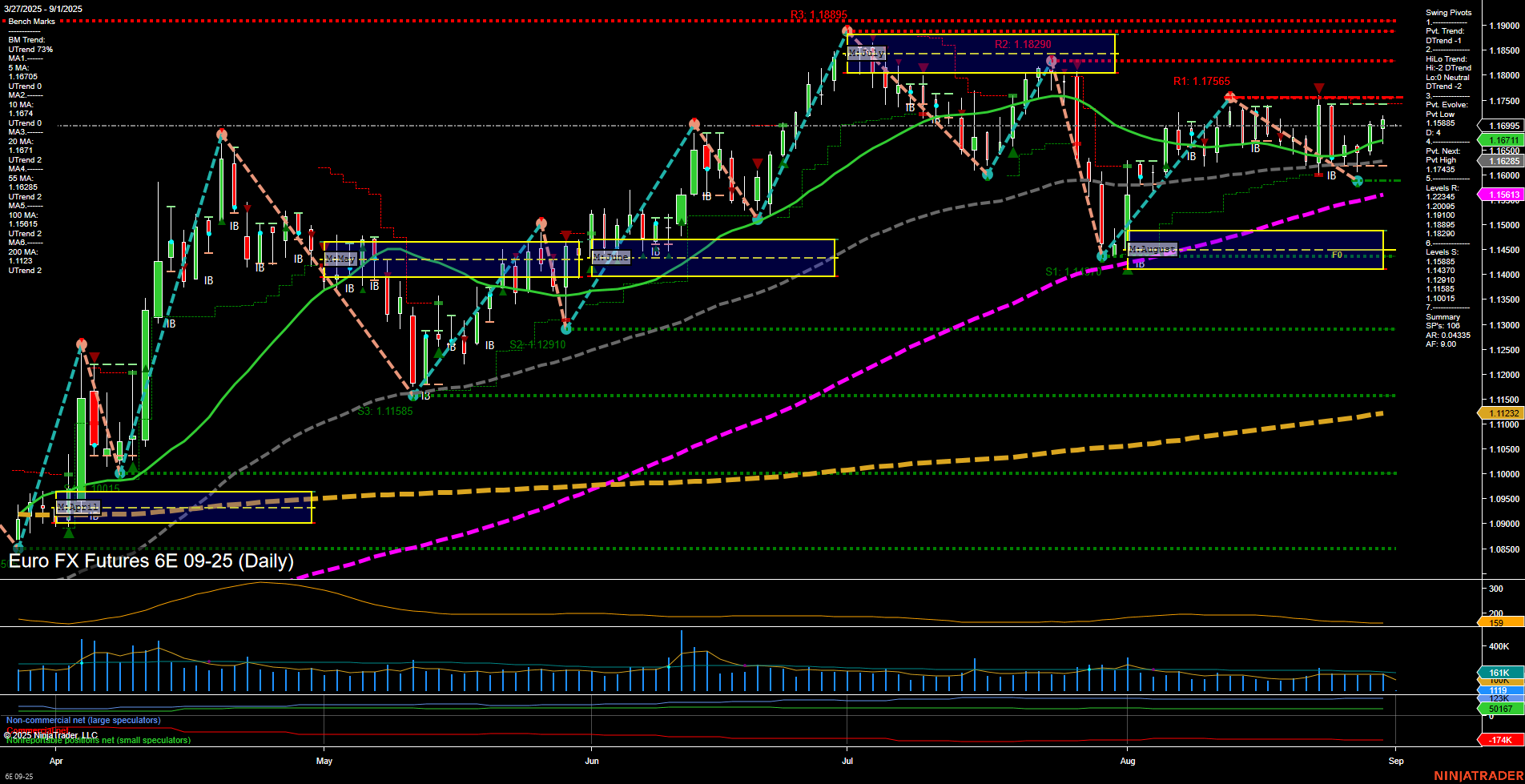

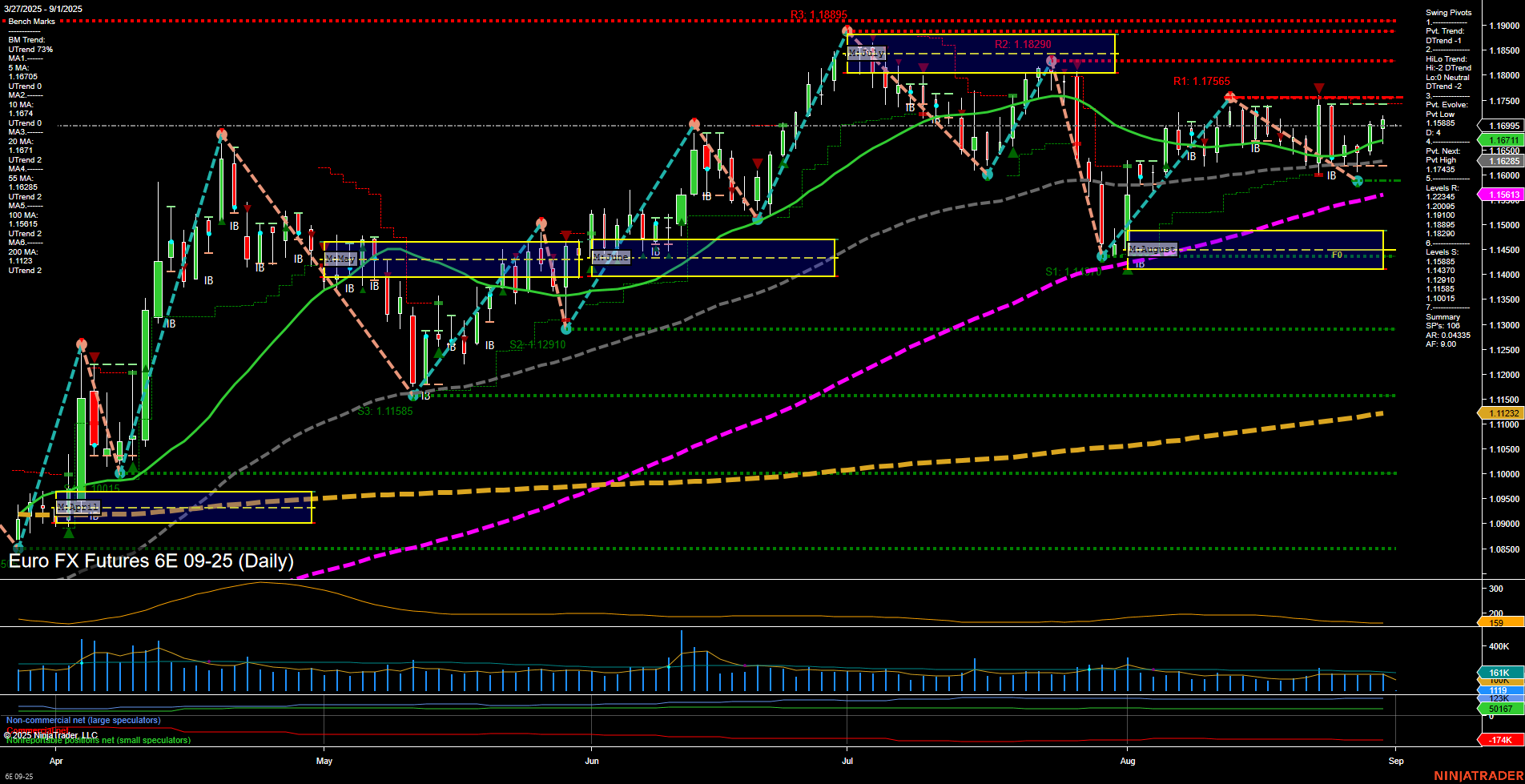

6E Euro FX Futures Daily Chart Analysis: 2025-Aug-31 18:01 CT

Price Action

- Last: 1.16711,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 60%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 84%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.16995,

- 4. Pvt. Next: Pvt low 1.15888,

- 5. Levels R: 1.17545, 1.18290, 1.18895,

- 6. Levels S: 1.16000, 1.15885, 1.14370, 1.12910, 1.11585, 1.11232, 1.10115.

Daily Benchmarks

- (Short-Term) 5 Day: 1.16705 Up Trend,

- (Short-Term) 10 Day: 1.16704 Up Trend,

- (Intermediate-Term) 20 Day: 1.16824 Up Trend,

- (Intermediate-Term) 55 Day: 1.16285 Up Trend,

- (Long-Term) 100 Day: 1.15115 Up Trend,

- (Long-Term) 200 Day: 1.11232 Up Trend.

Additional Metrics

Recent Trade Signals

- 28 Aug 2025: Long 6E 09-25 @ 1.16835 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in transition, with price action currently consolidating just above key moving averages and the NTZ center line. While all benchmark moving averages from short to long-term are in uptrends, the swing pivot structure is in a short-term and intermediate-term downtrend, indicating recent corrective action or a pullback within a broader uptrend. Resistance is layered above at 1.17545, 1.18290, and 1.18895, while support is well-defined below, starting at 1.16000 and extending down to 1.10115. The recent long signal on August 28th suggests renewed interest in the upside, but momentum remains average and price is near the lower end of the recent range, reflecting indecision. Volatility (ATR) and volume (VOLMA) are moderate, supporting the view of a market in consolidation after a prior rally. The overall structure favors a bullish long-term outlook, but the short and intermediate-term trends are neutral as the market digests gains and awaits a potential breakout or further retracement.

Chart Analysis ATS AI Generated: 2025-08-31 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.