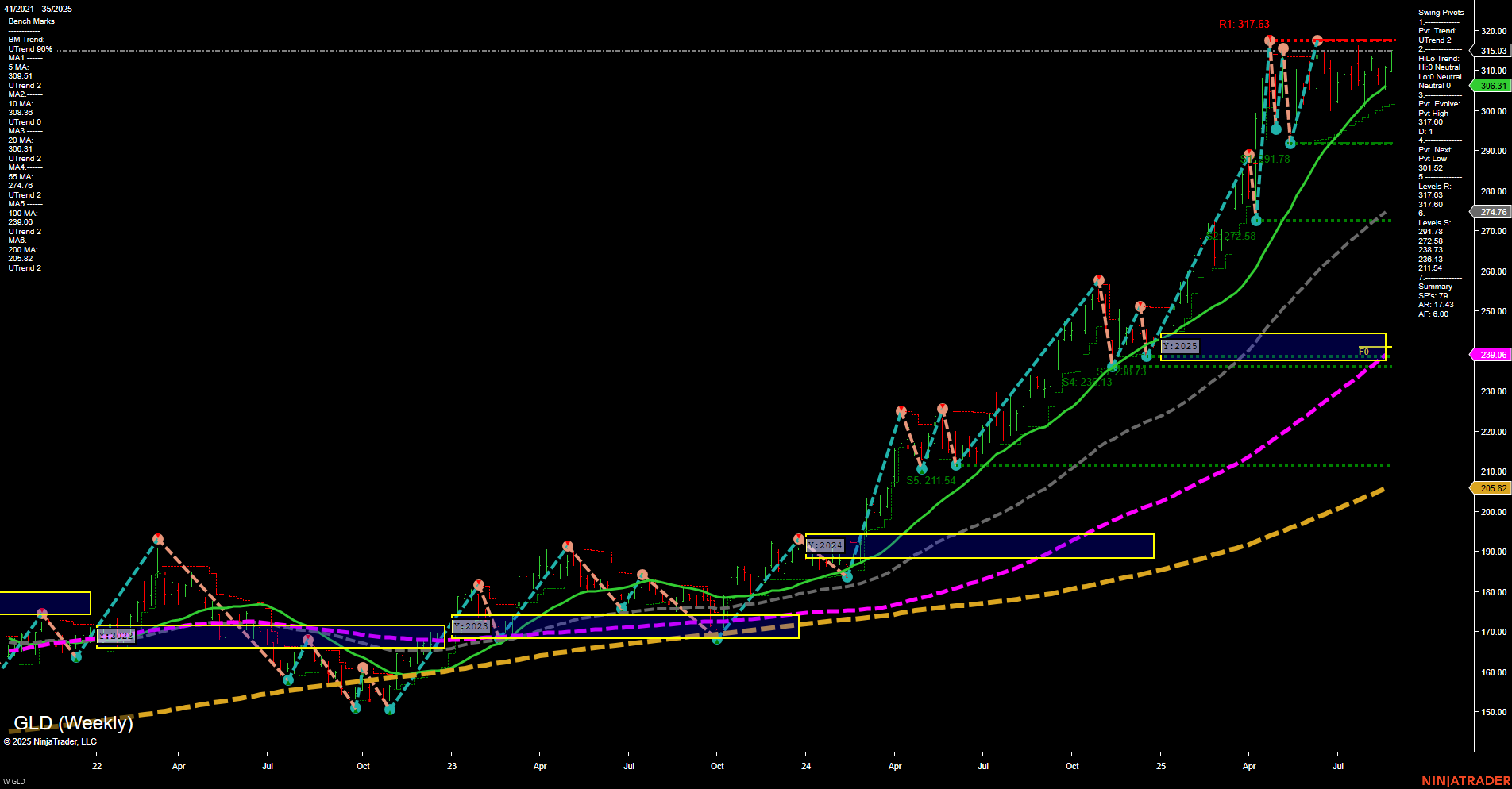

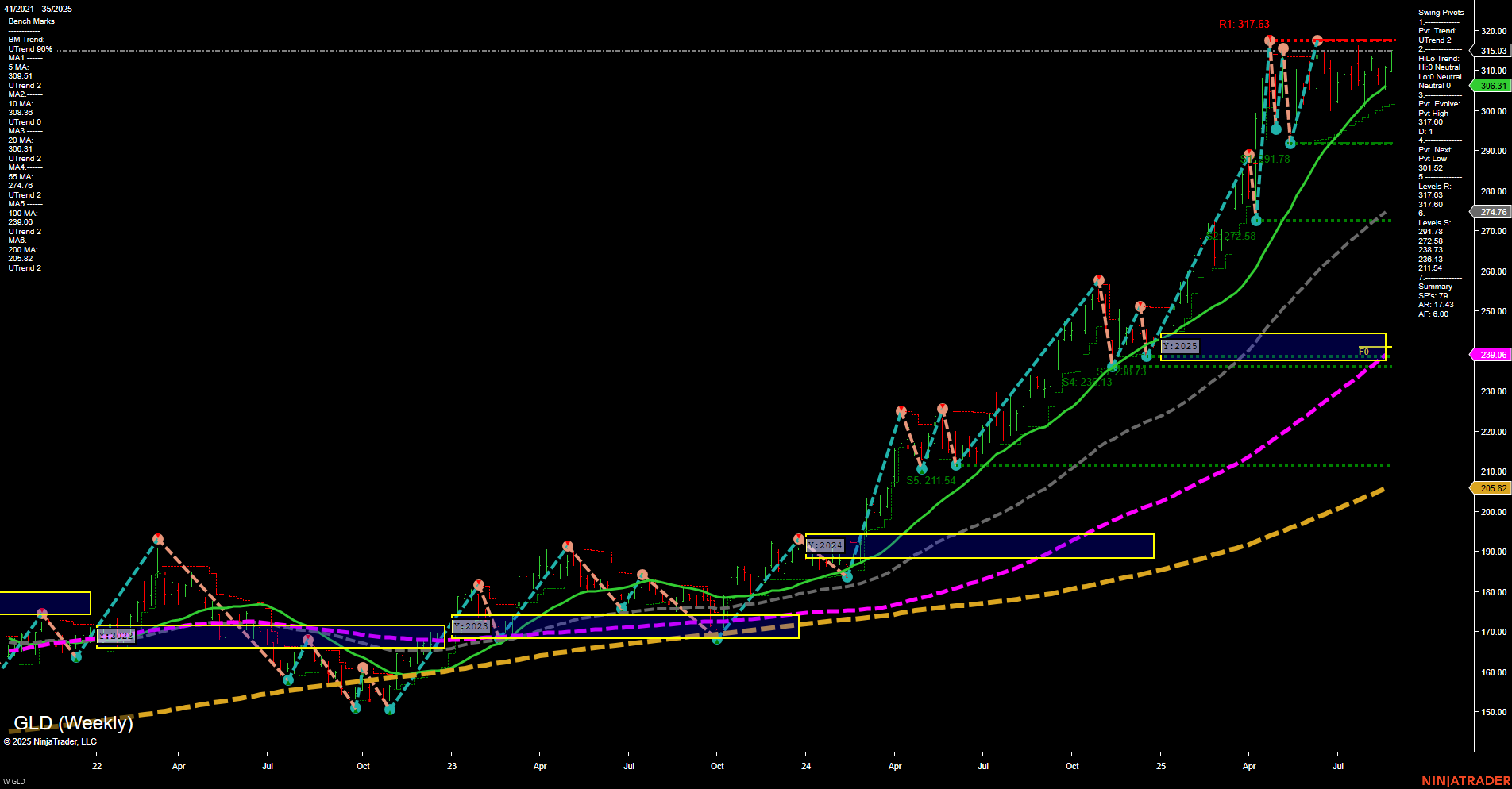

GLD SPDR Gold Shares Weekly Chart Analysis: 2025-Aug-29 07:09 CT

Price Action

- Last: 310.00,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 317.69,

- 4. Pvt. Next: Pvt low 301.52,

- 5. Levels R: 317.63,

- 6. Levels S: 301.52, 274.76, 239.06, 228.78, 222.13, 211.54.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 309.51 Up Trend,

- (Intermediate-Term) 10 Week: 308.86 Up Trend,

- (Long-Term) 20 Week: 303.14 Up Trend,

- (Long-Term) 55 Week: 274.76 Up Trend,

- (Long-Term) 100 Week: 239.06 Up Trend,

- (Long-Term) 200 Week: 205.82 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

GLD continues to exhibit a strong uptrend across all timeframes, with price consolidating near all-time highs after a significant rally. The most recent swing high at 317.69 marks a key resistance, while the nearest support is at 301.52, with additional support levels well below, indicating a wide cushion for any pullbacks. All benchmark moving averages are trending upward, confirming the underlying bullish momentum. The current price action is characterized by medium-sized bars and average momentum, suggesting a period of consolidation or digestion after the recent advance. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) reflects this consolidation phase, as price trades within the NTZ zone. The overall structure remains bullish, with higher lows and higher highs dominating the chart, and no immediate signs of trend reversal. This environment is typical of a market pausing after a strong move, potentially setting up for either a continuation breakout or a deeper retracement, depending on how price reacts to the established support and resistance levels.

Chart Analysis ATS AI Generated: 2025-08-29 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.