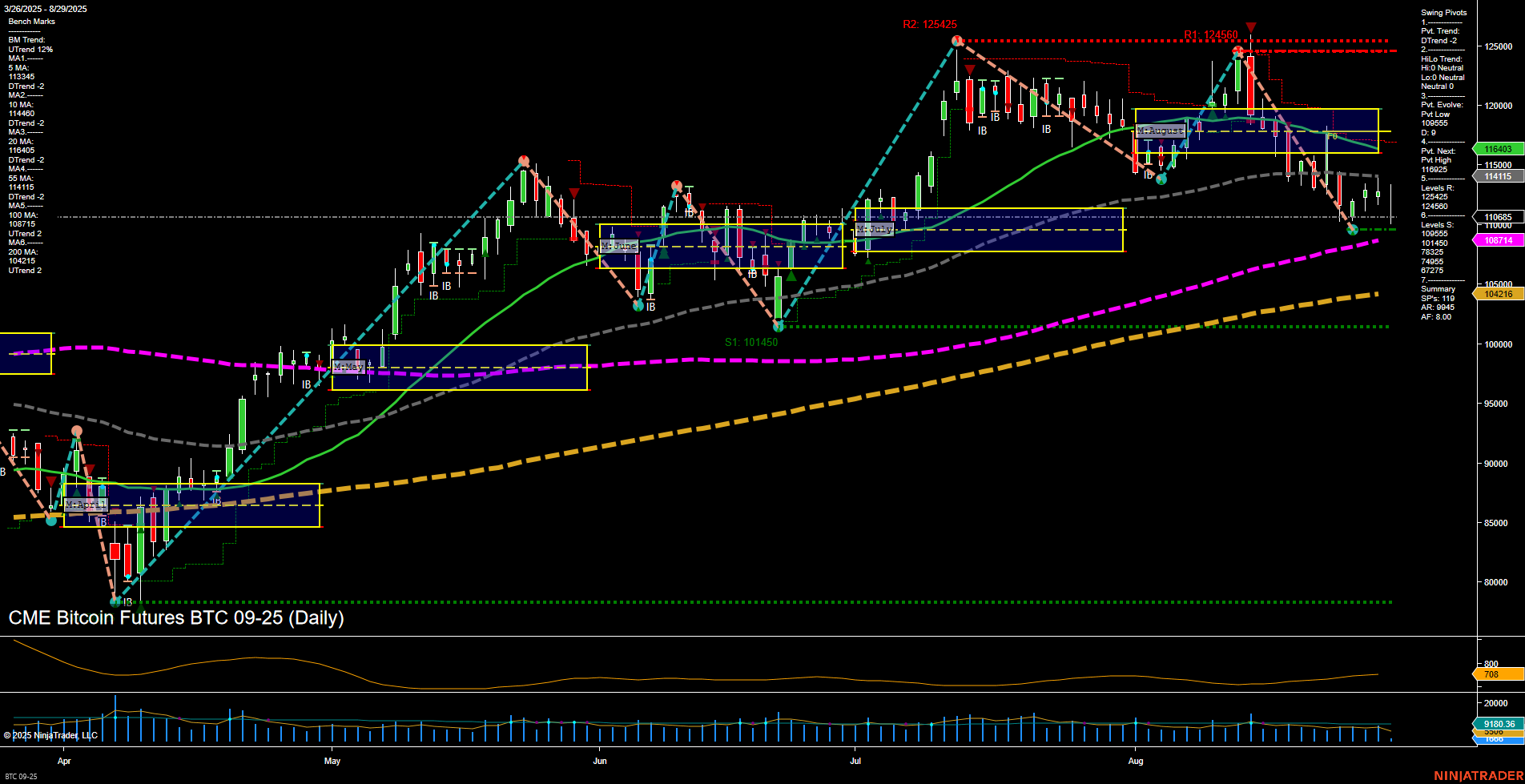

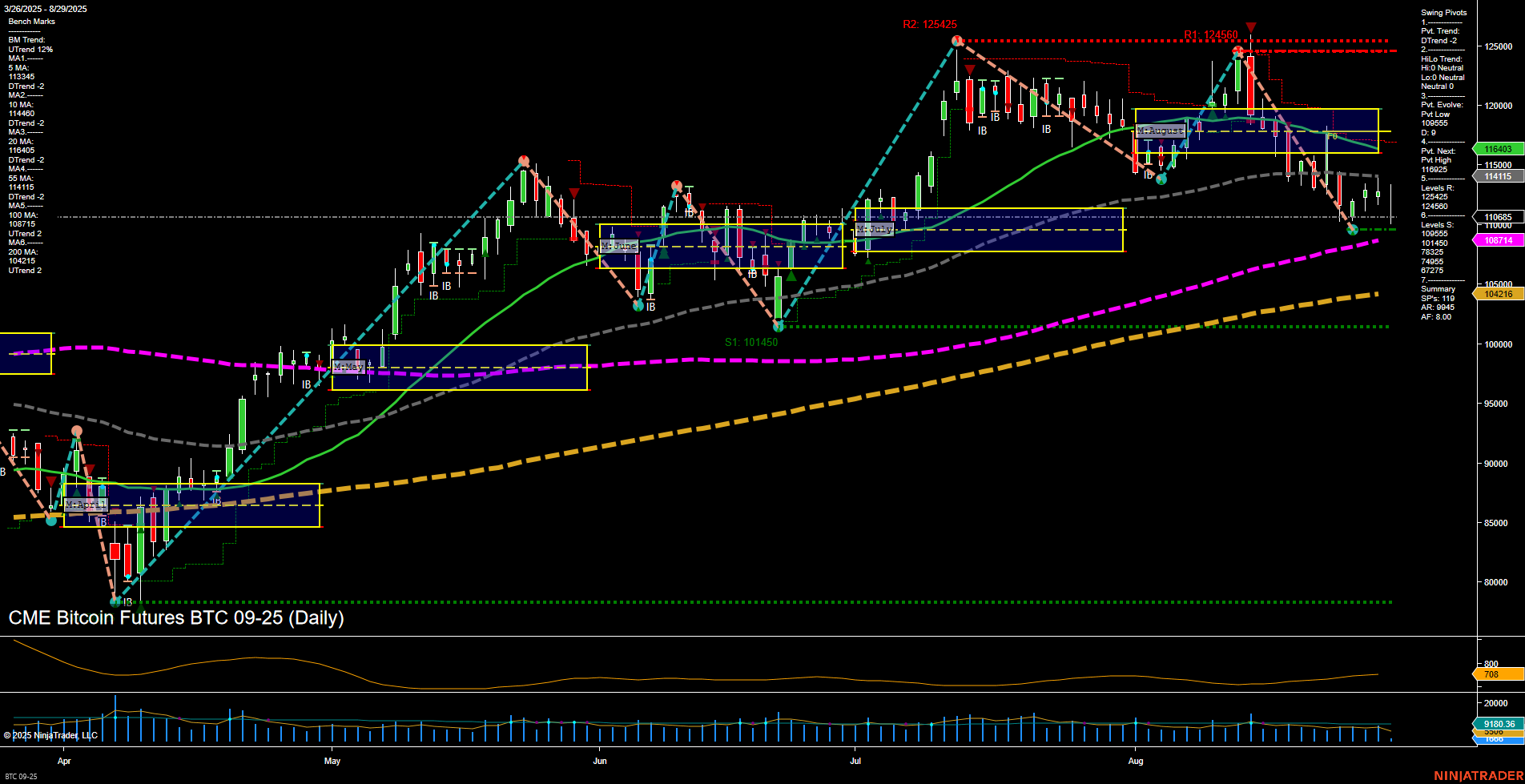

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Aug-29 07:03 CT

Price Action

- Last: 110685,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -55%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -37%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 42%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 109685,

- 4. Pvt. Next: Pvt High 116025,

- 5. Levels R: 125425, 124650, 115000, 110000,

- 6. Levels S: 101450, 73385, 70475, 67275.

Daily Benchmarks

- (Short-Term) 5 Day: 113344 Down Trend,

- (Short-Term) 10 Day: 114160 Down Trend,

- (Intermediate-Term) 20 Day: 116403 Down Trend,

- (Intermediate-Term) 55 Day: 114115 Down Trend,

- (Long-Term) 100 Day: 108714 Up Trend,

- (Long-Term) 200 Day: 104216 Up Trend.

Additional Metrics

Recent Trade Signals

- 22 Aug 2025: Long BTC 08-25 @ 117245 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

BTC CME futures are currently in a corrective phase, with both short-term and intermediate-term trends showing downside momentum as price trades below the key weekly and monthly session fib grid centers. The swing pivot structure confirms a dominant downtrend, with the most recent pivot low at 109685 and the next potential reversal only above 116025. Resistance levels are stacked above, with significant supply at 115000 and 124650, while support is well below at 101450. All short and intermediate-term moving averages are trending down, reinforcing the bearish bias for swing traders. However, the long-term trend remains intact to the upside, as both the 100-day and 200-day MAs are still rising, suggesting the broader bull cycle is not broken. Volatility is moderate, and volume is steady, indicating a controlled pullback rather than panic selling. The recent long signal from 22 Aug has not yet reversed the prevailing short-term trend. Overall, the market is in a retracement phase within a larger uptrend, with swing traders watching for signs of stabilization or a reversal at lower support levels.

Chart Analysis ATS AI Generated: 2025-08-29 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.