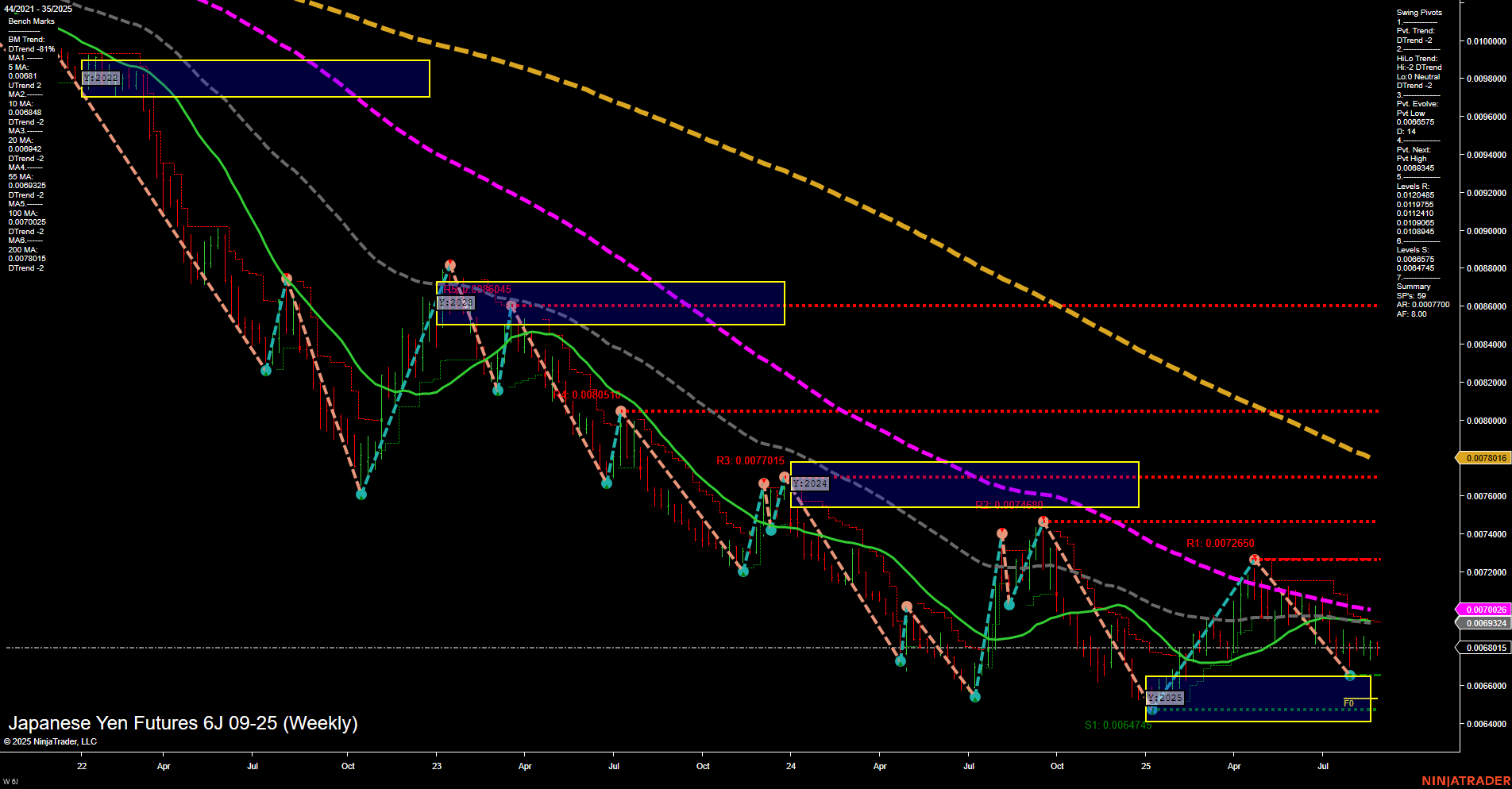

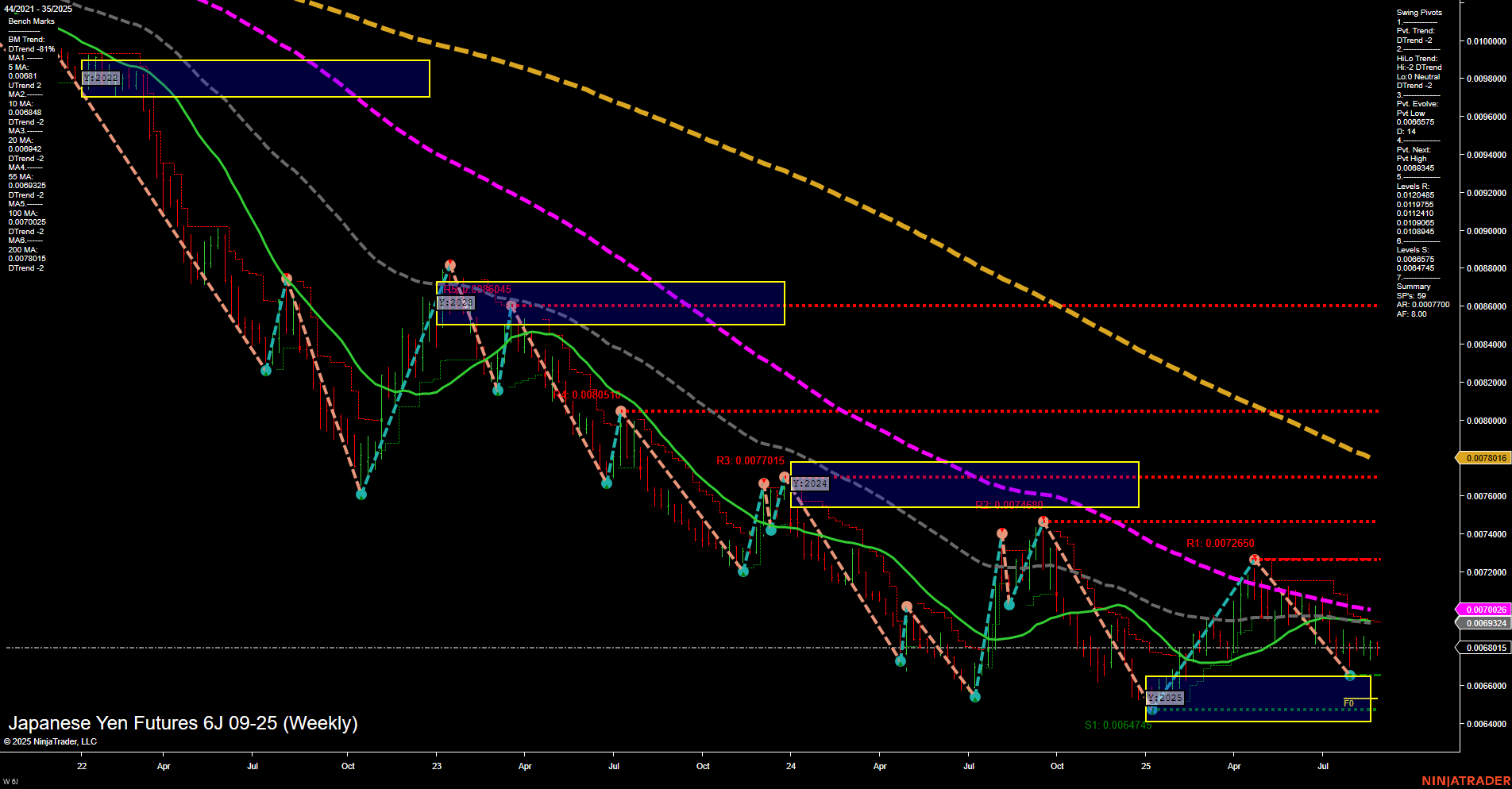

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Aug-29 07:02 CT

Price Action

- Last: 0.0068015,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -21%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0064745,

- 4. Pvt. Next: Pvt high 0.0069245,

- 5. Levels R: 0.0077015, 0.0074600, 0.0072650, 0.0070206, 0.0069245,

- 6. Levels S: 0.0068015, 0.0064745, 0.0004745.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0068011 Down Trend,

- (Intermediate-Term) 10 Week: 0.0068924 Down Trend,

- (Long-Term) 20 Week: 0.0070206 Down Trend,

- (Long-Term) 55 Week: 0.0078016 Down Trend,

- (Long-Term) 100 Week: 0.0082943 Down Trend,

- (Long-Term) 200 Week: 0.0088011 Down Trend.

Recent Trade Signals

- 28 Aug 2025: Long 6J 09-25 @ 0.006808 Signals.USAR.TR120

- 26 Aug 2025: Short 6J 09-25 @ 0.0068035 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart continues to reflect a dominant bearish structure across all timeframes. Price action remains subdued with slow momentum and medium-sized bars, indicating a lack of strong conviction from either buyers or sellers. The WSFG (Weekly Session Fib Grid) trend is down, with price trading below the NTZ center, reinforcing short-term weakness. Both swing pivot and HiLo trends are down, and the most recent pivot evolution points to a low, with the next significant resistance at 0.0069245. All benchmark moving averages from 5 to 200 weeks are trending down, confirming persistent long-term pressure. Despite a recent mixed signal (short then long within days), the overall technical landscape remains bearish, with price struggling to break above key resistance levels and remaining well below major moving averages. The market is in a prolonged downtrend, with any rallies so far being corrective rather than trend-changing. Swing traders should note the prevailing downward momentum, the clustering of resistance overhead, and the lack of a clear reversal pattern at this stage.

Chart Analysis ATS AI Generated: 2025-08-29 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.