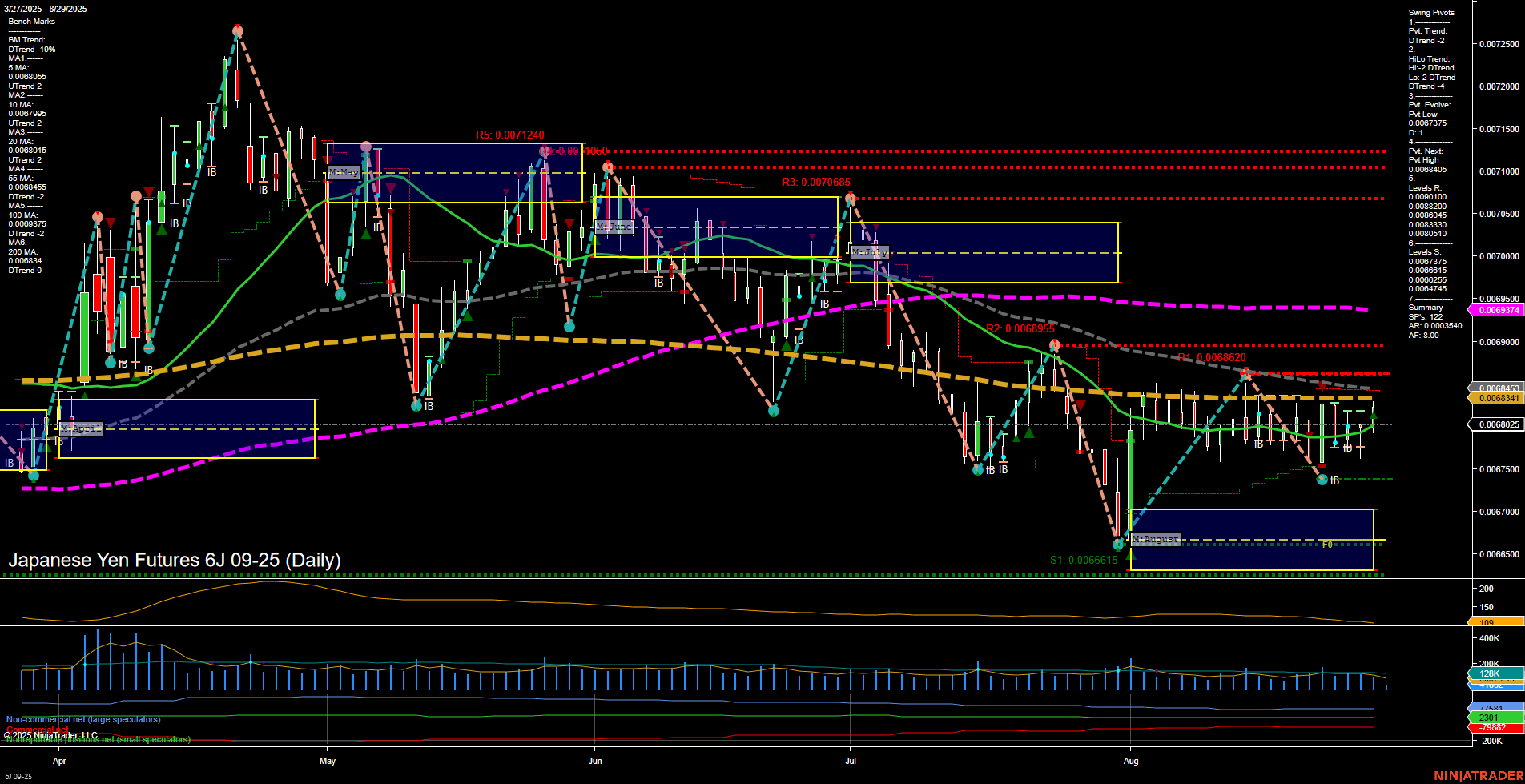

The 6J Japanese Yen Futures daily chart shows a market in transition. Price action is consolidating with small bars and slow momentum, indicating a lack of strong directional conviction in the short term. The weekly session fib grid (WSFG) trend is down, with price below the NTZ, reflecting short-term bearishness. However, both the monthly (MSFG) and yearly (YSFG) session fib grids are trending up, with price above their respective NTZs, suggesting intermediate and long-term bullish undertones. Swing pivot analysis confirms a short-term and intermediate-term downtrend, but the most recent pivot is a low, with the next key level being a potential pivot high at 0.0068405. Resistance levels are stacked above, while support is established at 0.0067375 and 0.0066615. Daily benchmarks show mixed signals: short-term moving averages are trending down, but the 20-day MA is turning up, hinting at a possible shift. Longer-term MAs remain in a downtrend, but the 200-day MA is nearly flat, suggesting a potential base forming. ATR and volume metrics indicate moderate volatility and steady participation. Recent trade signals show both long and short entries in close succession, reflecting the choppy, indecisive nature of the current market. Overall, the short-term outlook is neutral as the market digests recent moves, while the intermediate and long-term trends remain bullish, supported by higher timeframe fib grid trends and the potential for a reversal if resistance levels are breached. The market appears to be in a consolidation phase, with the potential for a breakout as volatility compresses and key levels are tested.