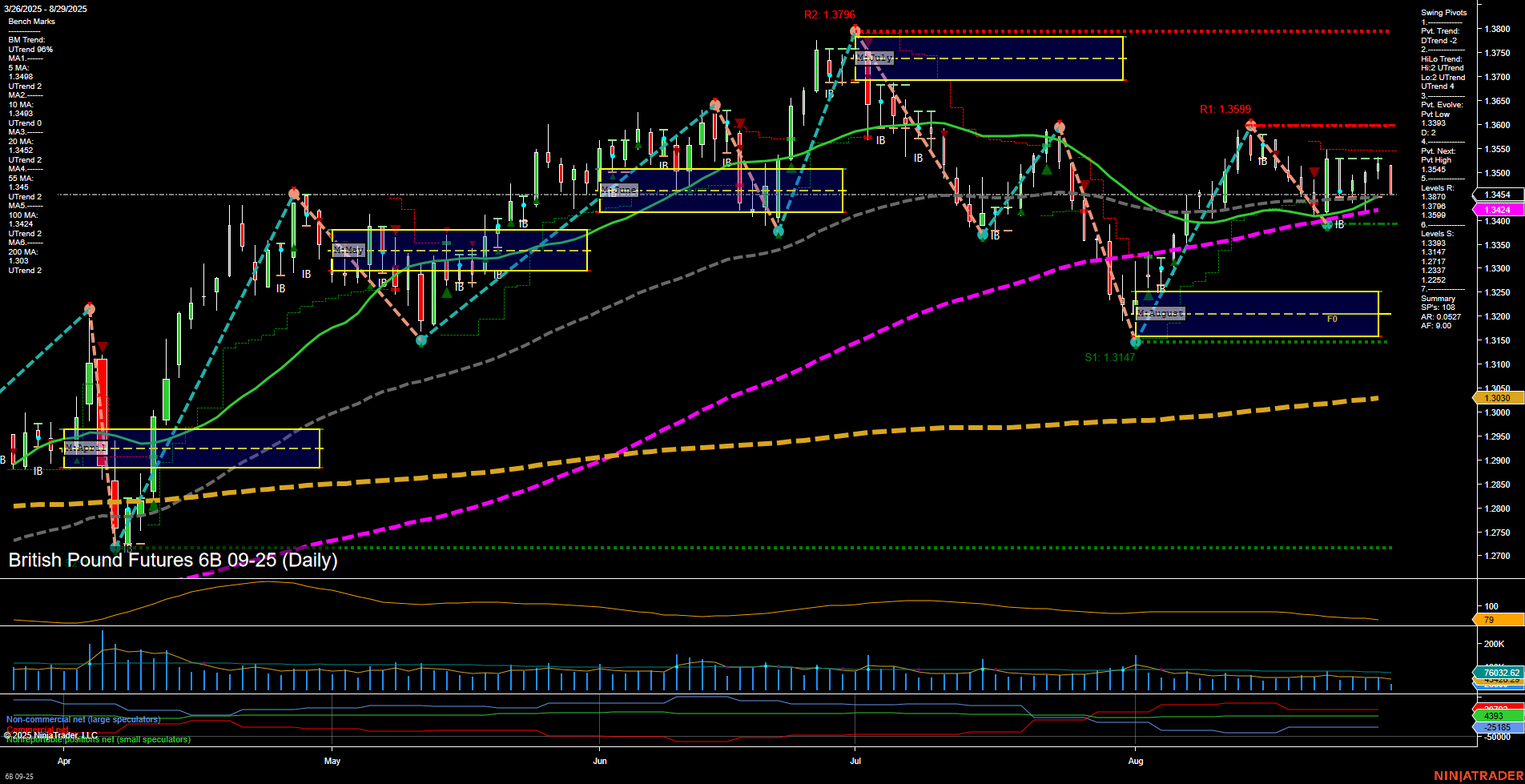

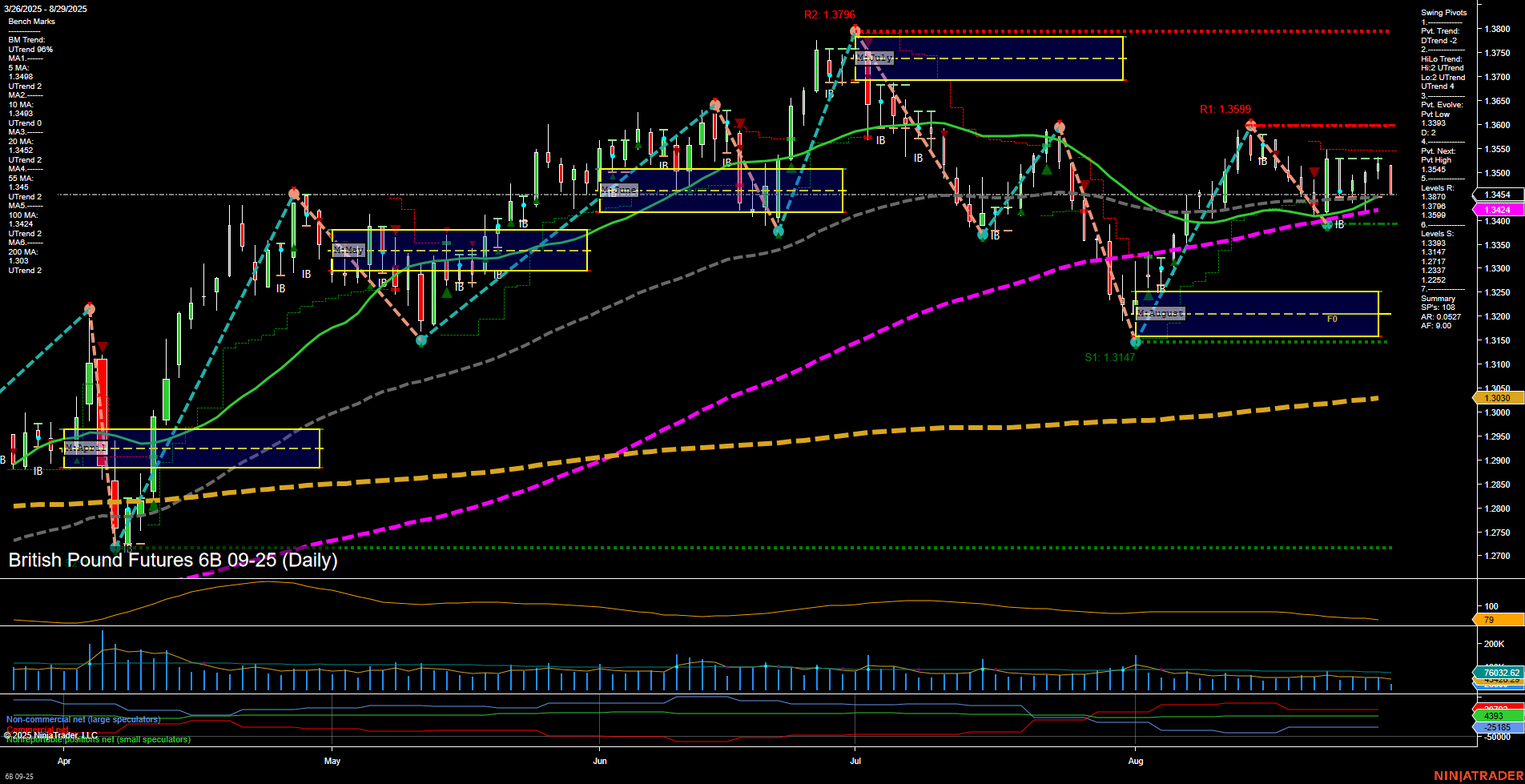

6B British Pound Futures Daily Chart Analysis: 2025-Aug-29 07:00 CT

Price Action

- Last: 1.3454,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -35%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 52%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 49%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 1.3392,

- 4. Pvt. Next: Pvt High 1.3545,

- 5. Levels R: 1.3599, 1.3545, 1.3488,

- 6. Levels S: 1.3392, 1.3147, 1.3033.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3468 Down Trend,

- (Short-Term) 10 Day: 1.3488 Down Trend,

- (Intermediate-Term) 20 Day: 1.3424 Up Trend,

- (Intermediate-Term) 55 Day: 1.3452 Up Trend,

- (Long-Term) 100 Day: 1.3456 Up Trend,

- (Long-Term) 200 Day: 1.3303 Up Trend.

Additional Metrics

Recent Trade Signals

- 29 Aug 2025: Short 6B 09-25 @ 1.3456 Signals.USAR.TR120

- 26 Aug 2025: Short 6B 09-25 @ 1.3482 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6B British Pound Futures daily chart shows a mixed but evolving landscape. Short-term momentum is average with medium-sized bars, and the price is currently below the weekly session fib grid (WSFG) NTZ, indicating a short-term bearish bias. This is reinforced by the downtrend in both the 5-day and 10-day moving averages, as well as the most recent short-term trade signals, which are both to the short side. However, the intermediate and long-term outlooks remain bullish, with the monthly and yearly session fib grids (MSFG and YSFG) both trending up and price holding above their respective NTZ levels. The 20, 55, 100, and 200-day moving averages are all in uptrends, supporting a broader bullish structure. Swing pivots show a short-term downtrend but an intermediate-term uptrend, with the next key resistance at 1.3545 and support at 1.3392. Volatility and volume are moderate, suggesting a market in transition. Overall, the chart reflects a short-term pullback or consolidation within a larger bullish trend, with potential for either a continuation lower in the near term or a resumption of the uptrend if key resistance levels are reclaimed.

Chart Analysis ATS AI Generated: 2025-08-29 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.