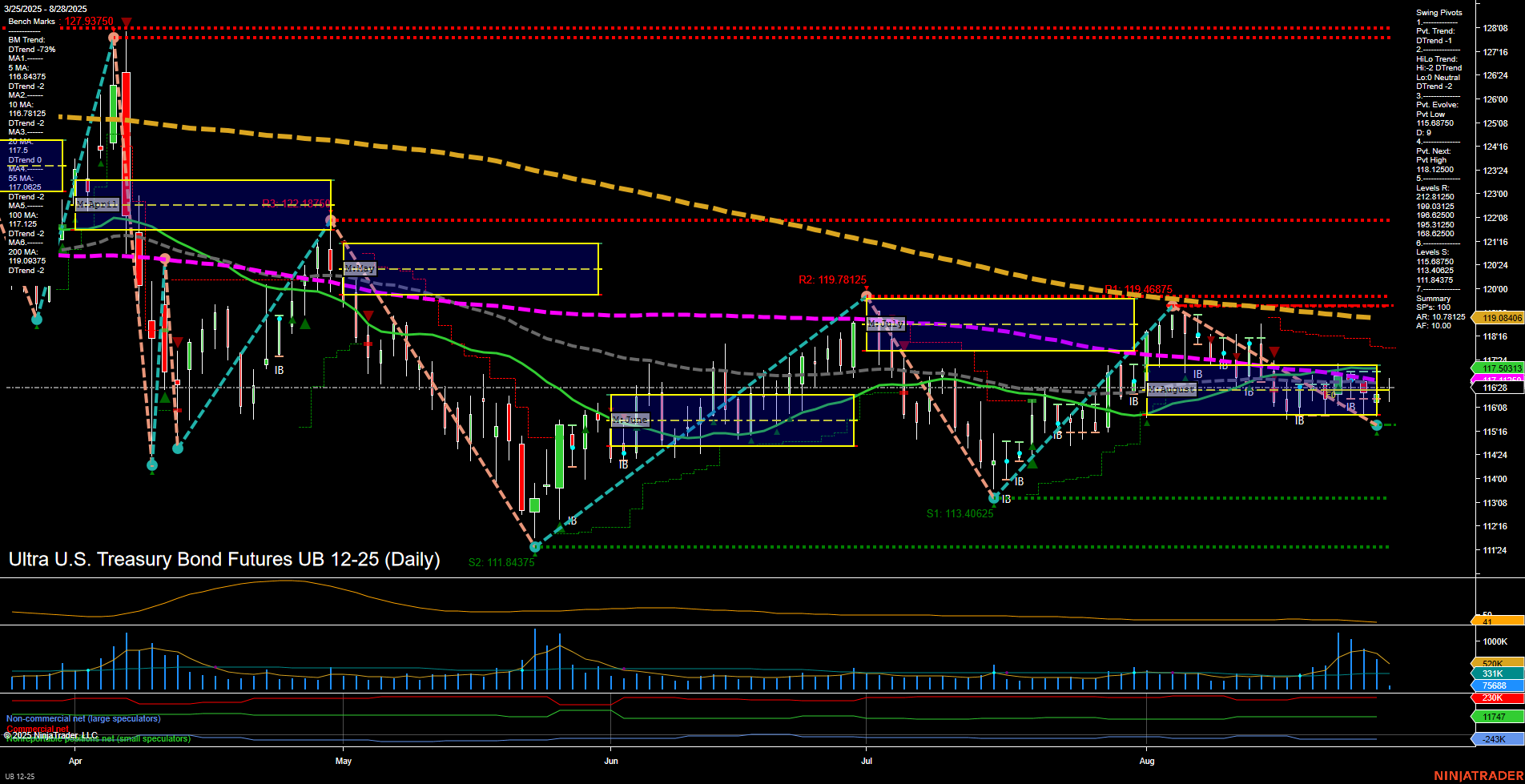

The UB Ultra U.S. Treasury Bond Futures daily chart reflects a market under pressure, with the short-term and long-term trends both pointing down. Price action is subdued, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The weekly session fib grid (WSFG) and yearly session fib grid (YSFG) both show price below their respective NTZ centers, reinforcing a bearish bias. The monthly session fib grid (MSFG) is slightly positive, with price just above the NTZ, suggesting some intermediate-term stabilization or potential for a minor bounce, but this is not yet supported by a broader trend shift. Swing pivot analysis confirms a dominant downtrend in both short-term and intermediate-term metrics, with the most recent pivot low at 115.6875 and resistance levels stacked above current price. All benchmark moving averages from short to long term are trending down, and price remains below these key levels, further confirming the prevailing bearish structure. Recent trade signals have all been to the short side, aligning with the technical backdrop. Volatility, as measured by ATR, is moderate, and volume metrics are elevated, indicating active participation but not extreme conditions. The market appears to be in a corrective or consolidation phase within a larger downtrend, with potential for further downside unless a significant reversal above resistance pivots and moving averages occurs. The overall environment is characterized by trend continuation to the downside, with only minor intermediate-term countertrend signals.