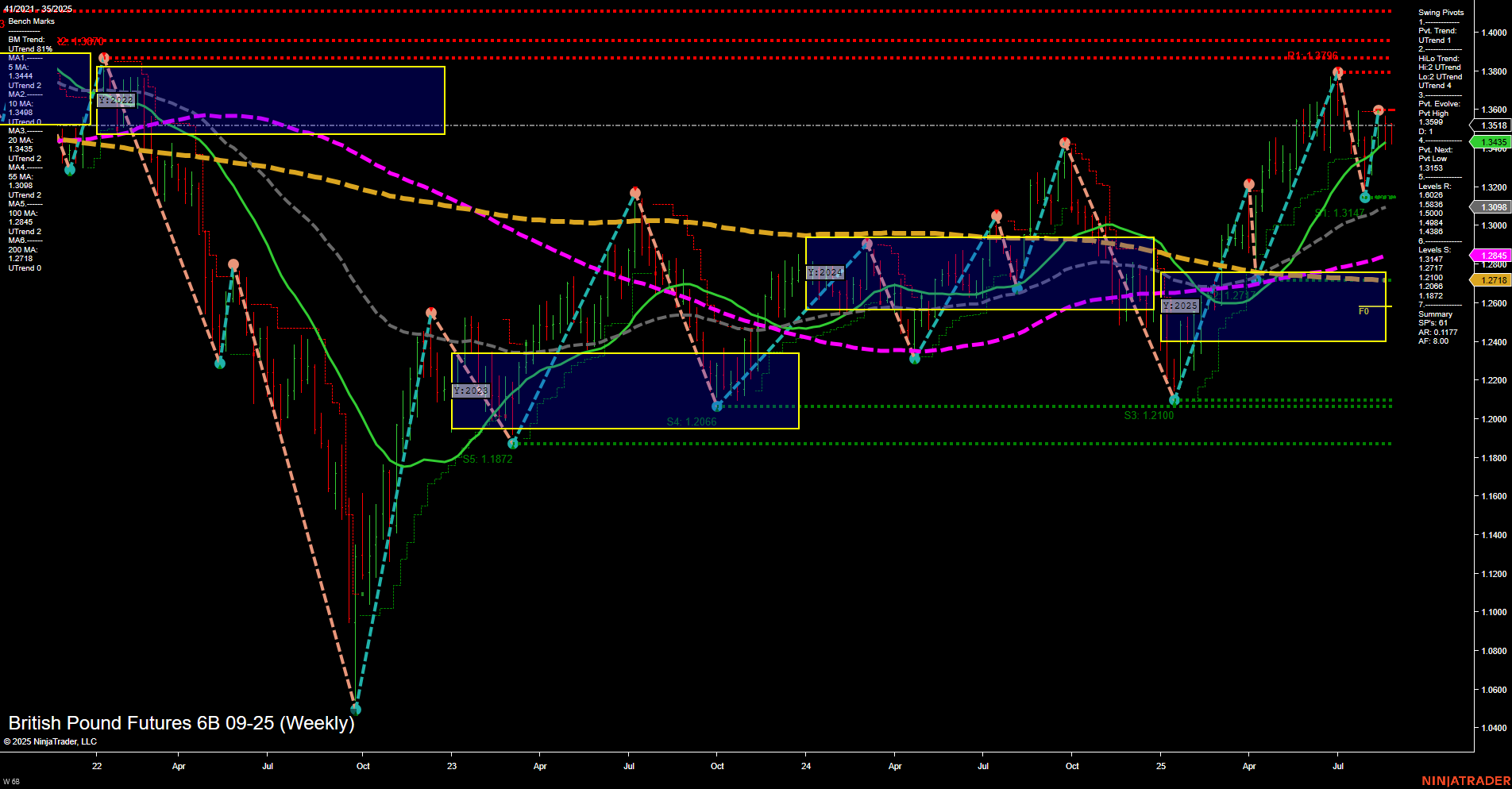

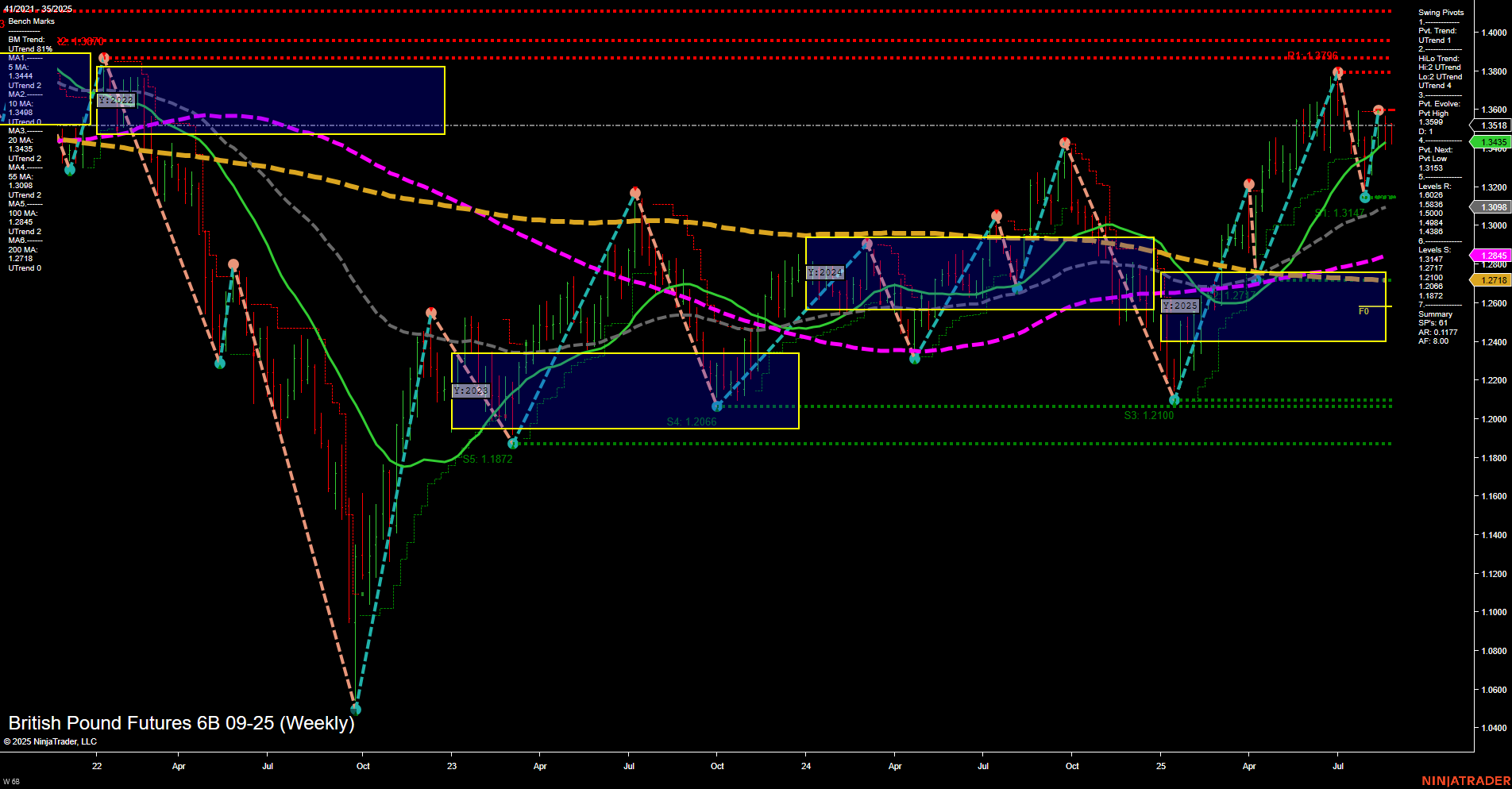

6B British Pound Futures Weekly Chart Analysis: 2025-Aug-28 07:02 CT

Price Action

- Last: 1.3482,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 79%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 52%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1.3518,

- 4. Pvt. Next: Pvt Low 1.3142,

- 5. Levels R: 1.3796, 1.3518, 1.3098,

- 6. Levels S: 1.3142, 1.2945, 1.2718, 1.2100, 1.2066, 1.1872.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3443 Up Trend,

- (Intermediate-Term) 10 Week: 1.3364 Up Trend,

- (Long-Term) 20 Week: 1.3142 Up Trend,

- (Long-Term) 55 Week: 1.2945 Up Trend,

- (Long-Term) 100 Week: 1.2718 Up Trend,

- (Long-Term) 200 Week: 1.2465 Up Trend.

Recent Trade Signals

- 26 Aug 2025: Short 6B 09-25 @ 1.3482 Signals.USAR-WSFG

- 25 Aug 2025: Short 6B 09-25 @ 1.3461 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) weekly chart shows a market that has recently experienced a strong upward move, with price currently consolidating near recent highs. The short-term WSFG trend is down, with price just below the NTZ center, suggesting some near-term resistance and a possible pause or pullback after the recent rally. However, both the intermediate and long-term trends remain firmly up, as indicated by the MSFG and YSFG readings, as well as all benchmark moving averages trending higher. Swing pivots confirm an uptrend in both short and intermediate terms, with the most recent pivot high at 1.3518 and next support at 1.3142. Resistance levels are stacked above, with 1.3796 as a major level to watch. Recent short-term trade signals suggest some profit-taking or hedging at these levels, but the broader structure remains constructive. The market is in a phase where short-term volatility and pullbacks may occur within a larger bullish context, with higher lows and higher highs dominating the longer-term price action.

Chart Analysis ATS AI Generated: 2025-08-28 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.