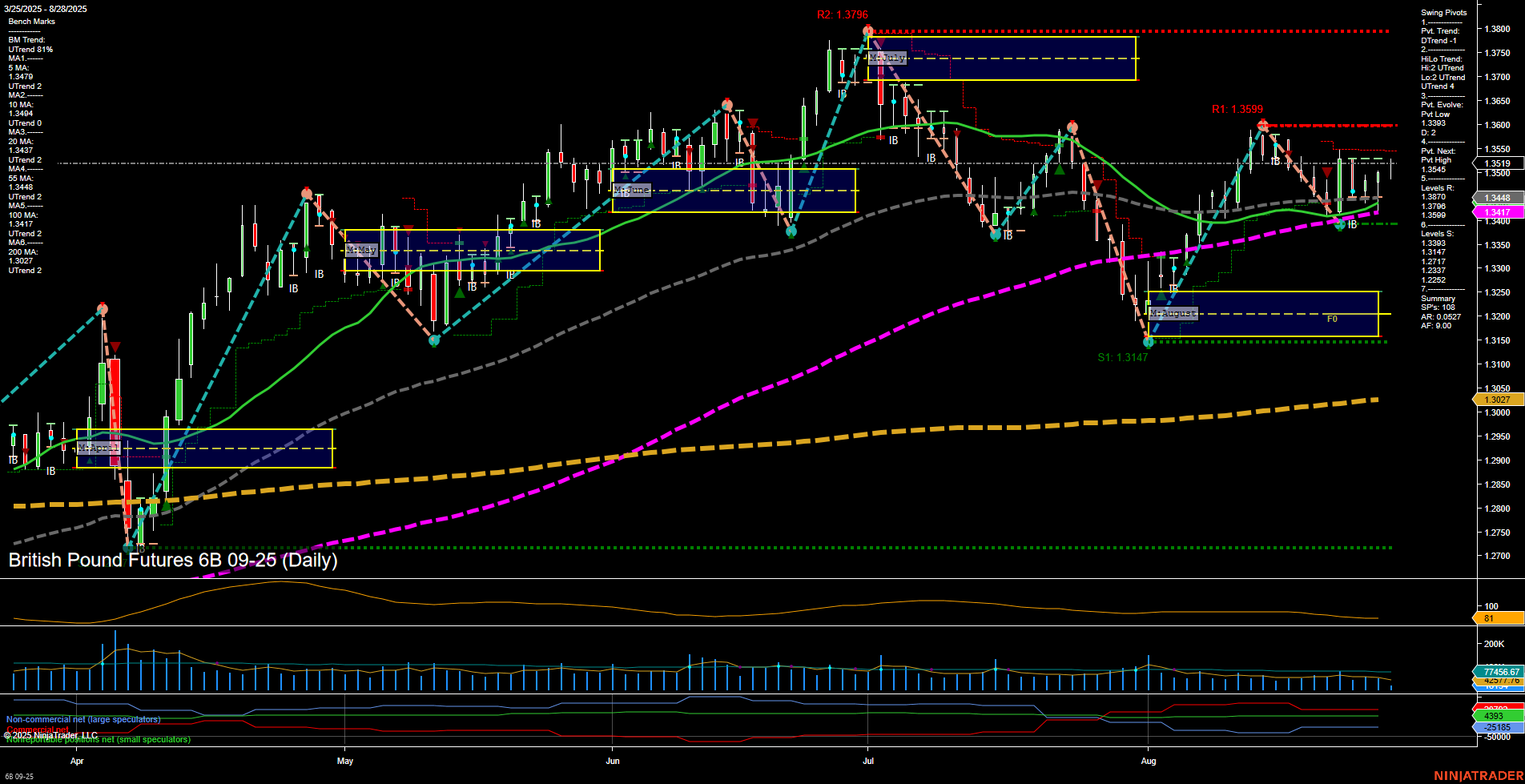

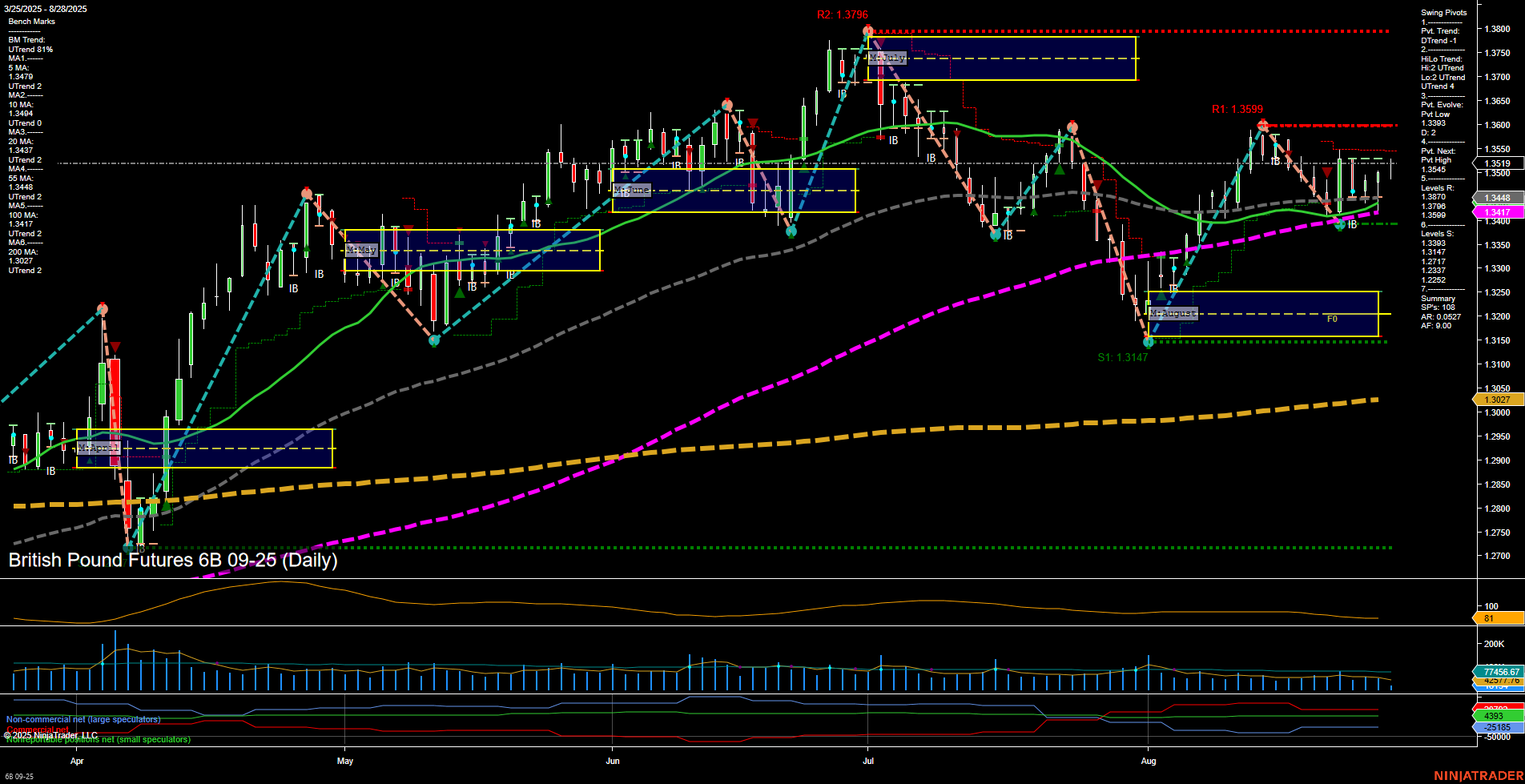

6B British Pound Futures Daily Chart Analysis: 2025-Aug-28 07:01 CT

Price Action

- Last: 1.3445,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 79%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 52%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.3147,

- 4. Pvt. Next: Pvt high 1.3545,

- 5. Levels R: 1.3559, 1.3796,

- 6. Levels S: 1.3147, 1.3027.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3478 Up Trend,

- (Short-Term) 10 Day: 1.3446 Up Trend,

- (Intermediate-Term) 20 Day: 1.3417 Up Trend,

- (Intermediate-Term) 55 Day: 1.3304 Up Trend,

- (Long-Term) 100 Day: 1.3217 Up Trend,

- (Long-Term) 200 Day: 1.3027 Up Trend.

Additional Metrics

Recent Trade Signals

- 26 Aug 2025: Short 6B 09-25 @ 1.3482 Signals.USAR-WSFG

- 25 Aug 2025: Short 6B 09-25 @ 1.3461 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) daily chart shows a market in transition. Short-term momentum has shifted bearish, as indicated by the downward WSFG trend and recent short trade signals, with price currently below the weekly NTZ and a DTrend in the short-term swing pivots. However, the intermediate and long-term outlooks remain bullish, supported by strong uptrends across all major moving averages and the MSFG/YSFG trends, with price holding above both monthly and yearly NTZ levels. The market recently bounced from a significant swing low (1.3147), and is now consolidating below resistance (1.3559), with volatility and volume at moderate levels. This setup suggests a short-term pullback or consolidation phase within a broader uptrend, with key support at 1.3147 and 1.3027, and resistance at 1.3559 and 1.3796. The overall structure favors monitoring for potential trend continuation or reversal signals as the market digests recent moves.

Chart Analysis ATS AI Generated: 2025-08-28 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.