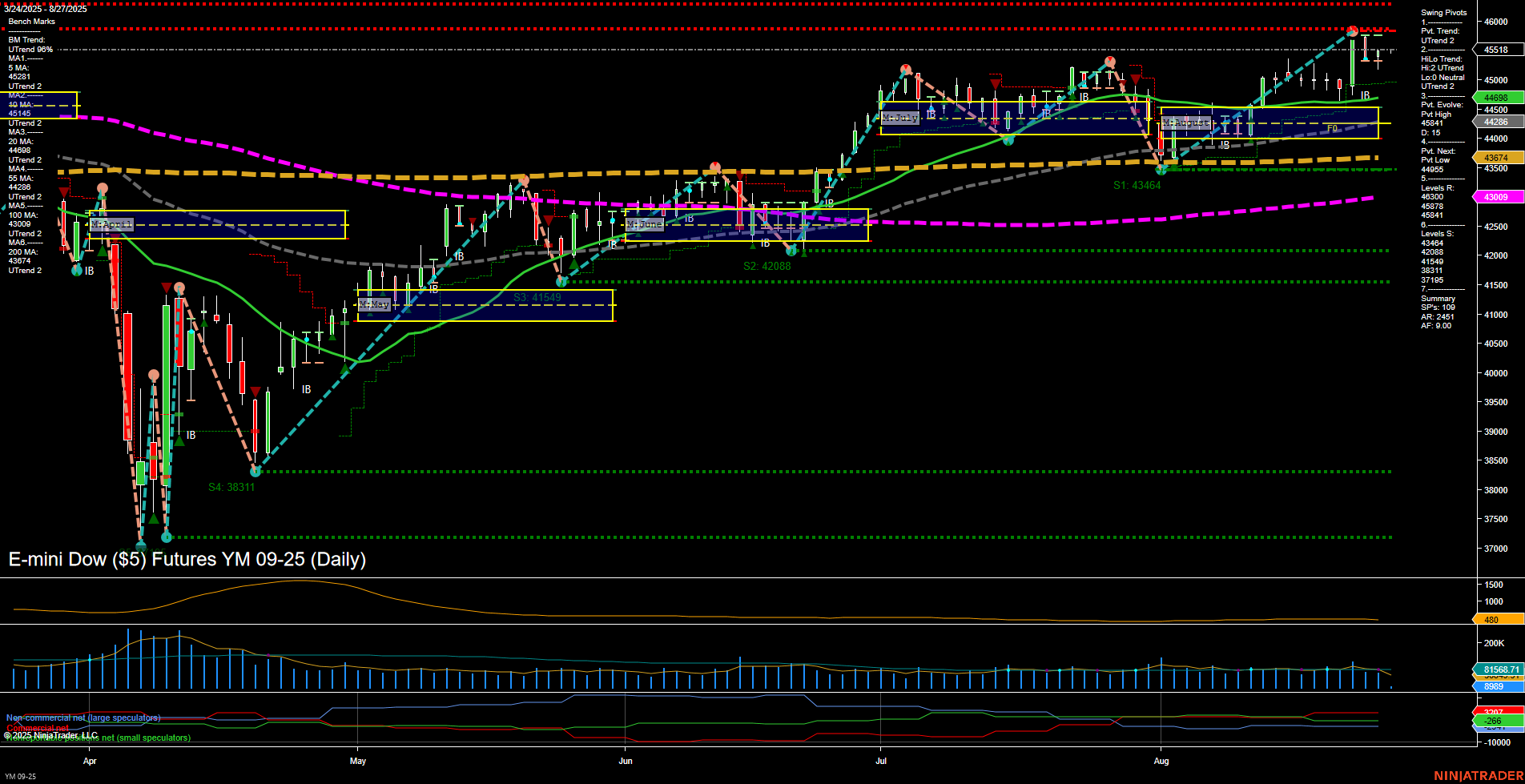

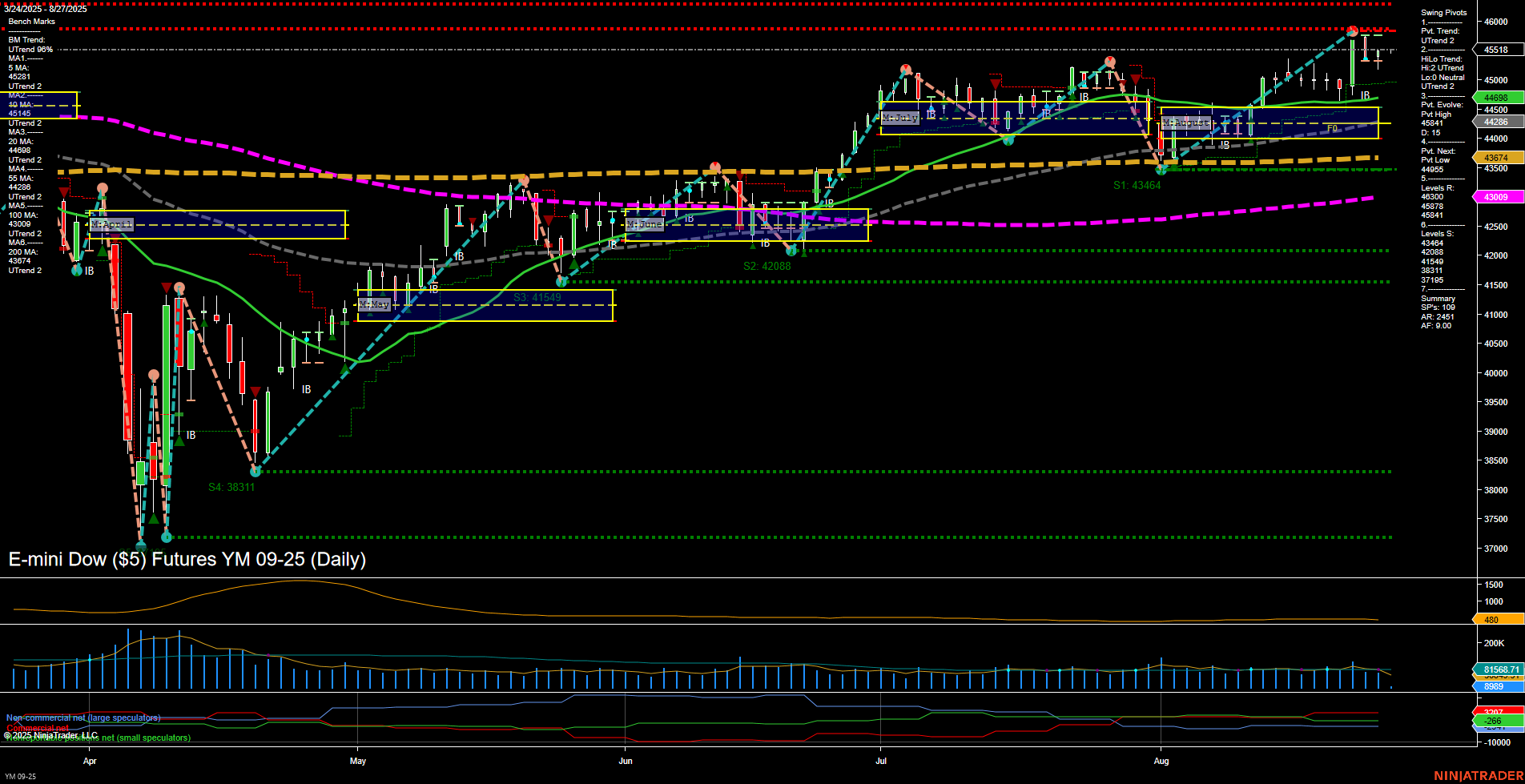

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Aug-27 07:22 CT

Price Action

- Last: 45518,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 71%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 46941,

- 4. Pvt. Next: Pvt Low 44506,

- 5. Levels R: 45518, 45041, 44898, 44628, 44348,

- 6. Levels S: 43674, 43464, 42088, 41549, 38311, 37105.

Daily Benchmarks

- (Short-Term) 5 Day: 45421 Up Trend,

- (Short-Term) 10 Day: 45145 Up Trend,

- (Intermediate-Term) 20 Day: 44898 Up Trend,

- (Intermediate-Term) 55 Day: 43009 Up Trend,

- (Long-Term) 100 Day: 44628 Up Trend,

- (Long-Term) 200 Day: 44348 Up Trend.

Additional Metrics

Recent Trade Signals

- 25 Aug 2025: Short YM 09-25 @ 45346 Signals.USAR.TR120

- 25 Aug 2025: Short YM 09-25 @ 45494 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow is currently trading near recent highs, with price action showing medium-sized bars and average momentum. The short-term WSFG trend is down, with price below the weekly NTZ, suggesting some near-term weakness or consolidation. However, both the intermediate-term (MSFG) and long-term (YSFG) session fib grids are trending up, with price above their respective NTZ levels, indicating underlying strength in the broader trend. Swing pivots confirm an uptrend in both short- and intermediate-term, with the most recent pivot high at 46941 and the next key support at 44506. All benchmark moving averages are in uptrends, reinforcing the bullish structure on higher timeframes. Recent short-term trade signals suggest some tactical selling, possibly in response to short-term overextension or a pullback within the broader uptrend. Volatility (ATR) and volume metrics are moderate, indicating a healthy but not extreme trading environment. Overall, the market is in a bullish phase on intermediate and long-term horizons, while short-term action is more neutral, likely reflecting a pause or minor retracement within the prevailing uptrend.

Chart Analysis ATS AI Generated: 2025-08-27 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.