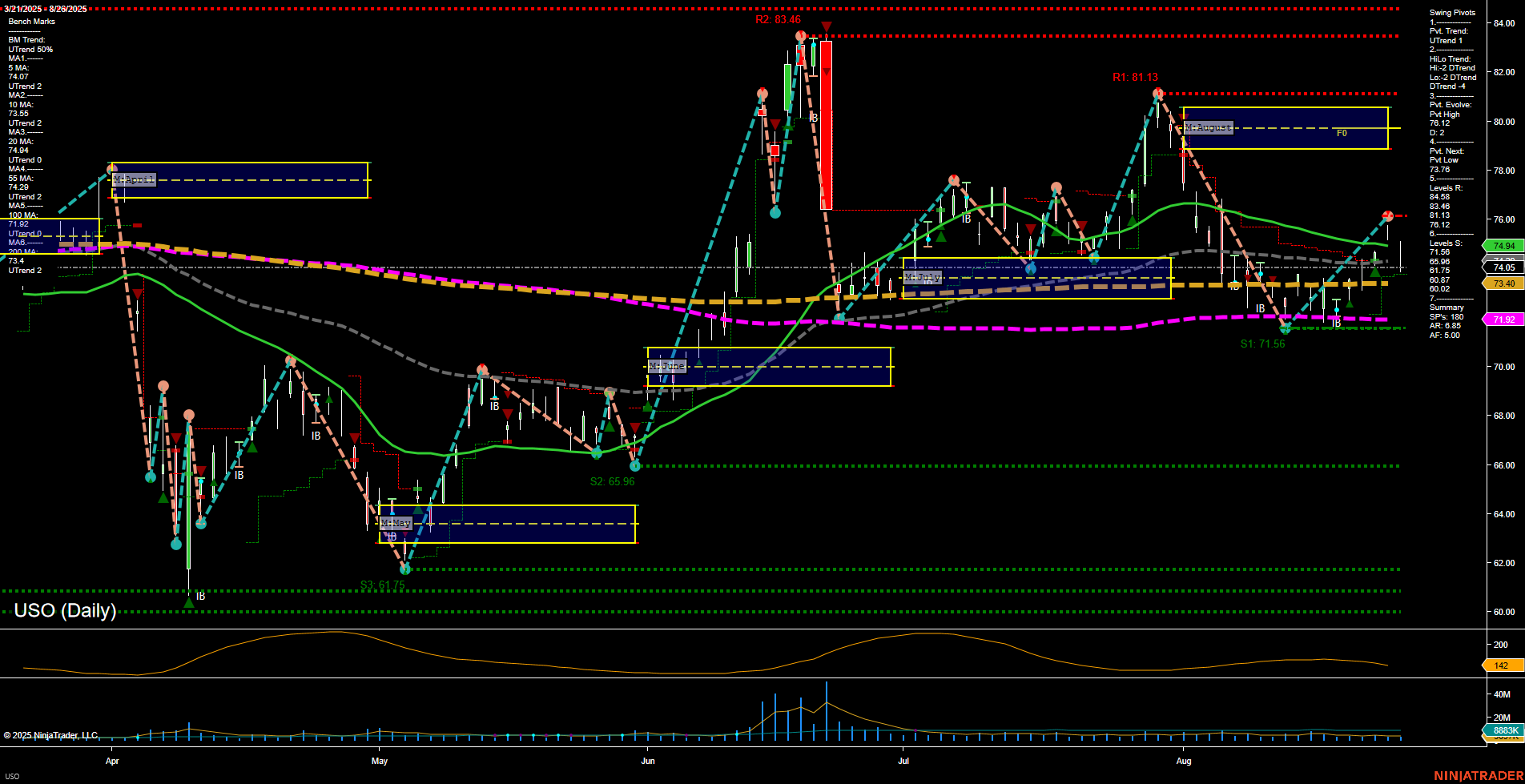

USO is currently trading in a consolidation phase, with price action showing medium-sized bars and average momentum. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains in a downtrend, reflecting a market that is attempting to recover from a recent pullback but has not yet confirmed a sustained reversal. Resistance is layered above at 74.86, 81.13, and 83.46, while support is clustered just below at 74.05, 73.40, and 71.92, indicating a tight trading range and potential for volatility if these levels are breached. Benchmark moving averages show mixed signals: short-term MAs (5 and 10 day) are in uptrends, while the 20-day MA is in a downtrend, suggesting some short-term strength but lingering intermediate-term weakness. However, the 55, 100, and 200-day MAs are all in uptrends, supporting a bullish long-term outlook. The ATR and volume metrics indicate moderate volatility and participation. Overall, the chart reflects a market in transition, with short-term and intermediate-term signals neutral as price consolidates near key support and resistance. The long-term structure remains bullish, but confirmation of a new trend direction will depend on a decisive move out of the current range. Swing traders should note the potential for breakout or breakdown as price approaches these pivotal levels, with the broader trend still favoring the upside over the long run.