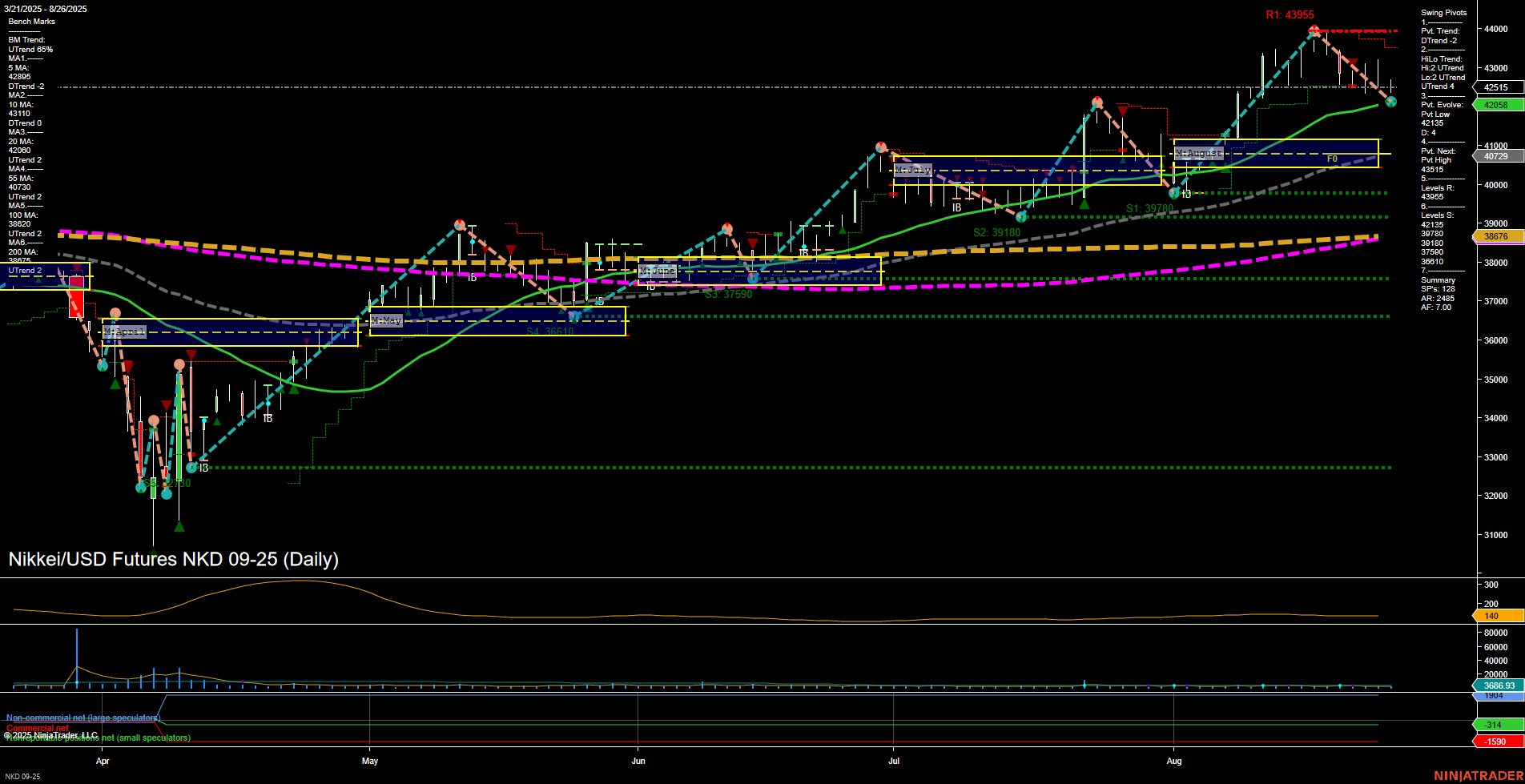

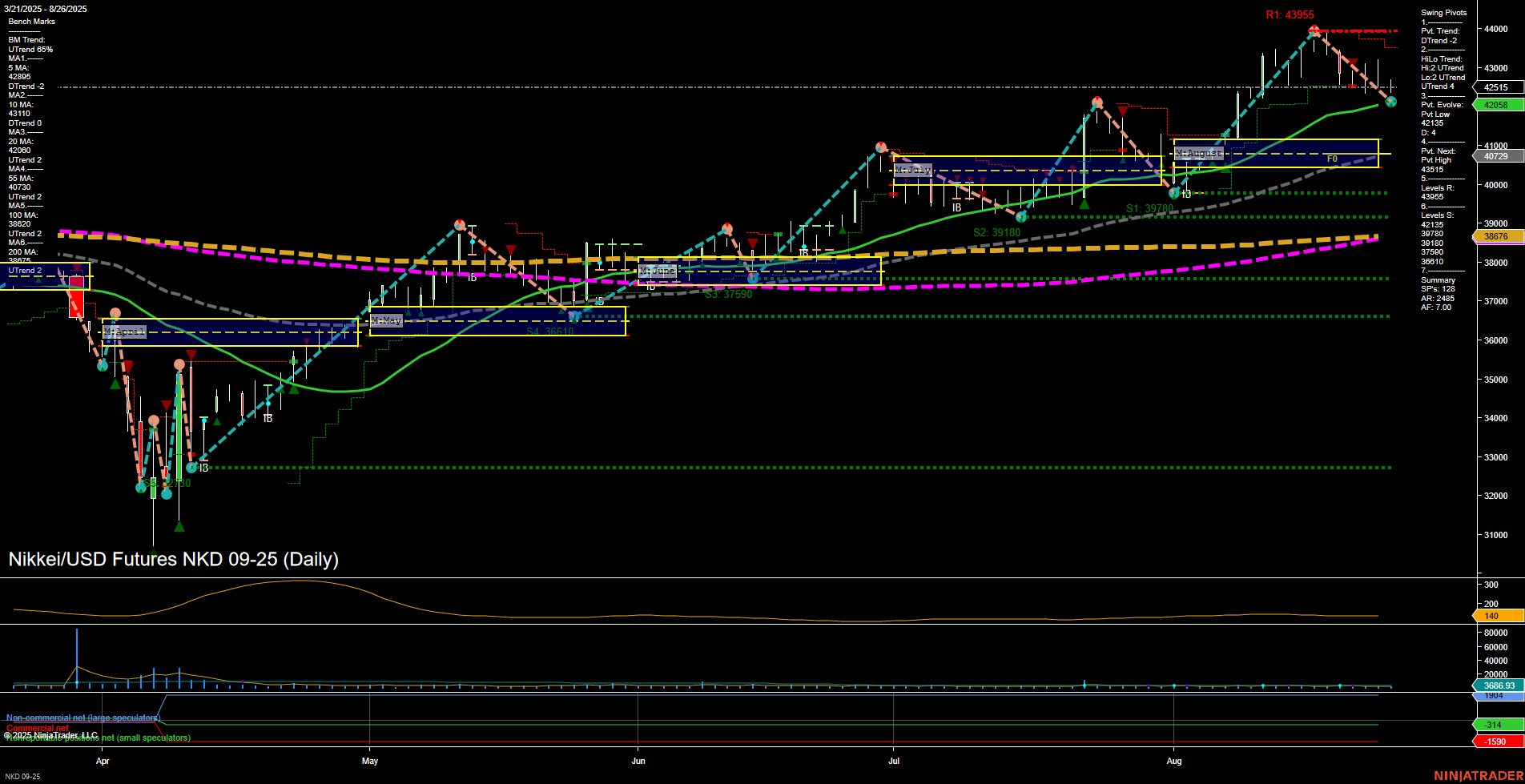

NKD Nikkei/USD Futures Daily Chart Analysis: 2025-Aug-27 07:14 CT

Price Action

- Last: 42,058,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -32%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 62%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 33%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 42,158,

- 4. Pvt. Next: Pvt high 43,955,

- 5. Levels R: 43,955, 43,515, 41,009,

- 6. Levels S: 40,729, 39,785, 39,180, 37,590, 36,610.

Daily Benchmarks

- (Short-Term) 5 Day: 42,866 Up Trend,

- (Short-Term) 10 Day: 43,110 Down Trend,

- (Intermediate-Term) 20 Day: 42,060 Up Trend,

- (Intermediate-Term) 55 Day: 40,200 Up Trend,

- (Long-Term) 100 Day: 39,766 Up Trend,

- (Long-Term) 200 Day: 38,676 Up Trend.

Additional Metrics

Recent Trade Signals

- 25 Aug 2025: Short NKD 09-25 @ 42,545 Signals.USAR.TR120

- 20 Aug 2025: Short NKD 09-25 @ 42,975 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD futures daily chart shows a market in transition. Short-term momentum has slowed, with the price recently breaking below the weekly session fib grid (WSFG) NTZ, and the short-term swing pivot trend turning down (DTrend). This is reinforced by recent short trade signals and a 10-day moving average that has shifted to a downtrend. However, the intermediate and long-term outlooks remain bullish, as the monthly and yearly session fib grids (MSFG, YSFG) both show price above their NTZ centers and uptrends, supported by rising 20, 55, 100, and 200-day moving averages. The market is currently testing support near 42,000, with significant resistance overhead at 43,955 and 43,515. Volatility and volume remain moderate. The overall structure suggests a short-term pullback or consolidation within a broader uptrend, with the potential for further downside in the near term before the longer-term bullish trend may reassert itself.

Chart Analysis ATS AI Generated: 2025-08-27 07:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.