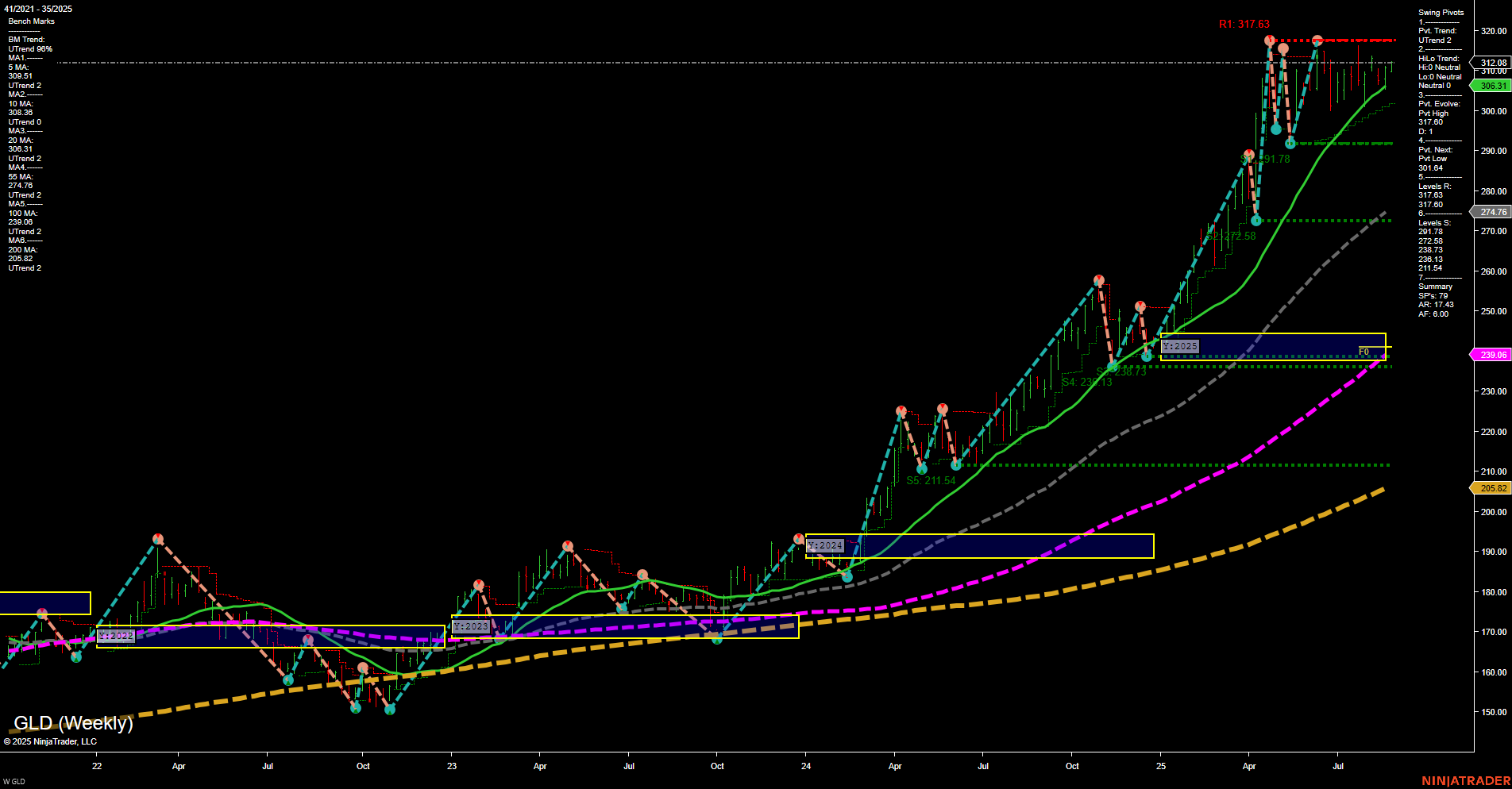

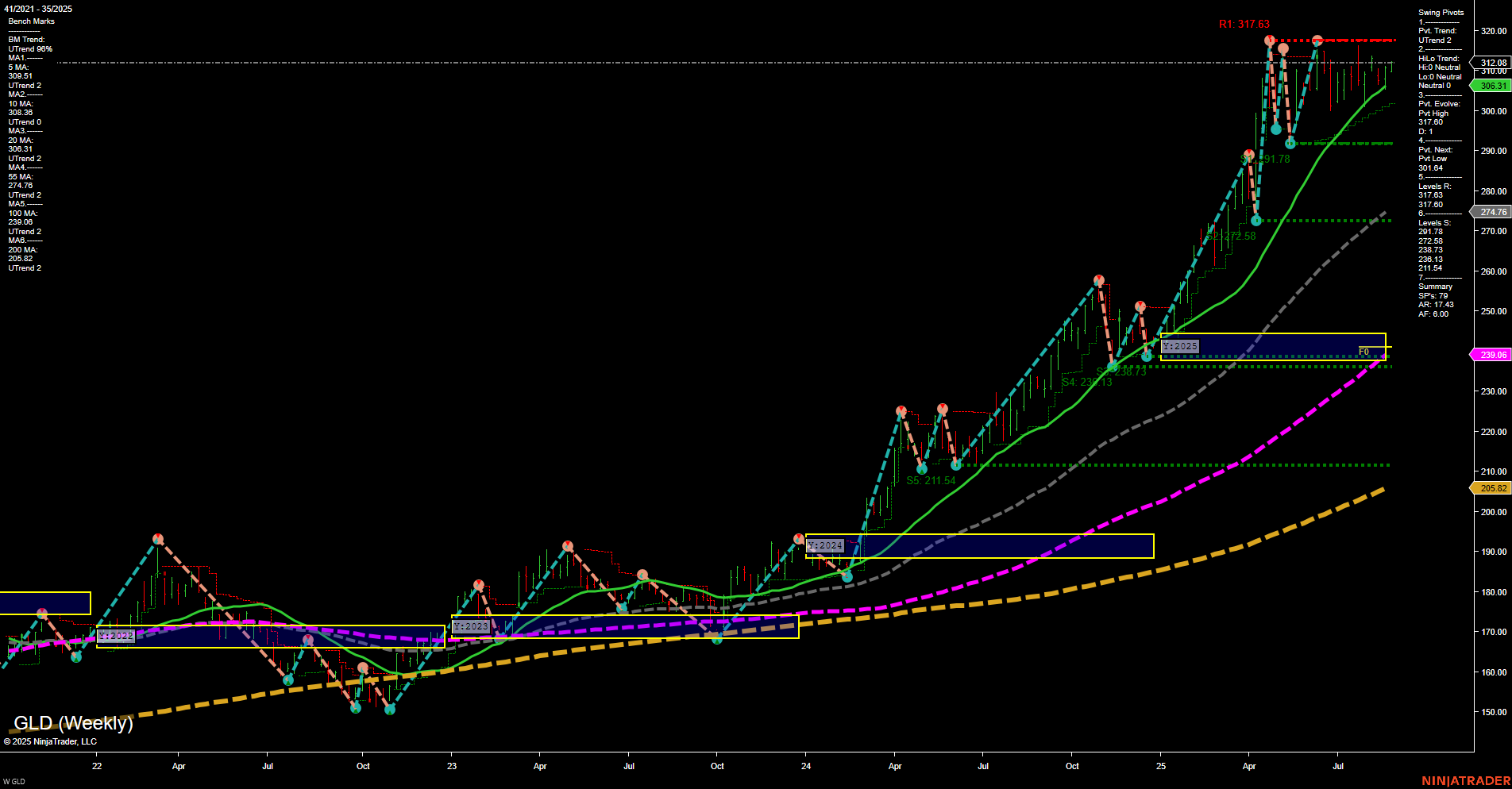

GLD SPDR Gold Shares Weekly Chart Analysis: 2025-Aug-27 07:13 CT

Price Action

- Last: 310.01,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: UTrend 2,

- 3. Pvt. Evolve: Pvt high 317.60,

- 4. Pvt. Next: Pvt low 301.64,

- 5. Levels R: 317.60, 312.08,

- 6. Levels S: 301.64, 291.78, 272.58, 239.13, 211.54.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 309.51 Up Trend,

- (Intermediate-Term) 10 Week: 308.86 Up Trend,

- (Long-Term) 20 Week: 303.31 Up Trend,

- (Long-Term) 55 Week: 274.76 Up Trend,

- (Long-Term) 100 Week: 239.08 Up Trend,

- (Long-Term) 200 Week: 205.82 Up Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

GLD is consolidating near all-time highs after a strong multi-month rally, with price action showing small bars and slow momentum, indicating a pause or digestion phase. Both short-term and intermediate-term swing pivots remain in uptrends, but resistance at 317.60 is capping further upside for now. Support is layered below at 301.64 and 291.78, with major long-term support at the 20, 55, and 100 week moving averages, all trending higher. The overall structure is bullish on intermediate and long-term timeframes, with the current range-bound action suggesting a potential base-building phase before the next directional move. No clear breakout or breakdown is evident, so futures swing traders may interpret this as a market in consolidation, awaiting a catalyst for renewed trend direction.

Chart Analysis ATS AI Generated: 2025-08-27 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.