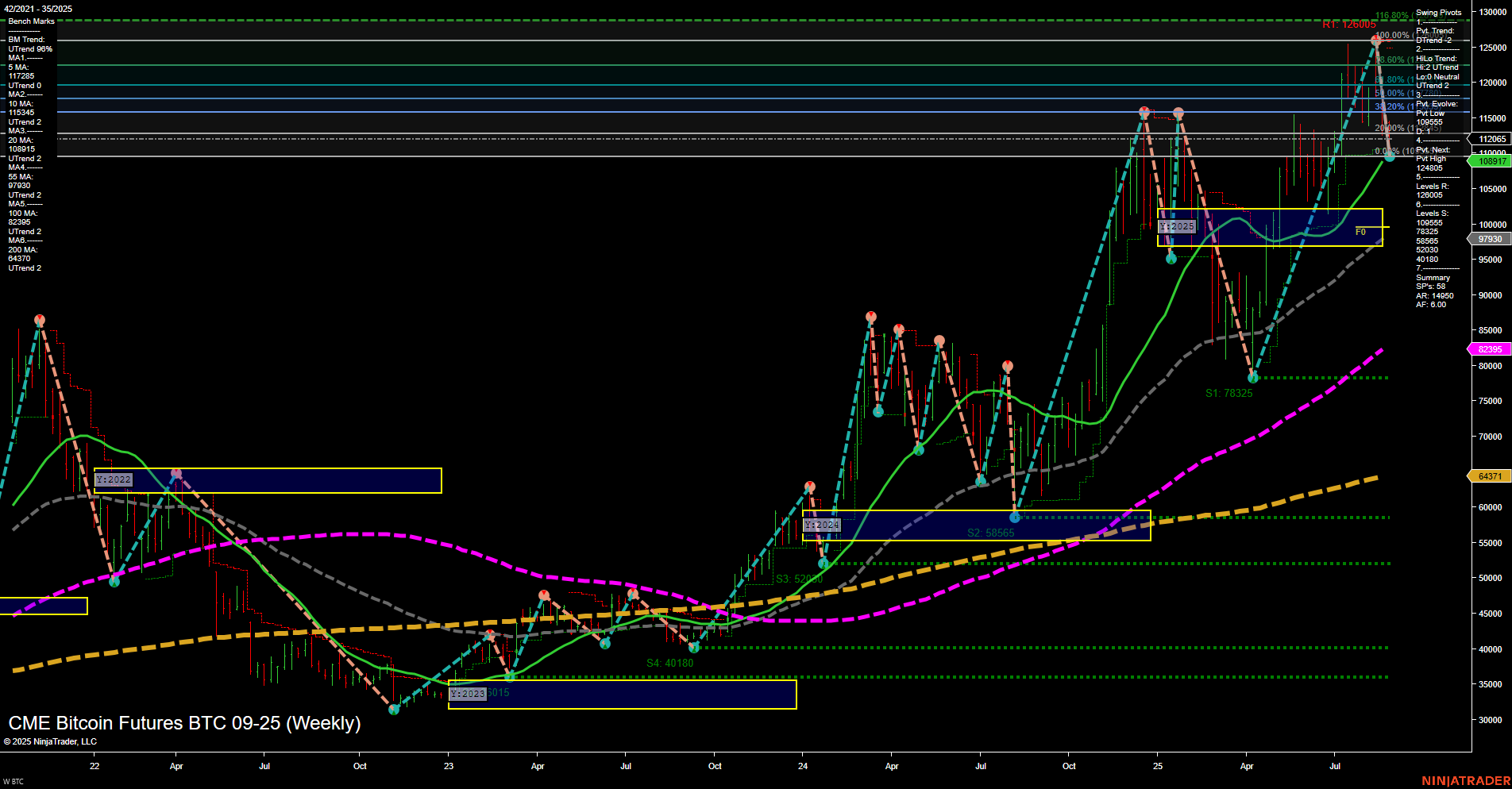

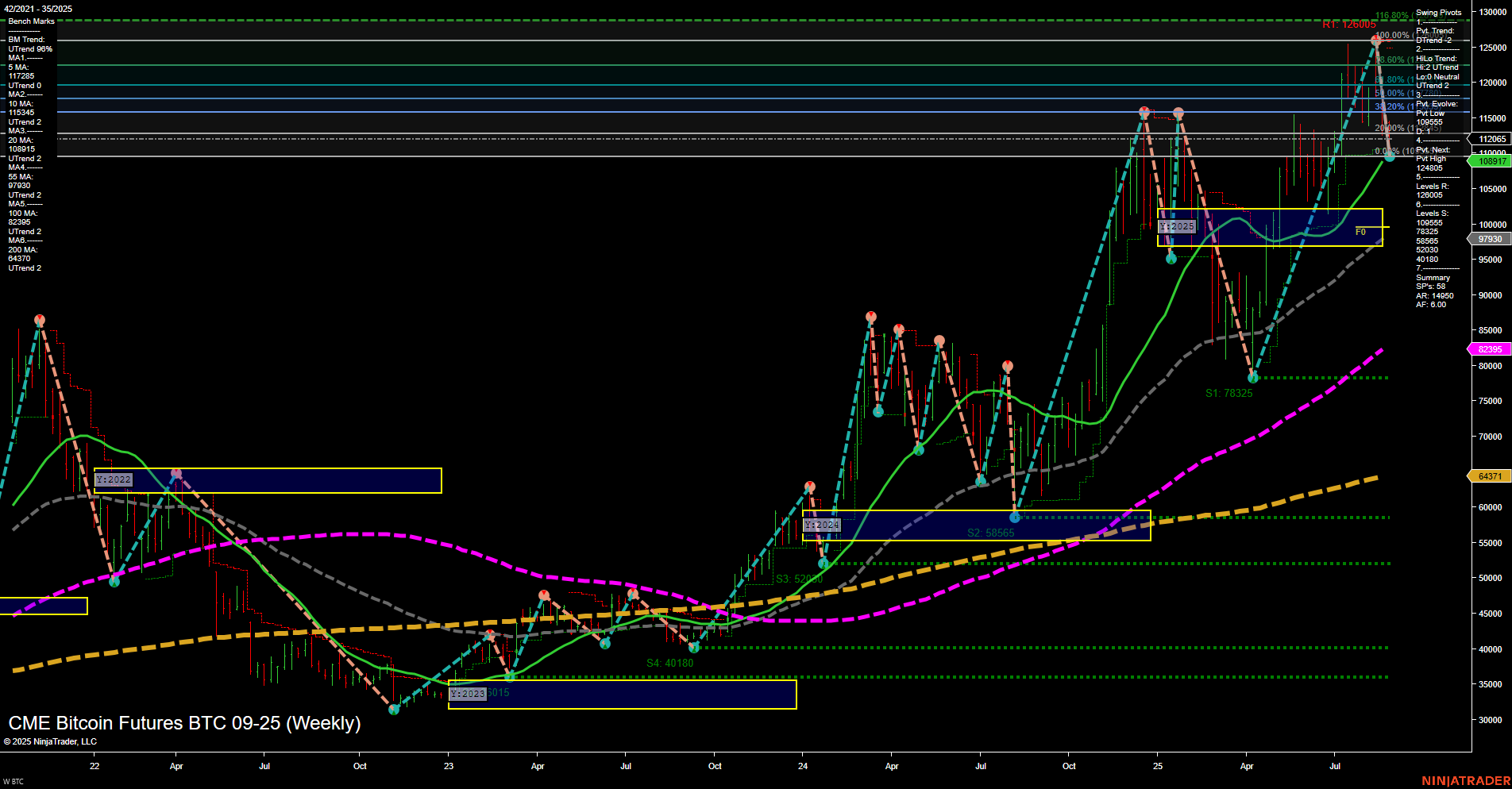

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Aug-27 07:05 CT

Price Action

- Last: 117265,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -32%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 48%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 124805,

- 4. Pvt. Next: Pvt low 109515,

- 5. Levels R: 126000, 124805, 120000, 117265, 113946,

- 6. Levels S: 109515, 97930, 78325, 58665, 52000, 40180, 30150.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 117265 Up Trend,

- (Intermediate-Term) 10 Week: 113946 Up Trend,

- (Long-Term) 20 Week: 108915 Up Trend,

- (Long-Term) 55 Week: 82395 Up Trend,

- (Long-Term) 100 Week: 82395 Up Trend,

- (Long-Term) 200 Week: 64371 Up Trend.

Recent Trade Signals

- 22 Aug 2025: Long BTC 08-25 @ 117245 Signals.USAR.TR120

- 19 Aug 2025: Short BTC 08-25 @ 113905 Signals.USAR-MSFG

- 19 Aug 2025: Short BTC 08-25 @ 113905 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

BTC CME Bitcoin Futures are showing a mixed technical landscape. Price action is strong with large bars and fast momentum, but the short-term WSFG and MSFG trends are both down, indicating recent weakness and a pullback below their respective NTZ/F0% levels. The short-term swing pivot trend is down, with the next key support at 109515 and resistance at 126000. However, the intermediate-term HiLo trend remains up, and all major weekly moving averages (from 5 to 200 week) are in uptrends, supporting a bullish long-term structure. The yearly session fib grid trend is up, with price well above the yearly NTZ/F0%, suggesting the broader uptrend is intact. Recent trade signals show both long and short activity, reflecting the current choppy and volatile environment. Overall, the short-term outlook is bearish due to the recent pullback, the intermediate-term is neutral as the market consolidates, and the long-term remains bullish with higher lows and strong support from moving averages. This environment is characterized by volatility, potential for further retracement, but with underlying strength in the broader trend.

Chart Analysis ATS AI Generated: 2025-08-27 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.