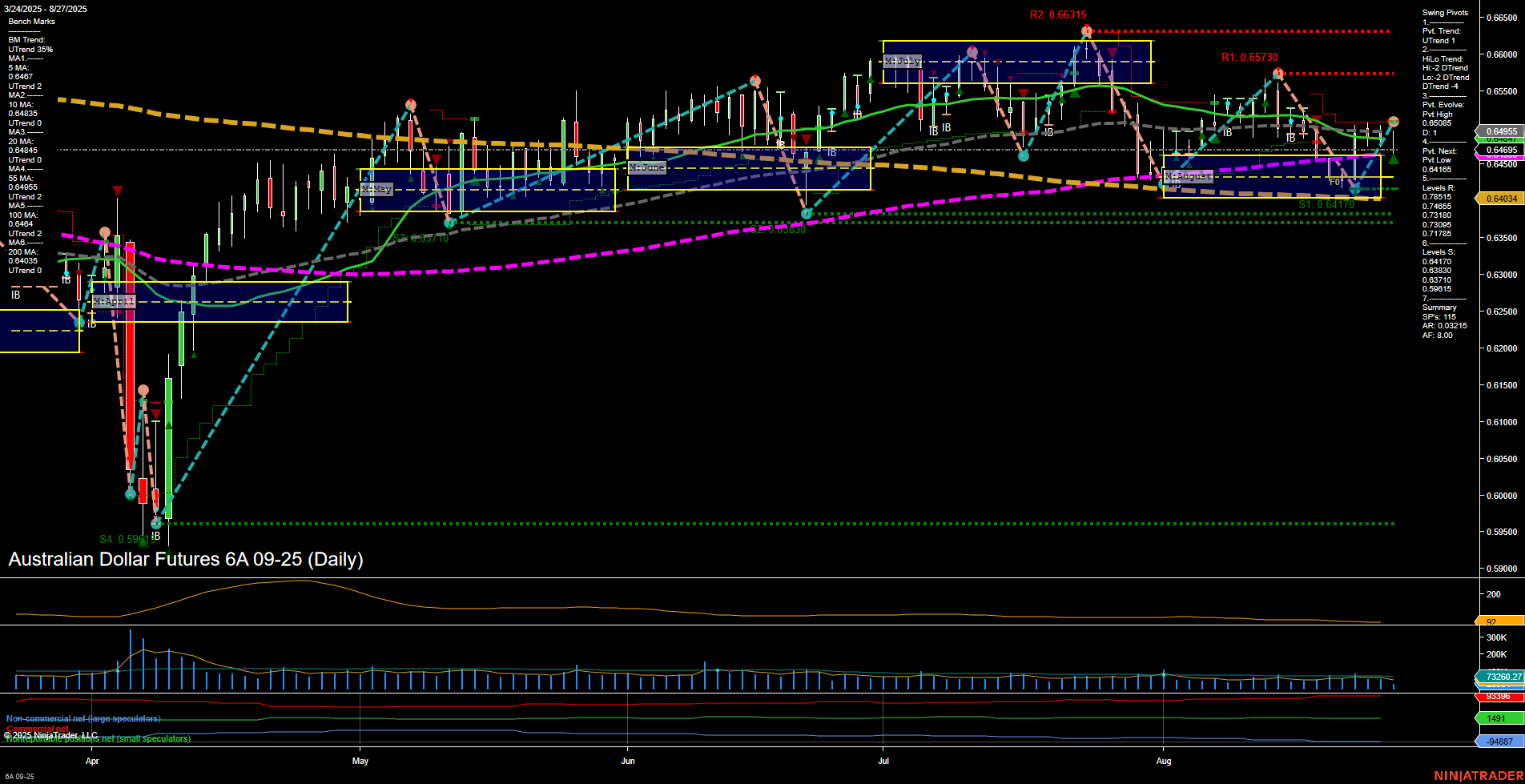

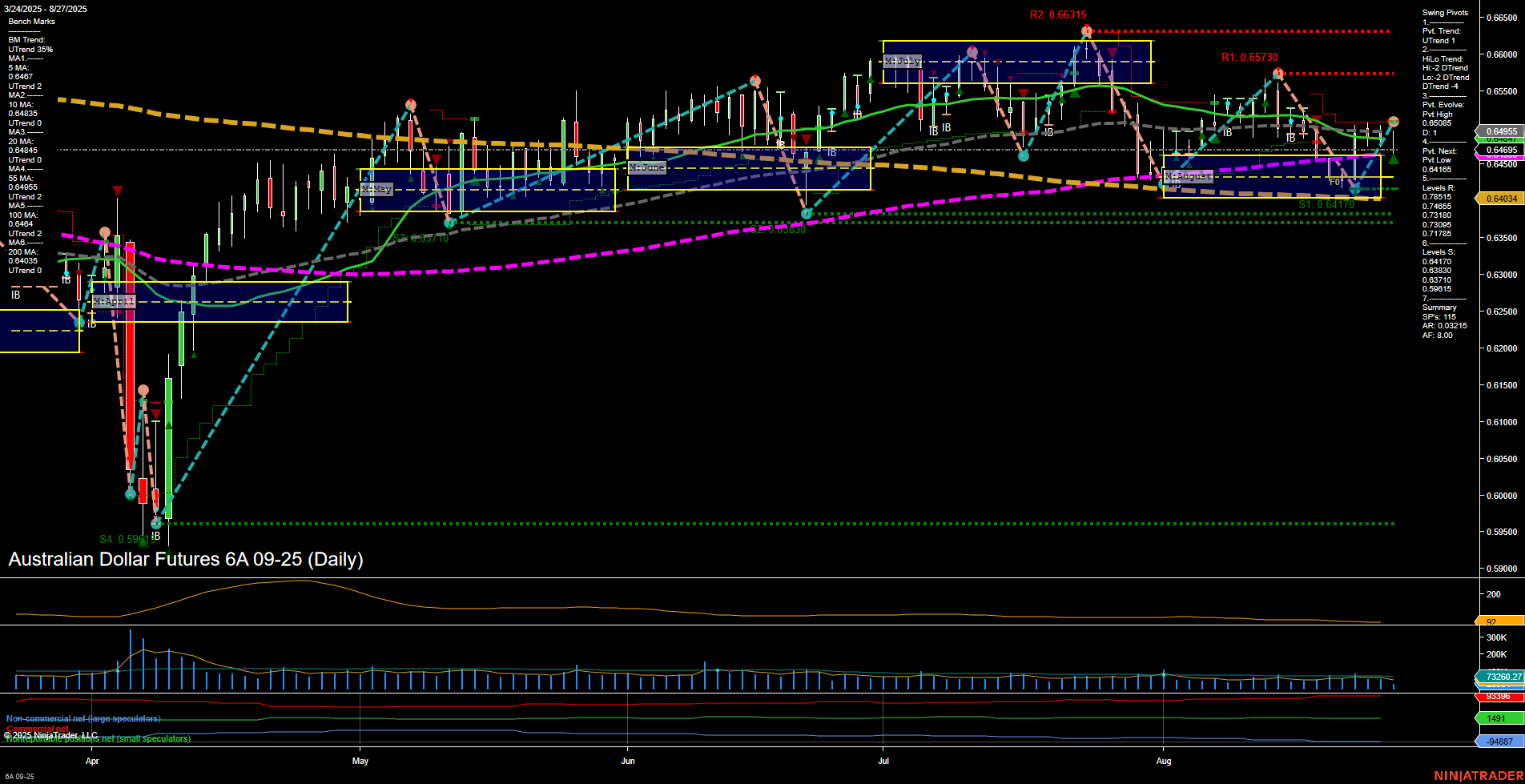

6A Australian Dollar Futures Daily Chart Analysis: 2025-Aug-27 07:00 CT

Price Action

- Last: 0.64955,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 0.65085,

- 4. Pvt. Next: Pvt Low 0.64170,

- 5. Levels R: 0.66315, 0.65730, 0.65085,

- 6. Levels S: 0.64170, 0.63835, 0.63170, 0.62615, 0.59915.

Daily Benchmarks

- (Short-Term) 5 Day: 0.6467 Up Trend,

- (Short-Term) 10 Day: 0.64835 Down Trend,

- (Intermediate-Term) 20 Day: 0.64845 Down Trend,

- (Intermediate-Term) 55 Day: 0.64485 Up Trend,

- (Long-Term) 100 Day: 0.64034 Up Trend,

- (Long-Term) 200 Day: 0.64895 Down Trend.

Additional Metrics

Recent Trade Signals

- 27 Aug 2025: Short 6A 09-25 @ 0.6473 Signals.USAR-WSFG

- 22 Aug 2025: Long 6A 09-25 @ 0.64975 Signals.USAR.TR120

- 22 Aug 2025: Short 6A 09-25 @ 0.64185 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures daily chart shows a market in transition, with price currently at 0.64955 and trading within a medium-range bar structure. Momentum is average, suggesting neither strong buying nor selling pressure at this time. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains in a downtrend, indicating a possible countertrend bounce or a developing consolidation phase. Resistance is layered above at 0.65085, 0.65730, and 0.66315, while support is found at 0.64170 and lower. Moving averages are mixed: the 5-day and 55/100-day MAs are in uptrends, but the 10, 20, and 200-day MAs are in downtrends, reflecting a lack of clear directional conviction. Recent trade signals show both long and short entries, highlighting choppy, range-bound conditions. Volatility (ATR) and volume (VOLMA) are moderate, supporting the view of a market in consolidation rather than trending. Overall, the chart suggests a neutral short-term outlook, a bearish intermediate-term bias, and a neutral long-term stance, with price action likely to remain range-bound unless a breakout above resistance or below support occurs.

Chart Analysis ATS AI Generated: 2025-08-27 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.