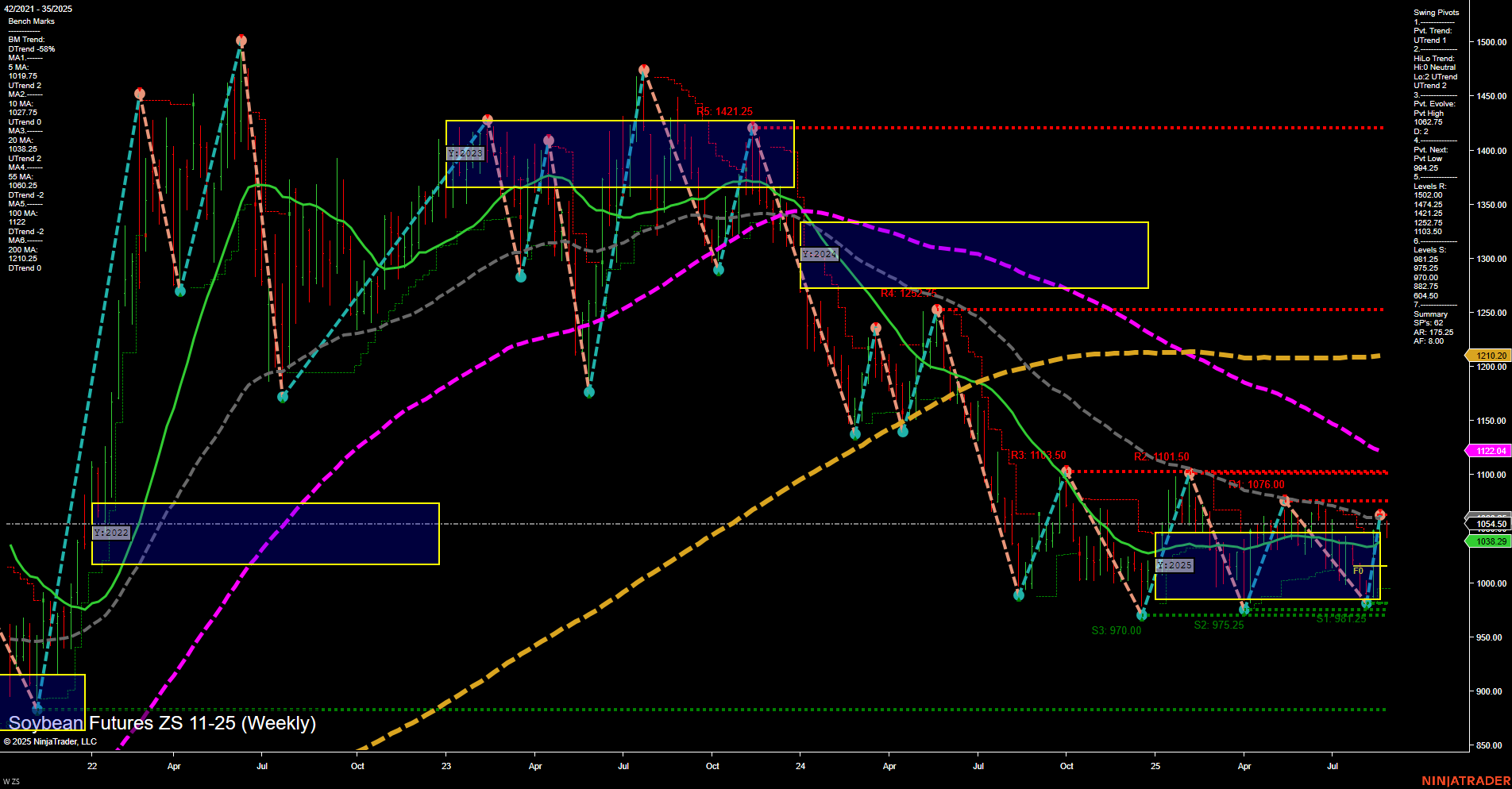

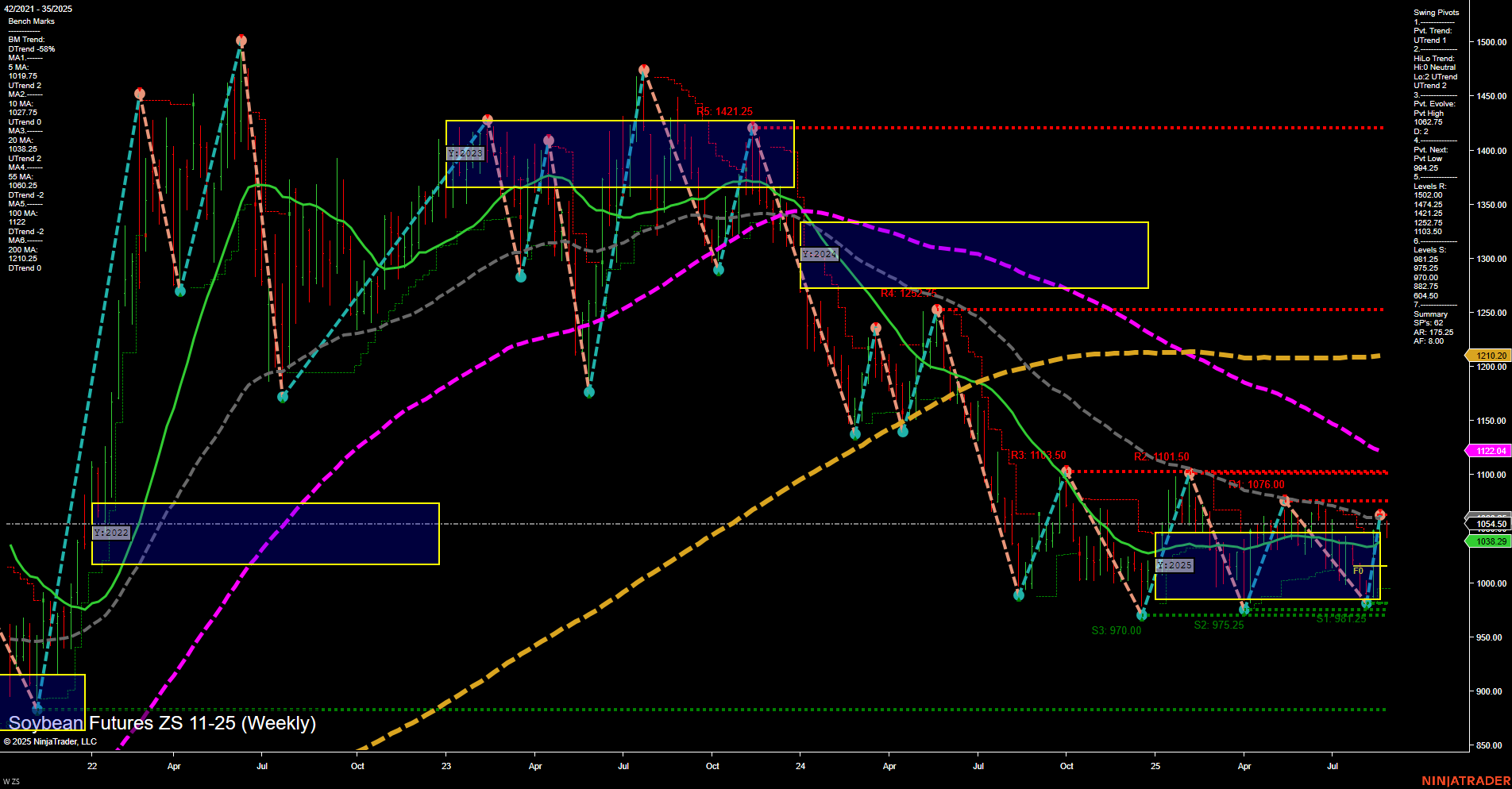

ZS Soybean Futures Weekly Chart Analysis: 2025-Aug-26 07:24 CT

Price Action

- Last: 1054.50,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 123%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1076.00,

- 4. Pvt. Next: Pvt low 987.25,

- 5. Levels R: 1404.00, 1421.25, 1262.25, 1101.50, 1076.00,

- 6. Levels S: 975.25, 970.00, 882.00, 840.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1047.75 Down Trend,

- (Intermediate-Term) 10 Week: 1053.25 Down Trend,

- (Long-Term) 20 Week: 1038.29 Up Trend,

- (Long-Term) 55 Week: 1122.04 Down Trend,

- (Long-Term) 100 Week: 1210.20 Down Trend,

- (Long-Term) 200 Week: 1220.25 Down Trend.

Recent Trade Signals

- 26 Aug 2025: Short ZS 11-25 @ 1053 Signals.USAR-WSFG

- 21 Aug 2025: Long ZS 11-25 @ 1049.25 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

ZS Soybean Futures are currently trading in a medium-range bar environment with slow momentum, reflecting a market in consolidation after a recent swing high at 1076.00 and a pivot low at 987.25. The short-term WSFG trend is down, with price below the NTZ center, and both the 5- and 10-week moving averages trending lower, confirming short-term bearishness. Intermediate-term signals also lean bearish, as the HiLo trend and swing pivots both point down, despite the monthly session grid showing an uptrend—suggesting a possible countertrend rally within a broader down move. Long-term structure remains bearish, with all major moving averages (55, 100, 200 week) in decline and price well below these benchmarks. Resistance is layered above at 1076.00, 1101.50, and 1262.25, while support is found at 975.25 and 970.00. Recent trade signals show mixed short-term action but favor the downside, aligning with the prevailing trend. Overall, the market is in a corrective phase within a larger bearish cycle, with volatility contained between well-defined support and resistance, and no clear breakout yet established.

Chart Analysis ATS AI Generated: 2025-08-26 07:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.