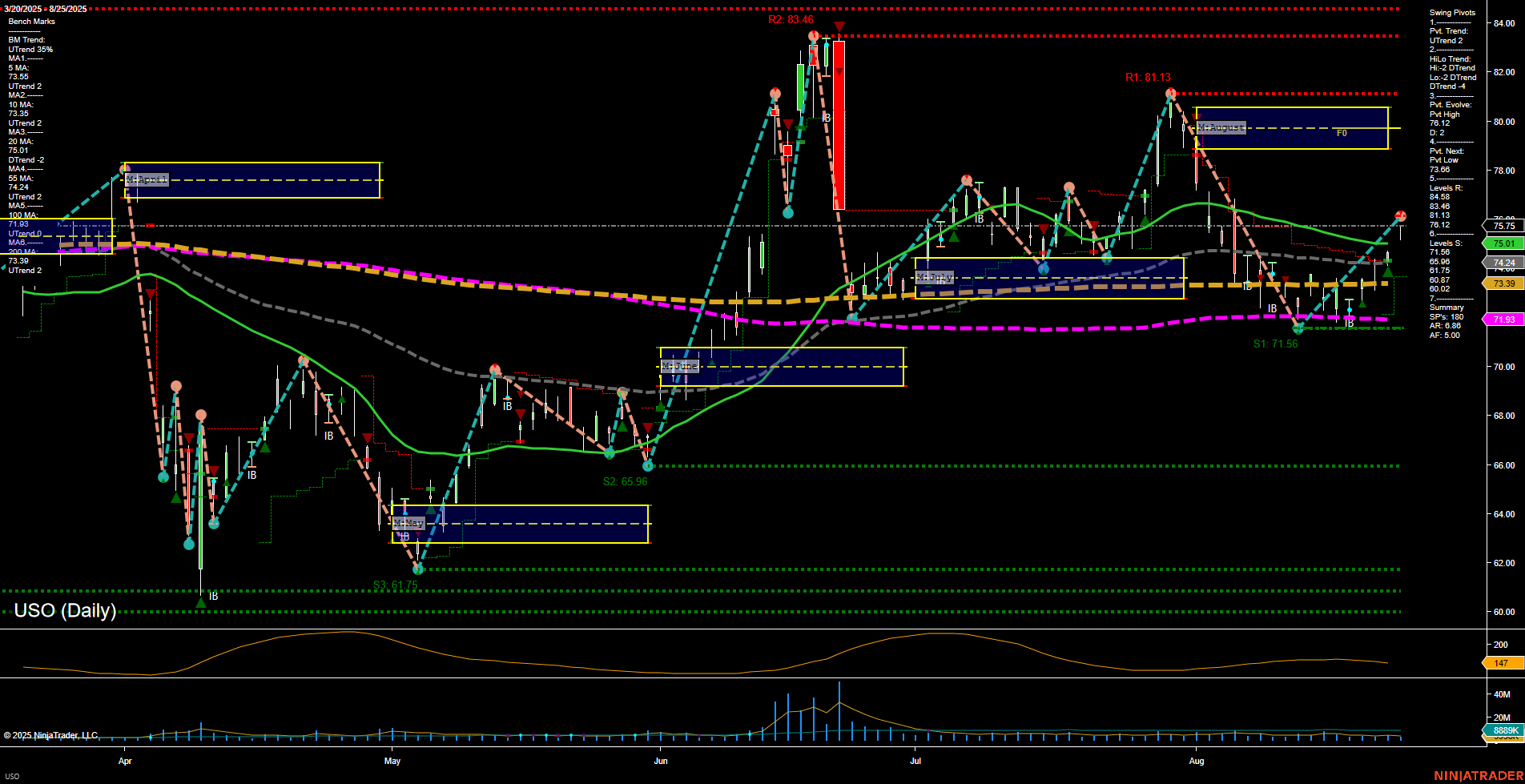

USO is currently showing a short-term bullish swing, with the latest price at 75.75 and momentum at an average pace. The short-term pivot trend has shifted to an uptrend, supported by all short- and intermediate-term moving averages (5, 10, 20, 55, and 200 day) trending upward, while the 100-day MA remains in a downtrend, indicating some longer-term resistance. The intermediate-term HiLo trend is still down, suggesting that the recent upward move is a countertrend rally within a broader consolidation or corrective phase. Key resistance levels are clustered above at 75.75, 78.12, 81.13, and 83.46, while support is layered below at 73.93, 73.39, 71.93, and 71.56. The ATR and volume metrics indicate moderate volatility and participation. The overall structure suggests a market in transition, with short-term bullish momentum facing intermediate-term headwinds and long-term neutrality. Price is oscillating within a range, with no clear breakout or breakdown, and the neutral bias across the session fib grids (weekly, monthly, yearly) reinforces the view of consolidation. Swing traders may observe for potential tests of resistance or support, as the market digests recent moves and awaits a decisive directional catalyst.