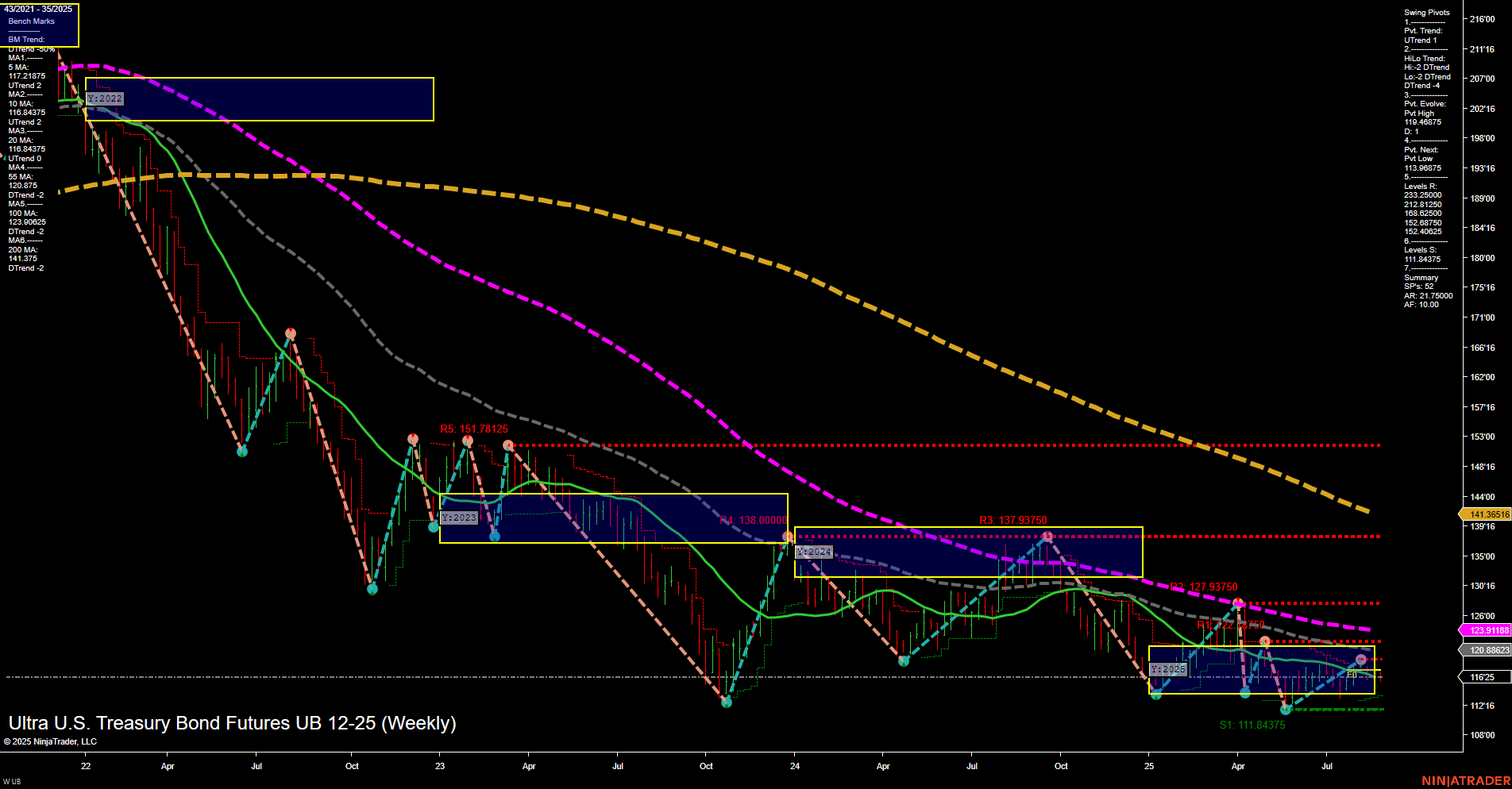

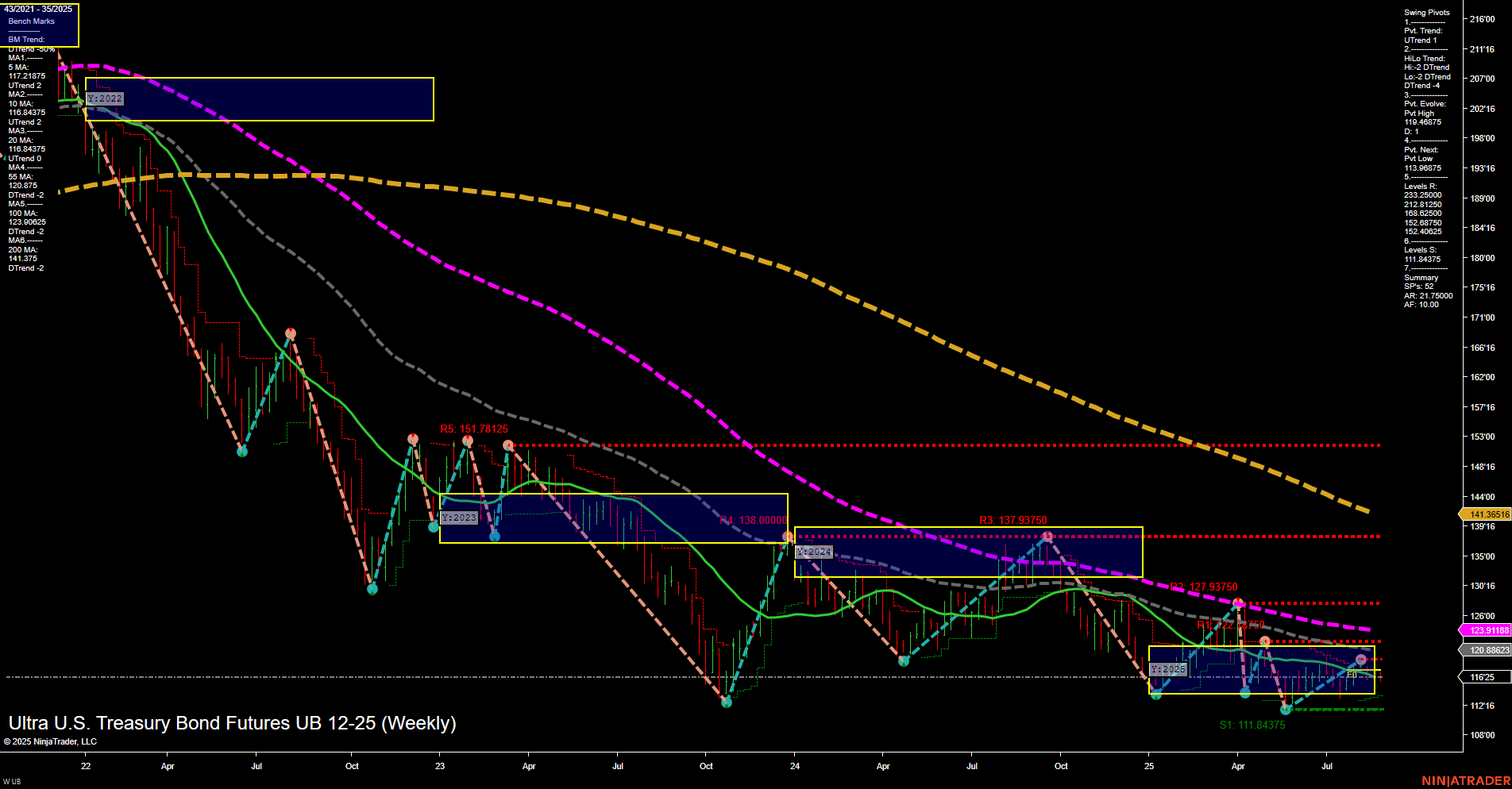

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Aug-26 07:19 CT

Price Action

- Last: 116.9375,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -29%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 119.46875,

- 4. Pvt. Next: Pvt Low 111.84375,

- 5. Levels R: 151.78125, 138.00000, 137.93750, 127.93750, 119.46875,

- 6. Levels S: 111.84375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 117.12875 Down Trend,

- (Intermediate-Term) 10 Week: 116.94625 Down Trend,

- (Long-Term) 20 Week: 120.88825 Down Trend,

- (Long-Term) 55 Week: 123.91188 Down Trend,

- (Long-Term) 100 Week: 141.35615 Down Trend,

- (Long-Term) 200 Week: 170.88263 Down Trend.

Recent Trade Signals

- 25 Aug 2025: Short UB 09-25 @ 116.9375 Signals.USAR-WSFG

- 22 Aug 2025: Long UB 09-25 @ 117.5 Signals.USAR-MSFG

- 21 Aug 2025: Short UB 09-25 @ 116.40625 Signals.USAR.TR120

- 18 Aug 2025: Short UB 09-25 @ 116.25 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The weekly chart for UB Ultra U.S. Treasury Bond Futures continues to reflect a persistent bearish environment across all timeframes. Price remains below the key NTZ (neutral trading zone) center lines on the weekly, monthly, and yearly session fib grids, confirming sustained downside pressure. Both short-term and intermediate-term swing pivot trends are down, with the most recent pivot high at 119.46875 acting as resistance and the next significant support at the pivot low of 111.84375. All benchmark moving averages from 5-week to 200-week are trending lower, reinforcing the dominant downtrend. Recent trade signals have been predominantly short, with only a brief long signal quickly reversed, highlighting the lack of bullish follow-through. The market is exhibiting slow momentum and medium-sized bars, suggesting a controlled but persistent sell-off rather than a panic-driven move. Overall, the technical structure points to continued weakness, with rallies likely to encounter resistance at prior swing highs and moving averages, while support is defined by the recent swing low. The environment remains unfavorable for sustained bullish reversals until a clear change in trend or momentum emerges.

Chart Analysis ATS AI Generated: 2025-08-26 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.