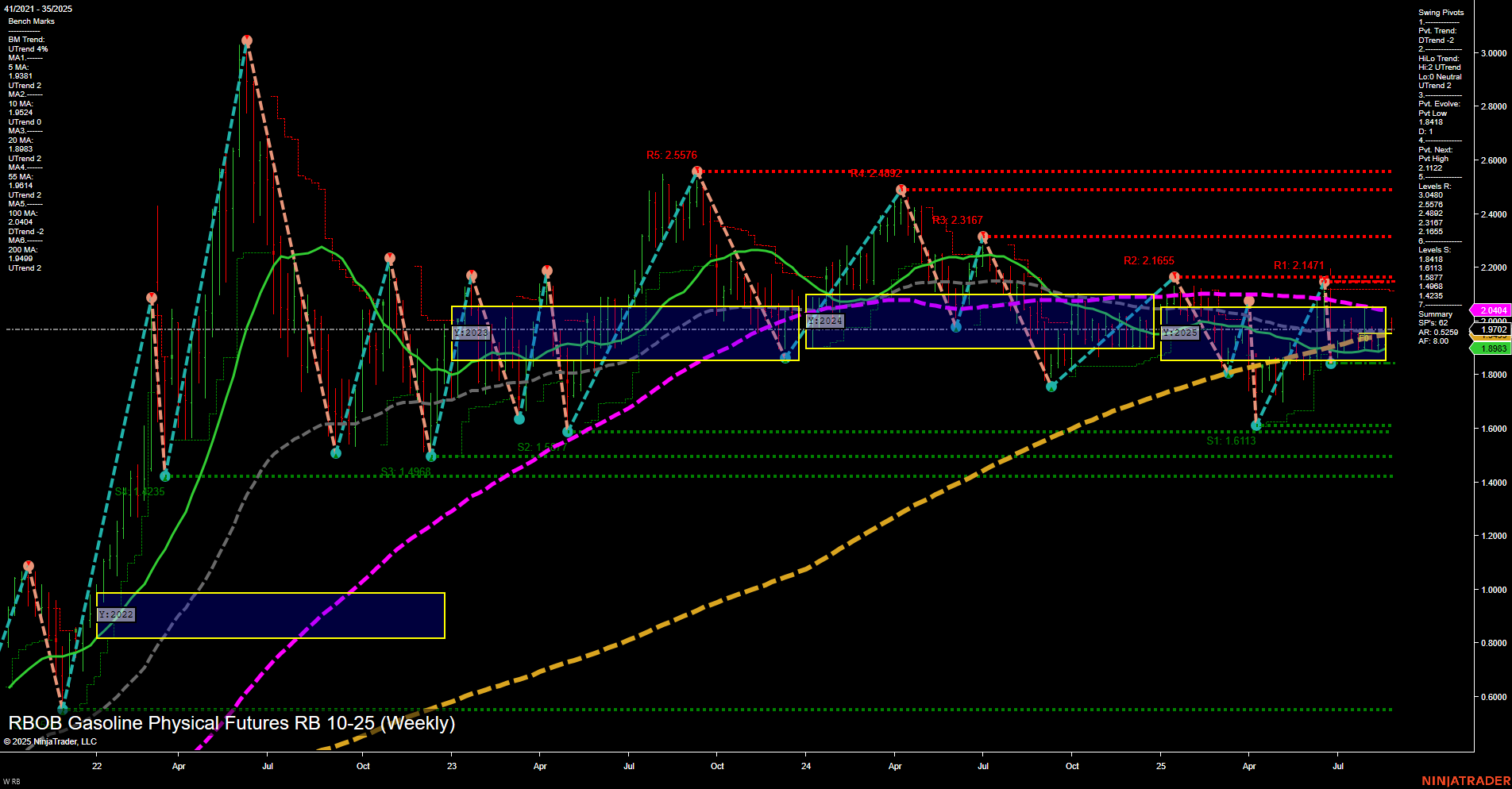

The RBOB Gasoline futures weekly chart shows a market under pressure in the short and intermediate term, with price action characterized by medium-sized bars and slow momentum. Both the Weekly and Monthly Session Fib Grids (WSFG and MSFG) indicate a downward trend, with price trading below their respective NTZ/F0% levels, reinforcing a bearish bias. The swing pivot structure confirms this, as the short-term pivot trend is down, though the intermediate-term HiLo trend remains up, suggesting some underlying support or potential for a bounce if conditions change. Resistance levels are clustered well above current price, with the nearest significant resistance at 2.1471 and higher at 2.1655 and beyond, while support is found at 1.6885 and 1.6177, indicating room for further downside if selling persists. All key moving averages (5, 10, 20, 55, 100 week) are trending down except the 200-week, which is still up, but price is currently below most of these benchmarks, highlighting persistent weakness. Recent trade signals are all short, aligning with the prevailing short-term and intermediate-term bearish trends. However, the yearly session grid trend remains up, and the long-term rating is neutral, suggesting that while the current cycle is corrective, the broader uptrend has not been fully negated. The market appears to be in a corrective phase within a larger consolidation, with the potential for further downside tests of support before any significant reversal or resumption of the long-term uptrend. Volatility remains moderate, and the market is likely to remain choppy until a decisive breakout or breakdown occurs.