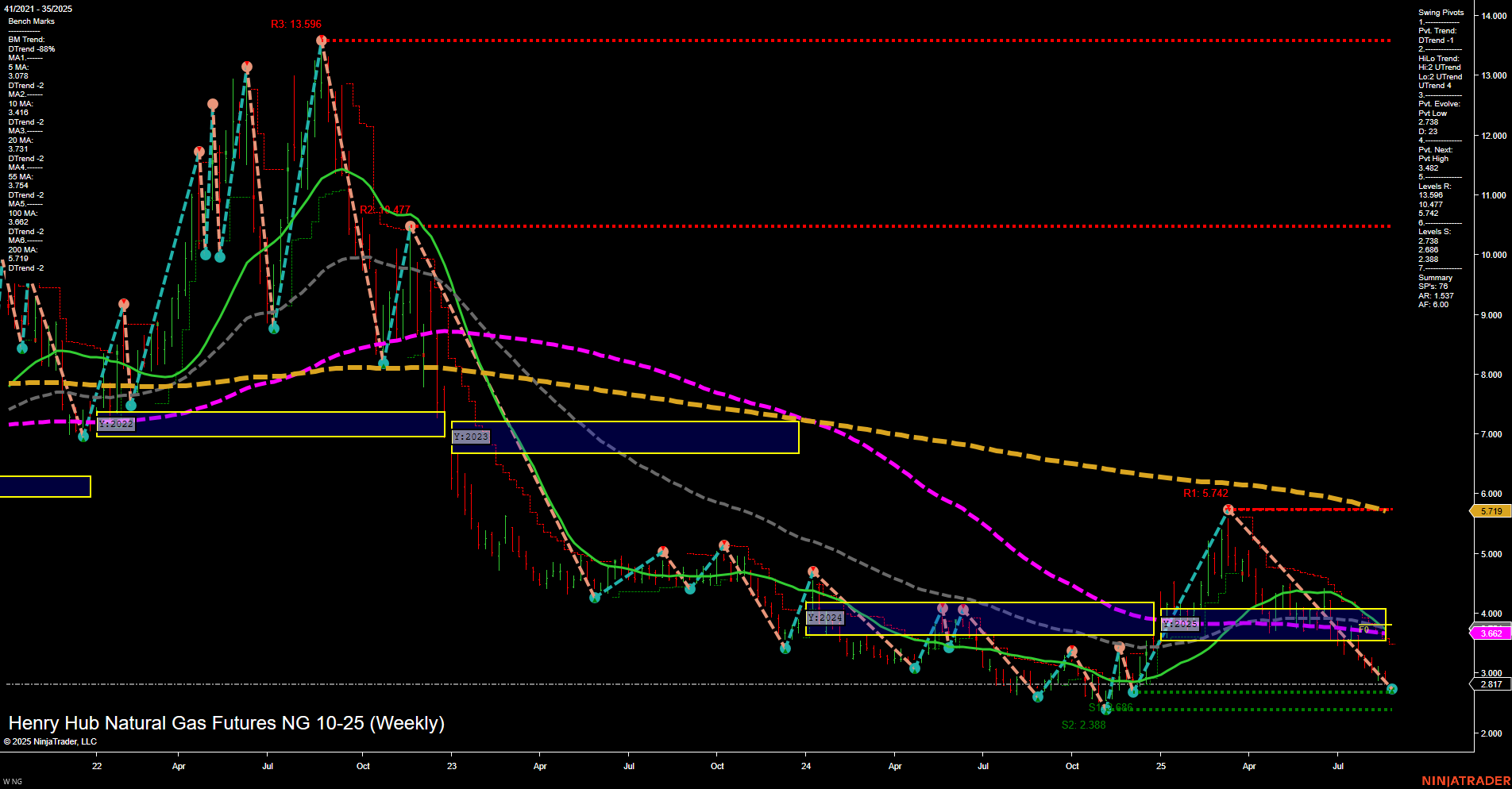

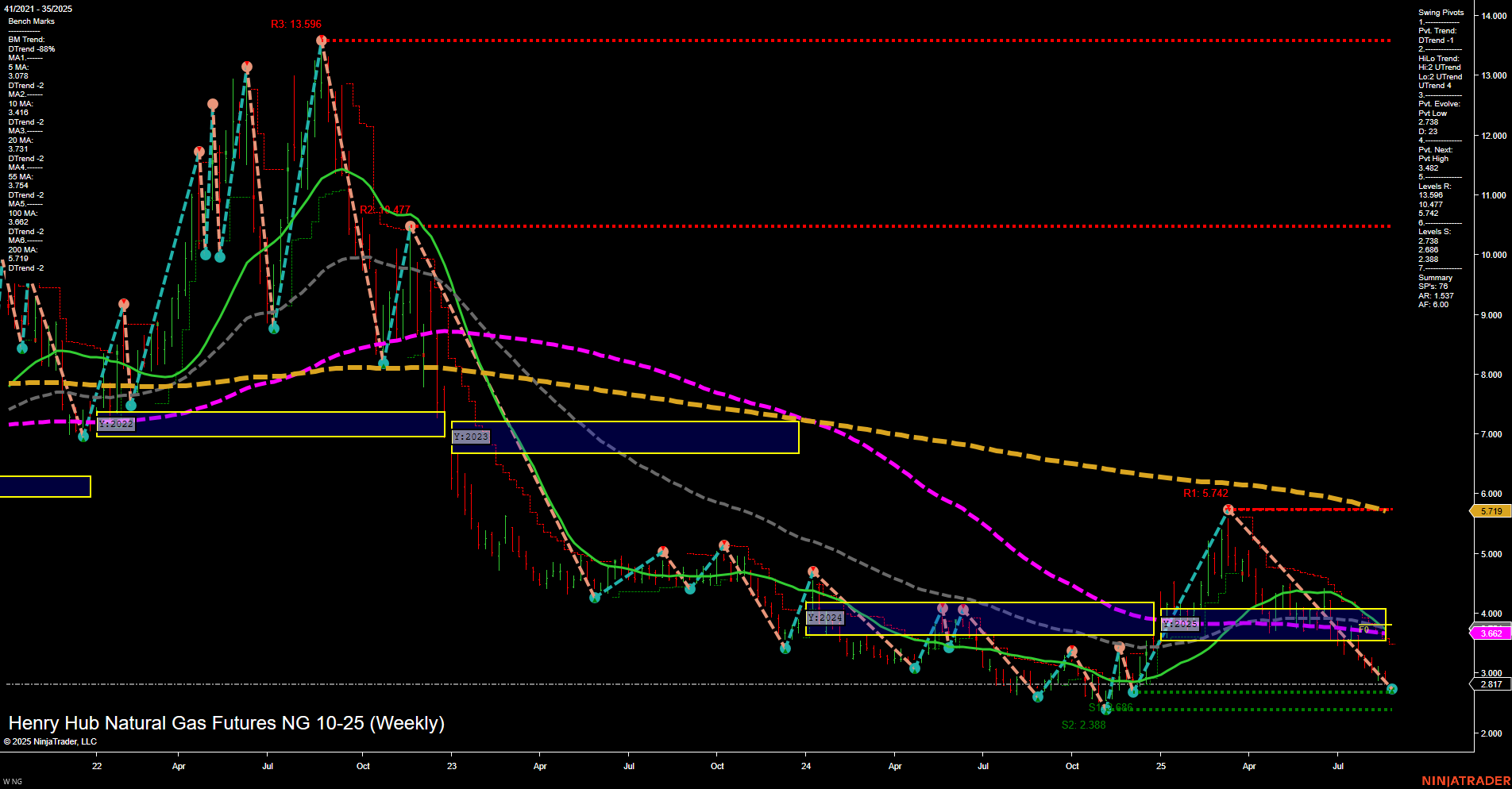

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Aug-26 07:12 CT

Price Action

- Last: 2.817,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2.738,

- 4. Pvt. Next: Pvt high 5.742,

- 5. Levels R: 13.596, 10.477, 5.742, 3.482,

- 6. Levels S: 2.738, 2.388, 2.288, 2.088.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.078 Down Trend,

- (Intermediate-Term) 10 Week: 3.146 Down Trend,

- (Long-Term) 20 Week: 3.662 Down Trend,

- (Long-Term) 55 Week: 4.344 Down Trend,

- (Long-Term) 100 Week: 5.170 Down Trend,

- (Long-Term) 200 Week: 5.719 Down Trend.

Recent Trade Signals

- 25 Aug 2025: Short NG 09-25 @ 2.655 Signals.USAR-WSFG

- 22 Aug 2025: Short NG 09-25 @ 2.696 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures continue to exhibit a persistent downtrend, with the last price at 2.817 and momentum remaining slow. The short-term swing pivot trend is down, supported by recent short trade signals and all benchmark moving averages trending lower. Intermediate-term HiLo trend shows some underlying upward structure, but this is overshadowed by the prevailing bearish sentiment in both short and long-term metrics. Price is currently near key support levels (2.738, 2.388), with resistance far above at 3.482 and 5.742, indicating a wide range and potential for volatility if a reversal or bounce occurs. The market remains in a consolidation phase near multi-year lows, with no clear breakout or reversal pattern yet visible. Overall, the technical landscape suggests continued pressure, with any rallies likely facing significant resistance from overhead moving averages and prior swing highs.

Chart Analysis ATS AI Generated: 2025-08-26 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.