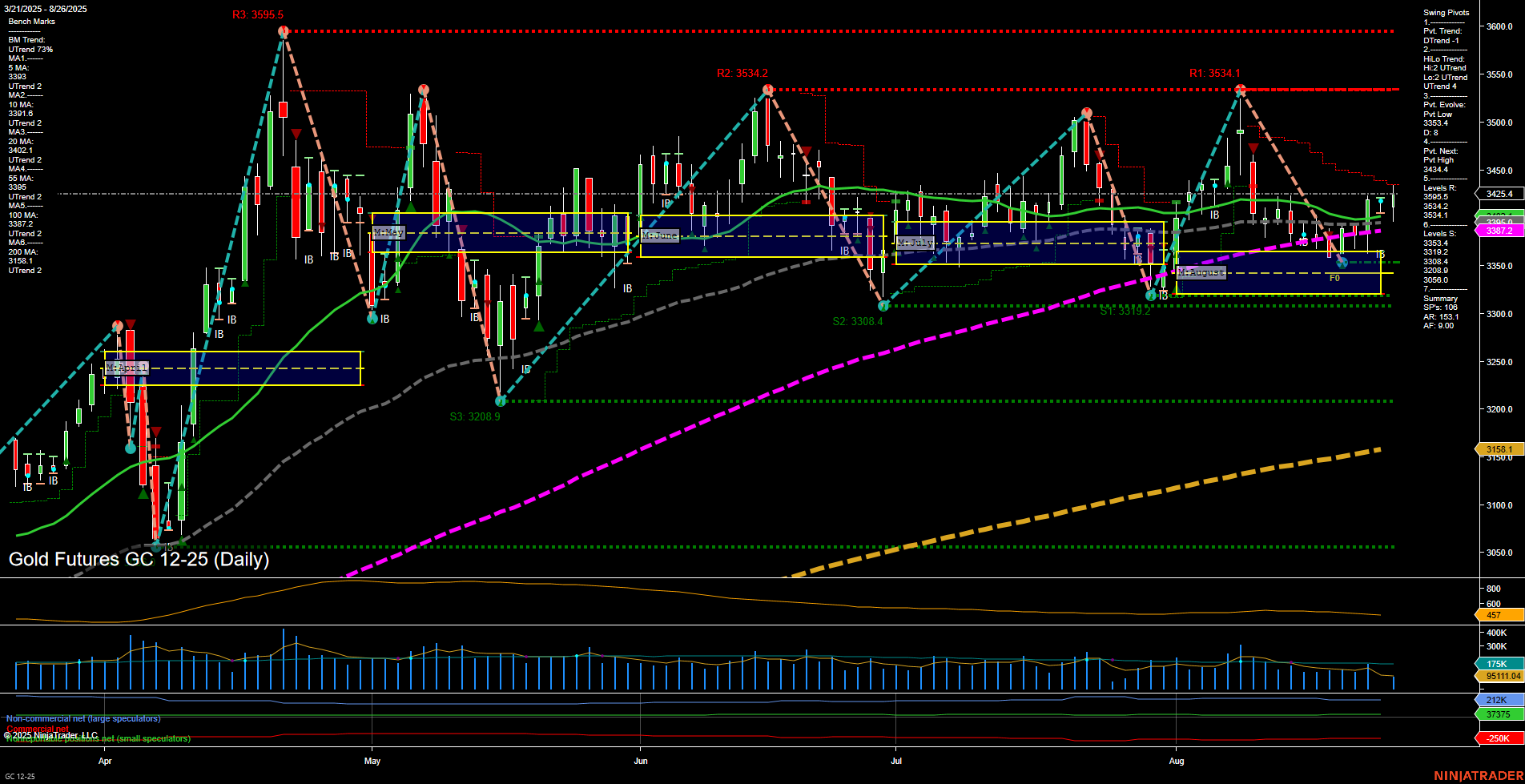

Gold futures are currently trading at 3425.4, with medium-sized bars and average momentum, indicating a balanced but active market. The short-term Weekly Session Fib Grid (WSFG) and intermediate-term Monthly Session Fib Grid (MSFG) both show price holding above their respective NTZ/F0% levels, supporting an upward bias and confirming the prevailing uptrend across all timeframes. However, the short-term swing pivot trend has shifted to a downtrend (DTrend), suggesting some near-term resistance and potential for a pullback or consolidation phase. Intermediate and long-term trends remain firmly bullish, as reflected in the HiLo Trend and all benchmark moving averages, which are aligned in uptrends and stacked in proper order. Key resistance is clustered around 3534–3595, while support is established at 3319 and below, providing clear levels for swing traders to monitor for potential reversals or continuation moves. Recent trade signals show a mix of short and long entries, highlighting the choppy, rotational nature of the current price action as the market tests upper resistance and finds support on pullbacks. Volatility remains moderate (ATR 347), and volume is steady, indicating healthy participation. Overall, the market is in a bullish structure on higher timeframes, but short-term traders should be alert to possible retracements or sideways action before the next directional move.