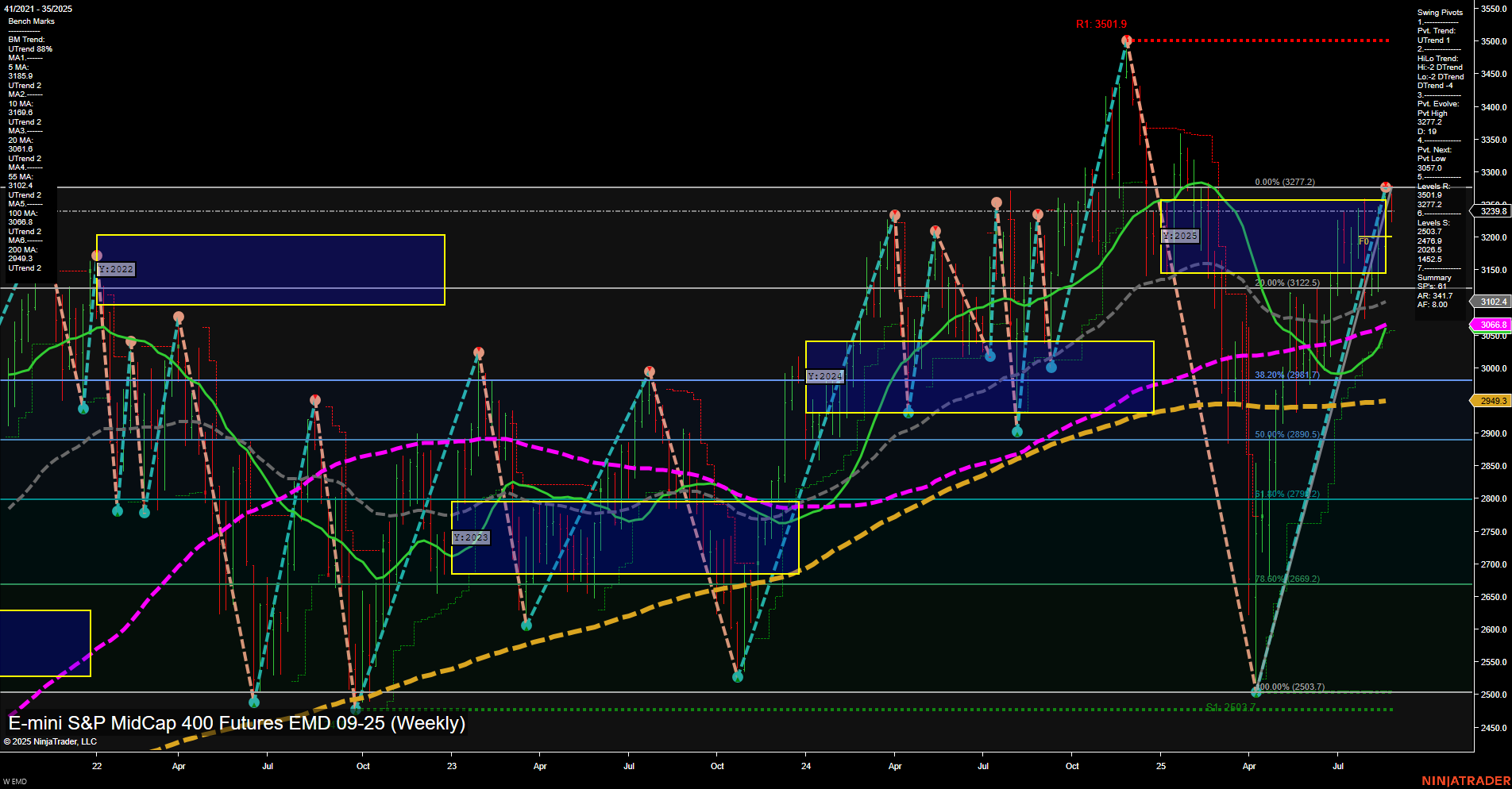

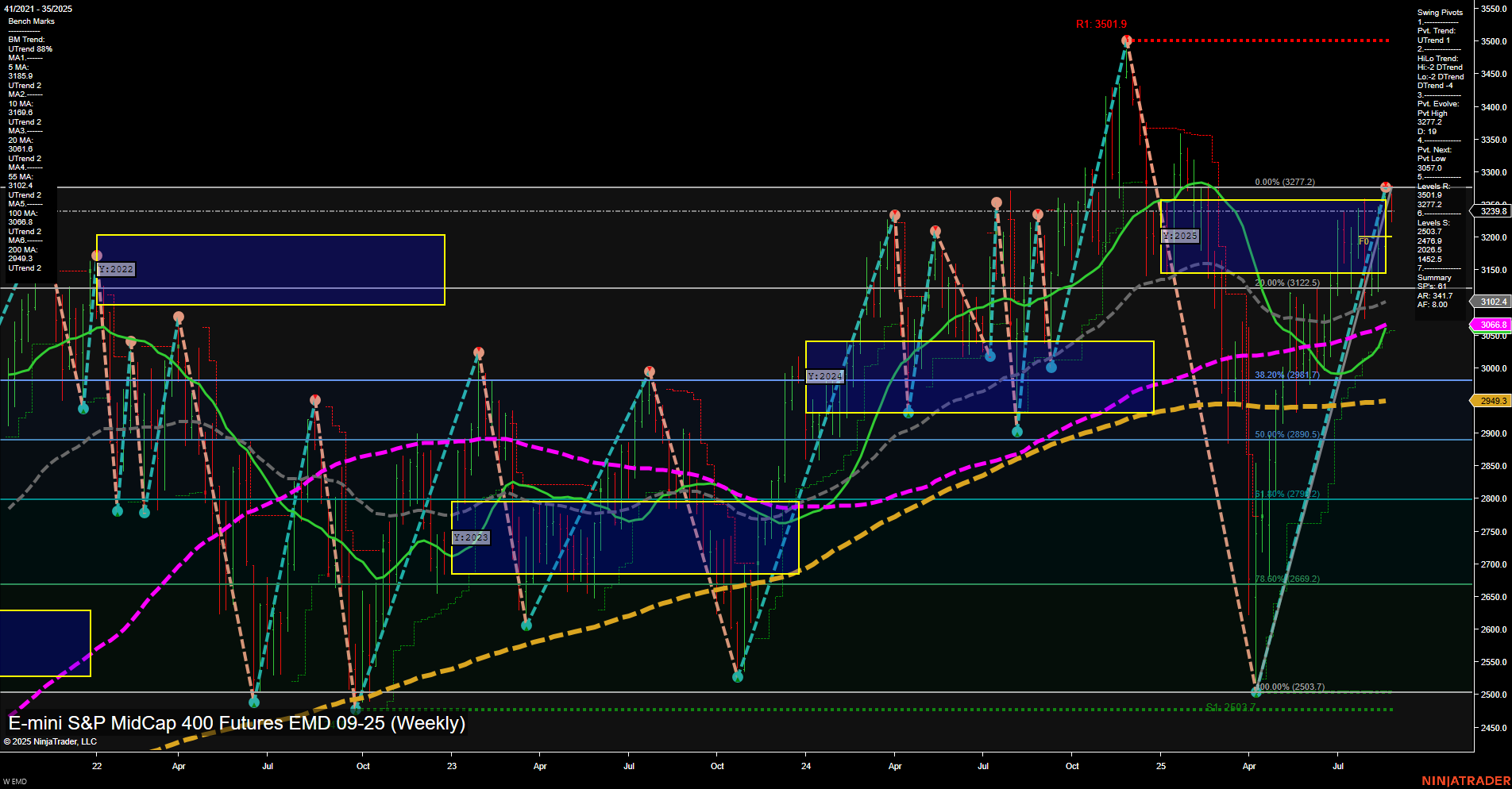

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Aug-26 07:06 CT

Price Action

- Last: 3239.8,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 45%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 3277.2,

- 4. Pvt. Next: Pvt low 3070.5,

- 5. Levels R: 3501.9, 3277.2,

- 6. Levels S: 3070.5, 2607.2.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3165.2 Up Trend,

- (Intermediate-Term) 10 Week: 3170.8 Up Trend,

- (Long-Term) 20 Week: 3066.8 Up Trend,

- (Long-Term) 55 Week: 3102.4 Up Trend,

- (Long-Term) 100 Week: 3098.6 Up Trend,

- (Long-Term) 200 Week: 2949.3 Up Trend.

Recent Trade Signals

- 25 Aug 2025: Short EMD 09-25 @ 3246.6 Signals.USAR-WSFG

- 22 Aug 2025: Long EMD 09-25 @ 3200.2 Signals.USAR.TR120

- 22 Aug 2025: Long EMD 09-25 @ 3191.5 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures market is currently experiencing strong price momentum with large weekly bars, indicating heightened volatility and active participation. Short-term signals are mixed: while the swing pivot trend is up, the WSFG trend is down and the most recent signal was a short, suggesting a possible pause or retracement after a sharp rally. Intermediate and long-term trends remain bullish, supported by all major moving averages trending higher and price holding above key monthly and yearly session fib grid levels. Resistance is noted at 3277.2 and the major swing high at 3501.9, while support is established at 3070.5 and 2607.2. The market has recently rebounded strongly from lower levels, forming a V-shaped recovery, but faces overhead resistance and may consolidate or retest lower supports before any sustained breakout. Overall, the structure favors a bullish bias for the intermediate and long term, with short-term action likely to be choppy as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-08-26 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.