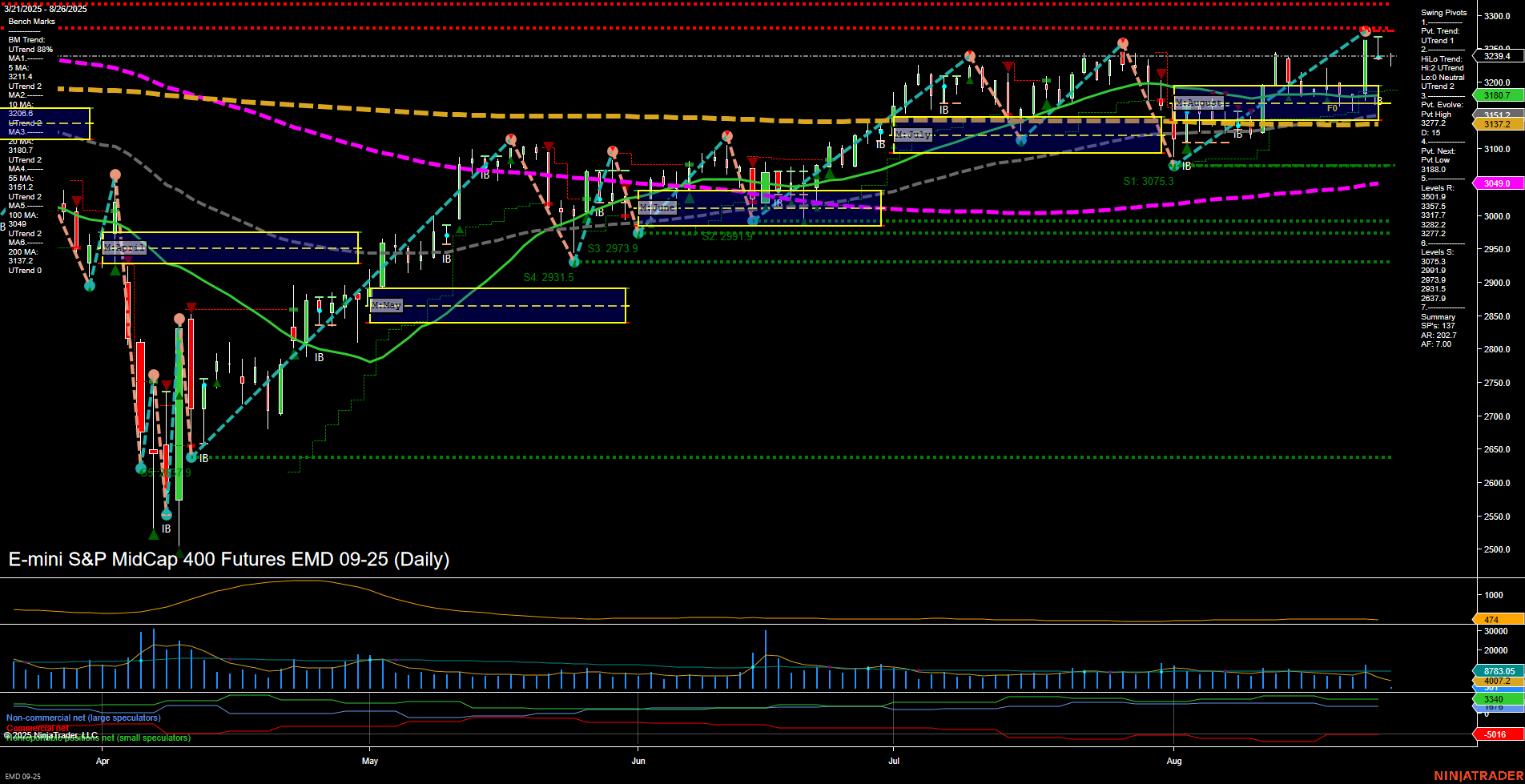

The EMD futures daily chart shows a market in transition, with short-term signals mixed but intermediate and long-term trends remaining bullish. Price action is currently near recent swing highs, with medium-sized bars and average momentum, suggesting a pause or consolidation after a recent advance. The short-term WSFG trend is down, with price below the weekly NTZ, indicating some near-term resistance or pullback pressure. However, both the monthly and yearly session fib grids show price above their respective NTZs and in uptrends, supporting a broader bullish structure. Swing pivots confirm an uptrend in both short and intermediate terms, with the most recent pivot high at 3239.4 and the next key support at 3137.2. Resistance levels are layered above, with 3293.4 as the next major upside target. All benchmark moving averages are trending up, reinforcing the underlying strength in the market. Volatility, as measured by ATR, remains moderate, and volume metrics are stable. Recent trade signals reflect this mixed environment, with a short signal on the latest bar but prior long signals still active from lower levels. Overall, the market is consolidating gains within a larger uptrend, with short-term choppiness but a supportive backdrop for the intermediate and long-term outlook. Watch for resolution of the current range between 3137 and 3293 for the next directional move.