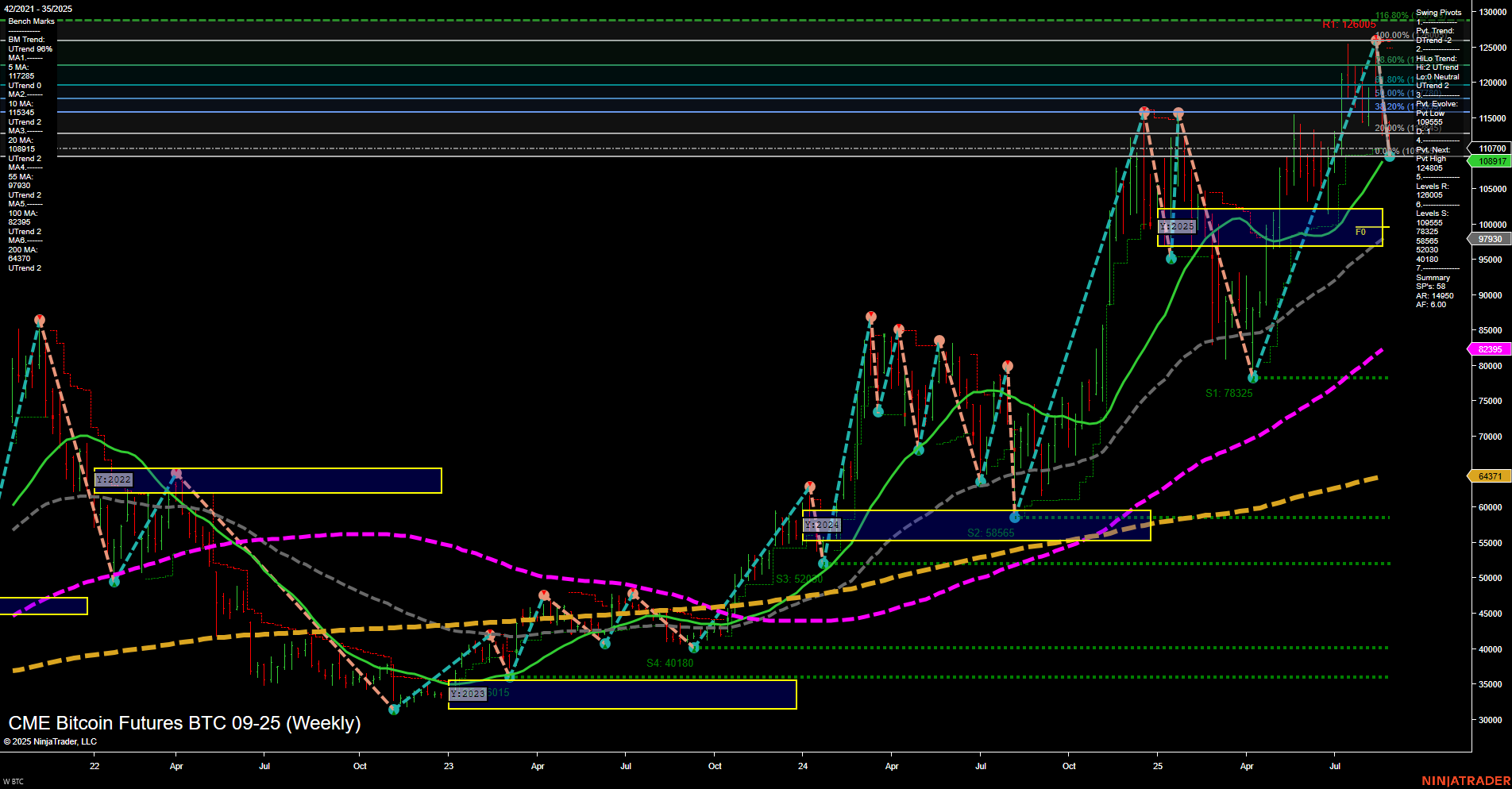

The current weekly chart for CME Bitcoin Futures shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and potential for sharp moves. Short-term and intermediate-term Fib grid trends are both down, with price below their respective NTZ/F0% levels, reflecting recent weakness and a corrective phase. However, the long-term yearly grid remains up, with price still above the annual NTZ, suggesting the broader bull trend is intact. Swing pivots highlight a short-term downtrend, but the intermediate-term HiLo trend is still up, showing underlying strength. Key resistance levels cluster between 113946 and 126000, while support is layered below at 109515 and much lower at 97930 and 78325, indicating a wide trading range and potential for volatility. Weekly benchmarks show short-term moving averages trending down, but all long-term averages (20, 55, 100, 200 week) are in uptrends, reinforcing the idea of a pullback within a larger bullish structure. Recent trade signals are mixed, with both long and short entries triggered in the past week, reflecting the choppy, two-way action typical of a market in consolidation or transition. Overall, the short-term outlook is bearish due to recent downside momentum and pivot structure, while the intermediate-term is neutral as the market digests gains and tests support. The long-term remains bullish, with higher time frame trends and moving averages still pointing up. This environment is characterized by volatility, potential for sharp reversals, and a need to watch for either a resumption of the uptrend or a deeper correction.