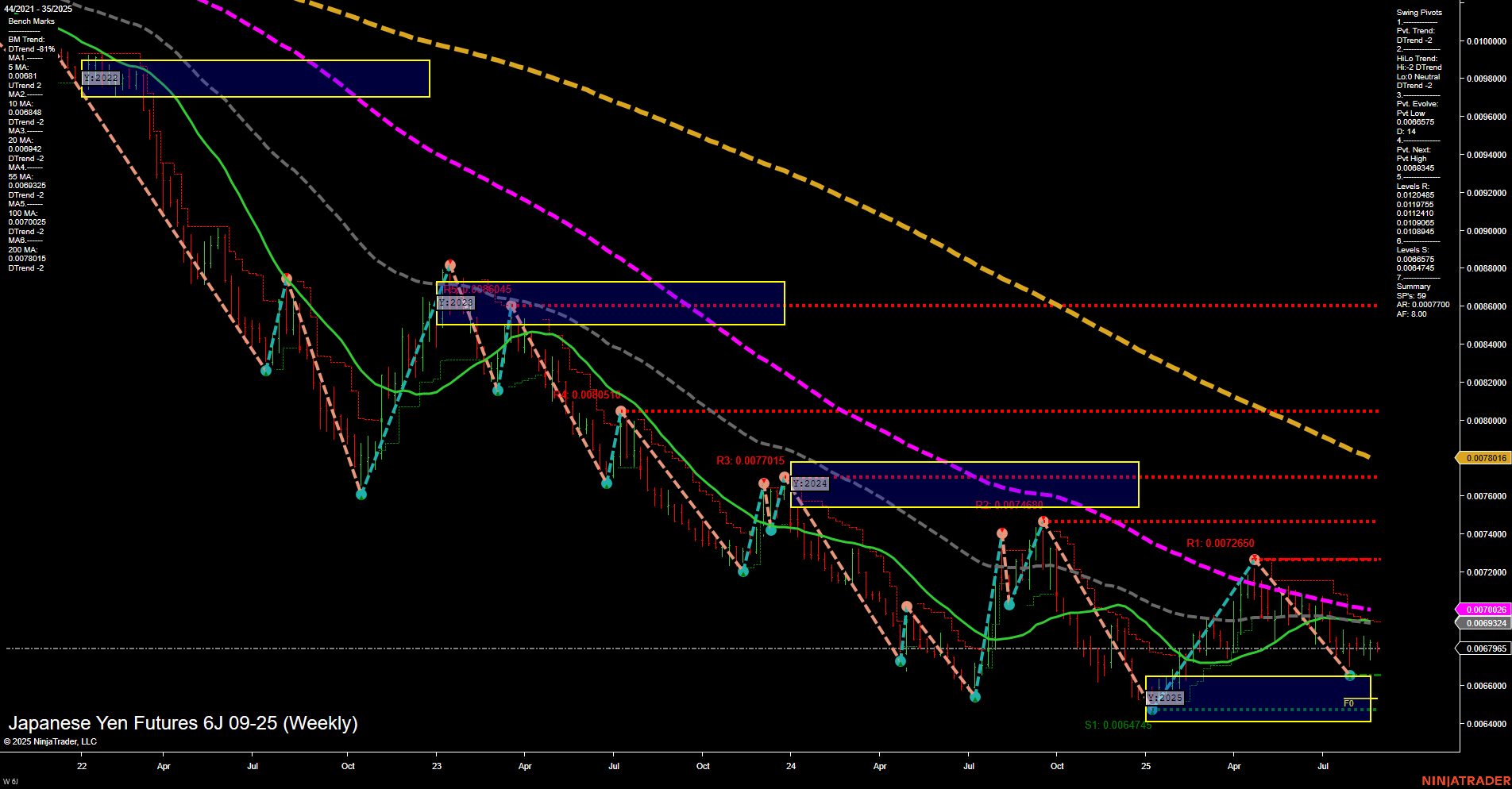

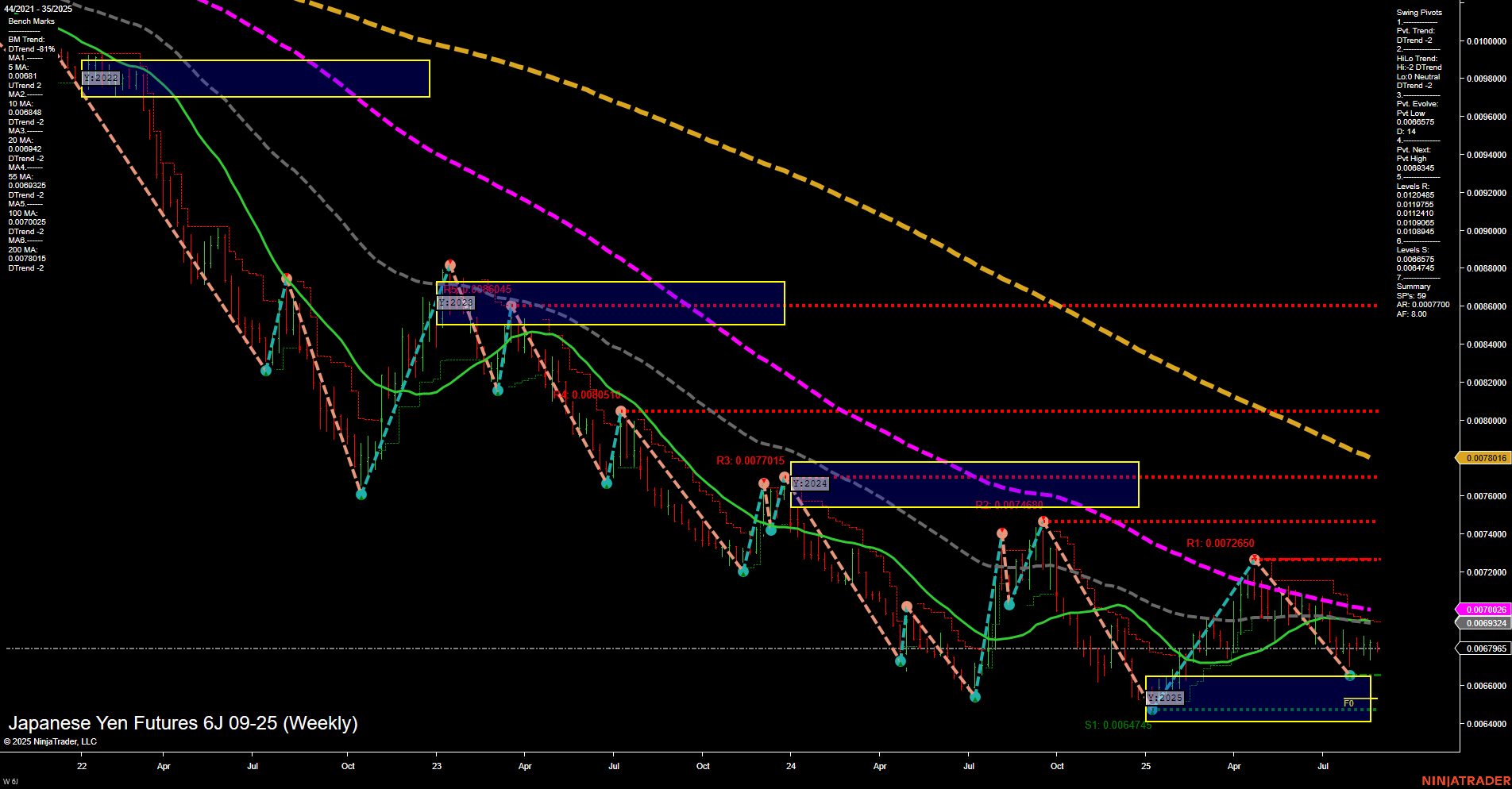

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Aug-26 07:03 CT

Price Action

- Last: 0.0067965,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 45%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 22%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Lo2 Neutral,

- 3. Pvt. Evolve: Pvt low 0.0064745,

- 4. Pvt. Next: Pvt high 0.0072045,

- 5. Levels R: 0.0083045, 0.0080510, 0.0077015, 0.0074260, 0.0072650,

- 6. Levels S: 0.0064745, 0.0004745, 0.0004770.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.006921 Up Trend,

- (Intermediate-Term) 10 Week: 0.006934 Up Trend,

- (Long-Term) 20 Week: 0.007026 Up Trend,

- (Long-Term) 55 Week: 0.0078016 Down Trend,

- (Long-Term) 100 Week: 0.0081945 Down Trend,

- (Long-Term) 200 Week: 0.0087016 Down Trend.

Recent Trade Signals

- 26 Aug 2025: Short 6J 09-25 @ 0.0068035 Signals.USAR-WSFG

- 22 Aug 2025: Long 6J 09-25 @ 0.006836 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart shows a market in transition. Short-term momentum is slow with small bars, and the price is currently below the weekly session fib grid (WSFG) neutral zone, confirming a short-term downtrend. The most recent swing pivot trend is down, and the latest trade signal is a short, reinforcing the bearish short-term outlook. Intermediate-term signals are mixed: the monthly session fib grid (MSFG) trend is up and price is above the monthly NTZ, but the HiLo trend is neutral, suggesting indecision or consolidation. Long-term, the yearly session fib grid (YSFG) trend is up, but all major long-term moving averages (55, 100, 200 week) remain in downtrends, indicating that the broader bearish structure is still intact. Resistance levels are stacked above, with the next significant swing high at 0.0072045, while support is anchored at the recent swing low of 0.0064745. The market appears to be in a corrective phase within a larger downtrend, with potential for further consolidation or a retest of lower support if bearish momentum persists. Volatility is subdued, and price action is choppy, reflecting uncertainty and a lack of strong directional conviction.

Chart Analysis ATS AI Generated: 2025-08-26 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.