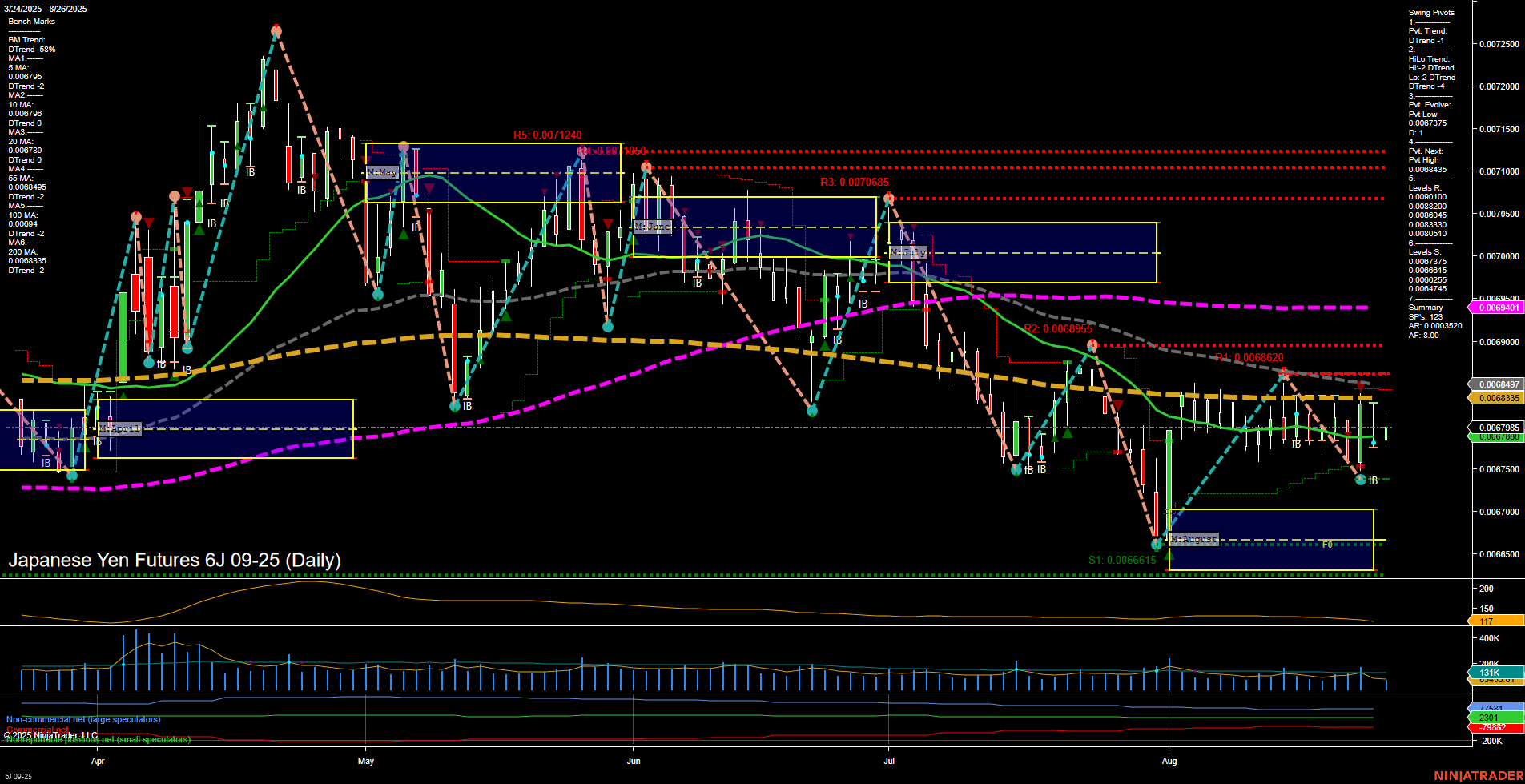

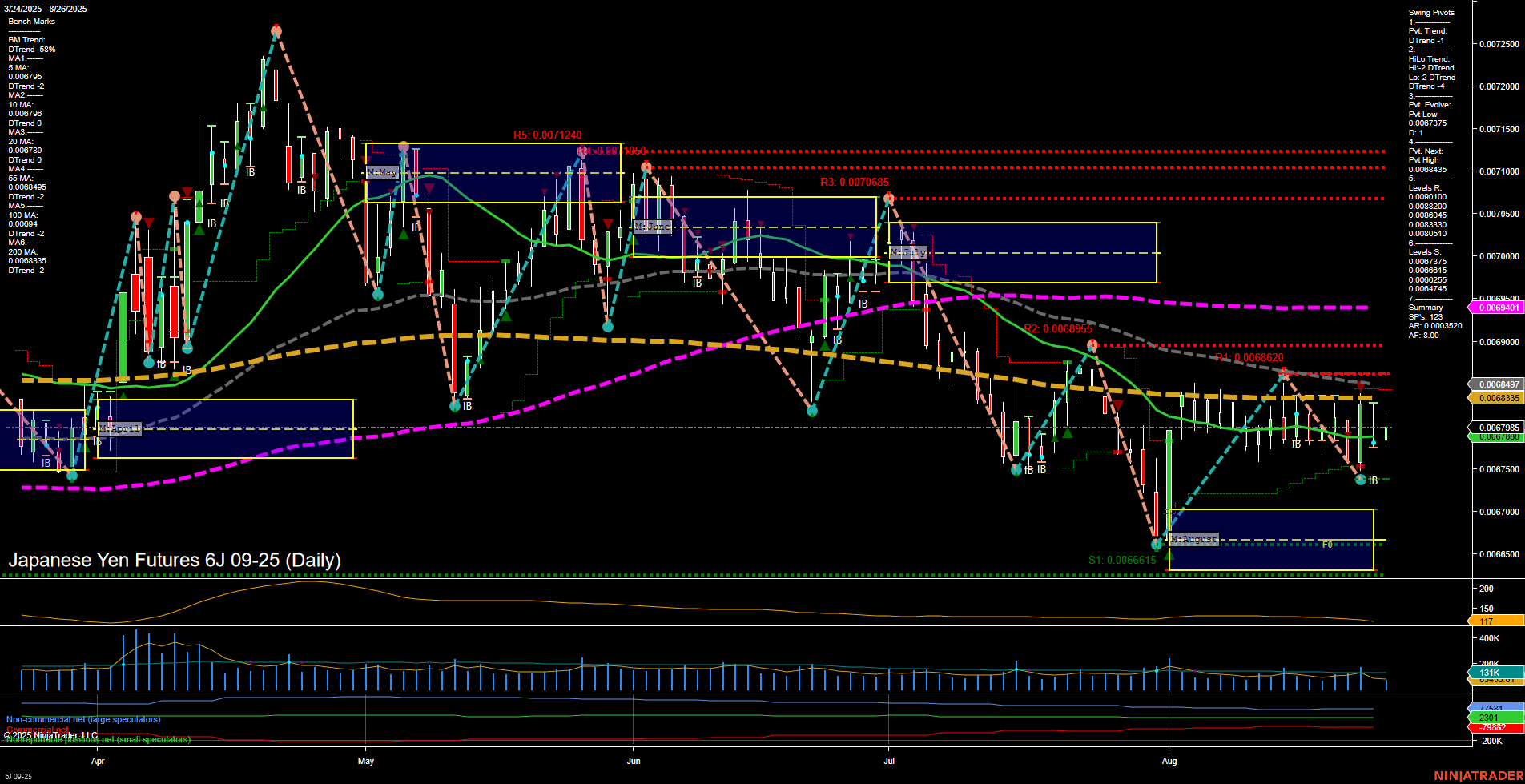

6J Japanese Yen Futures Daily Chart Analysis: 2025-Aug-26 07:02 CT

Price Action

- Last: 0.0067985,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 45%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 22%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0067375,

- 4. Pvt. Next: Pvt high 0.0068435,

- 5. Levels R: 0.0071240, 0.0071065, 0.0070685, 0.0068955, 0.0068620, 0.0068435,

- 6. Levels S: 0.0067375, 0.0066615, 0.0064445.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0067895 Down Trend,

- (Short-Term) 10 Day: 0.0067898 Down Trend,

- (Intermediate-Term) 20 Day: 0.0068497 Down Trend,

- (Intermediate-Term) 55 Day: 0.0068335 Down Trend,

- (Long-Term) 100 Day: 0.0069401 Down Trend,

- (Long-Term) 200 Day: 0.0068495 Down Trend.

Additional Metrics

Recent Trade Signals

- 26 Aug 2025: Short 6J 09-25 @ 0.0068035 Signals.USAR-WSFG

- 22 Aug 2025: Long 6J 09-25 @ 0.006836 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures daily chart shows a market under pressure, with price action characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term WSFG trend is down, with price trading below the NTZ center, reinforcing a bearish short-term outlook. Intermediate and long-term MSFG and YSFG trends remain technically up, but price is currently below all key moving averages (5, 10, 20, 55, 100, and 200 day), all of which are trending down, suggesting persistent downside pressure across all timeframes. Swing pivot analysis confirms a dominant downtrend in both short and intermediate terms, with the most recent pivot low at 0.0067375 and resistance levels stacked above current price, indicating overhead supply. The ATR and VOLMA values suggest moderate volatility and average volume, with no signs of a volatility spike or exhaustion. Recent trade signals show a short entry following a failed long attempt, highlighting the market's inability to sustain upward moves. Overall, the chart reflects a market in a corrective or trending down phase, with rallies being sold and support levels being tested. The environment favors trend continuation to the downside unless a significant reversal or breakout above resistance pivots occurs.

Chart Analysis ATS AI Generated: 2025-08-26 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.