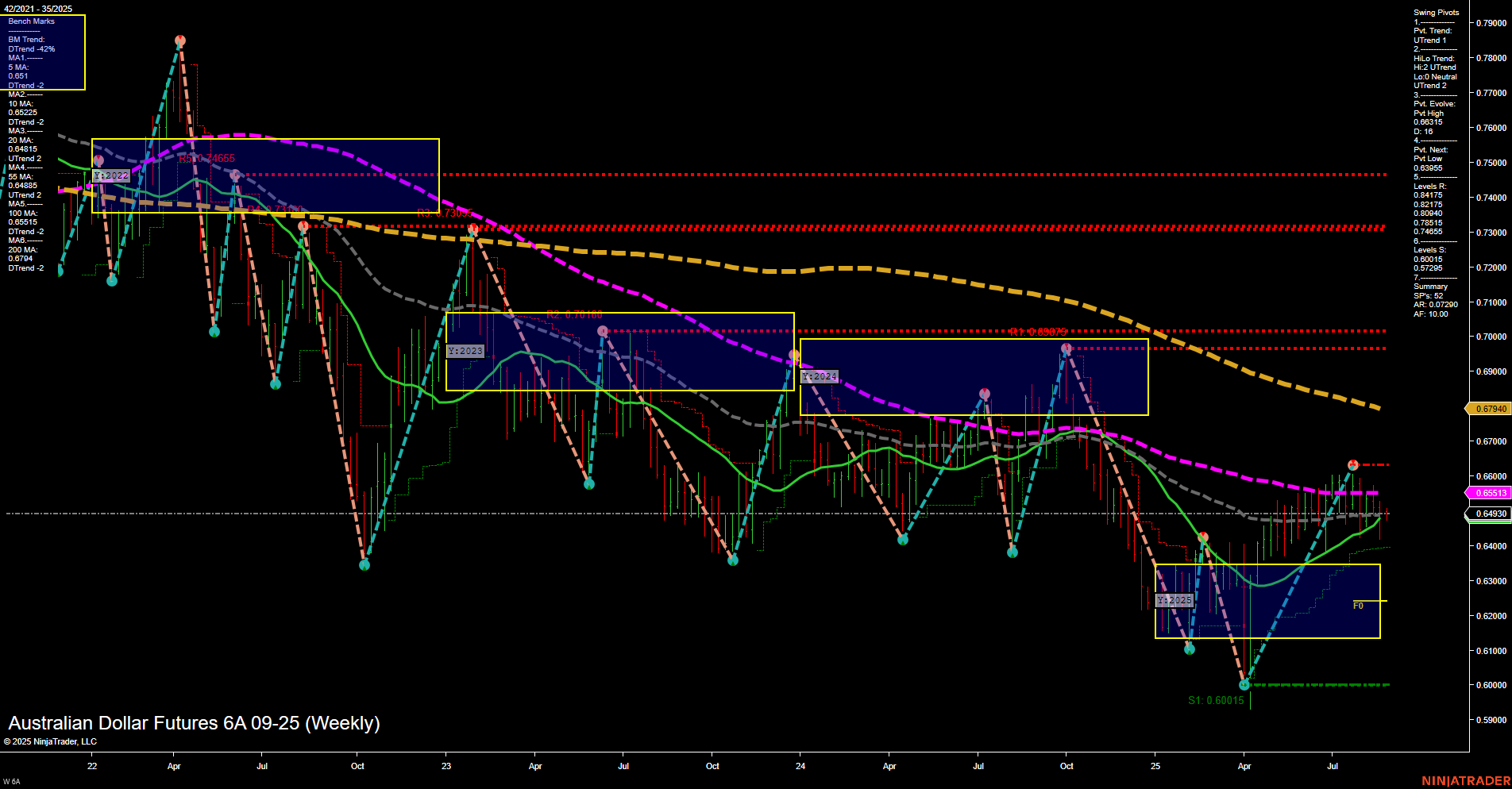

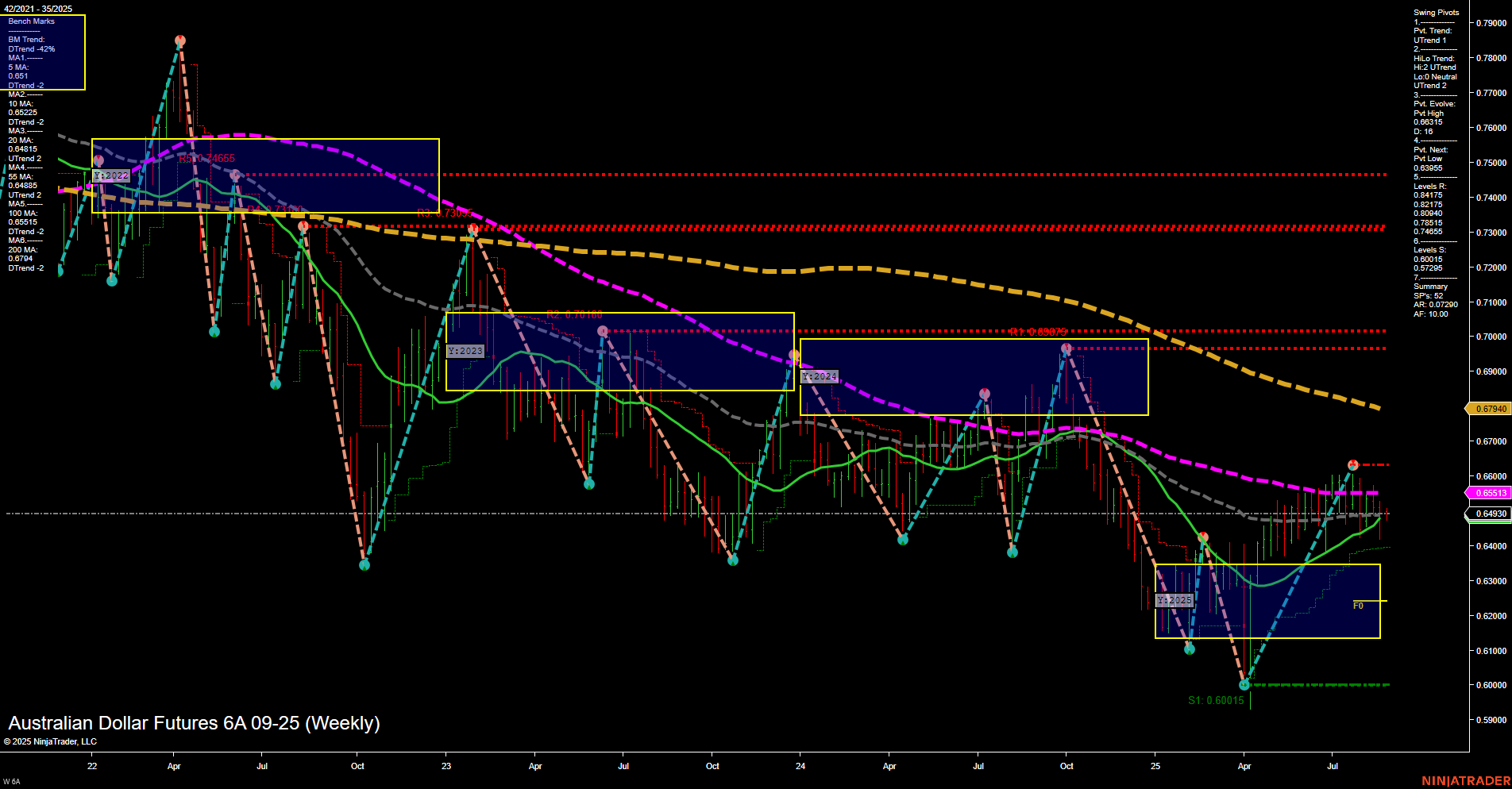

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Aug-26 07:00 CT

Price Action

- Last: 0.64930,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.64975,

- 4. Pvt. Next: Pvt low 0.64185,

- 5. Levels R: 0.66975, 0.68975, 0.70100,

- 6. Levels S: 0.64185, 0.60015.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65513 Up Trend,

- (Intermediate-Term) 10 Week: 0.64555 Up Trend,

- (Long-Term) 20 Week: 0.64922 Up Trend,

- (Long-Term) 55 Week: 0.66144 Down Trend,

- (Long-Term) 100 Week: 0.67022 Down Trend,

- (Long-Term) 200 Week: 0.67940 Down Trend.

Recent Trade Signals

- 26 Aug 2025: Short 6A 09-25 @ 0.64825 Signals.USAR-WSFG

- 22 Aug 2025: Long 6A 09-25 @ 0.64975 Signals.USAR.TR120

- 22 Aug 2025: Short 6A 09-25 @ 0.64185 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a market in transition, with price action consolidating near the 0.64930 level. Momentum is average and bars are medium-sized, reflecting a lack of strong directional conviction. Both the short-term and intermediate-term trends, as indicated by the WSFG and MSFG grids, are neutral, with price oscillating around key pivot levels and within the NTZ (neutral zone). Swing pivots show an upward trend in both short and intermediate timeframes, but resistance at 0.66975 and above remains unchallenged, while support at 0.64185 and 0.60015 is holding. The 5, 10, and 20-week moving averages are in uptrends, but longer-term 55, 100, and 200-week benchmarks remain in downtrends, highlighting a broader bearish structure. Recent trade signals reflect mixed sentiment, with both long and short entries triggered in close succession, underscoring the choppy, range-bound nature of the current market. Overall, the chart suggests a market in consolidation, with no clear breakout or breakdown, and a long-term bearish overhang despite short-term upward attempts.

Chart Analysis ATS AI Generated: 2025-08-26 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.