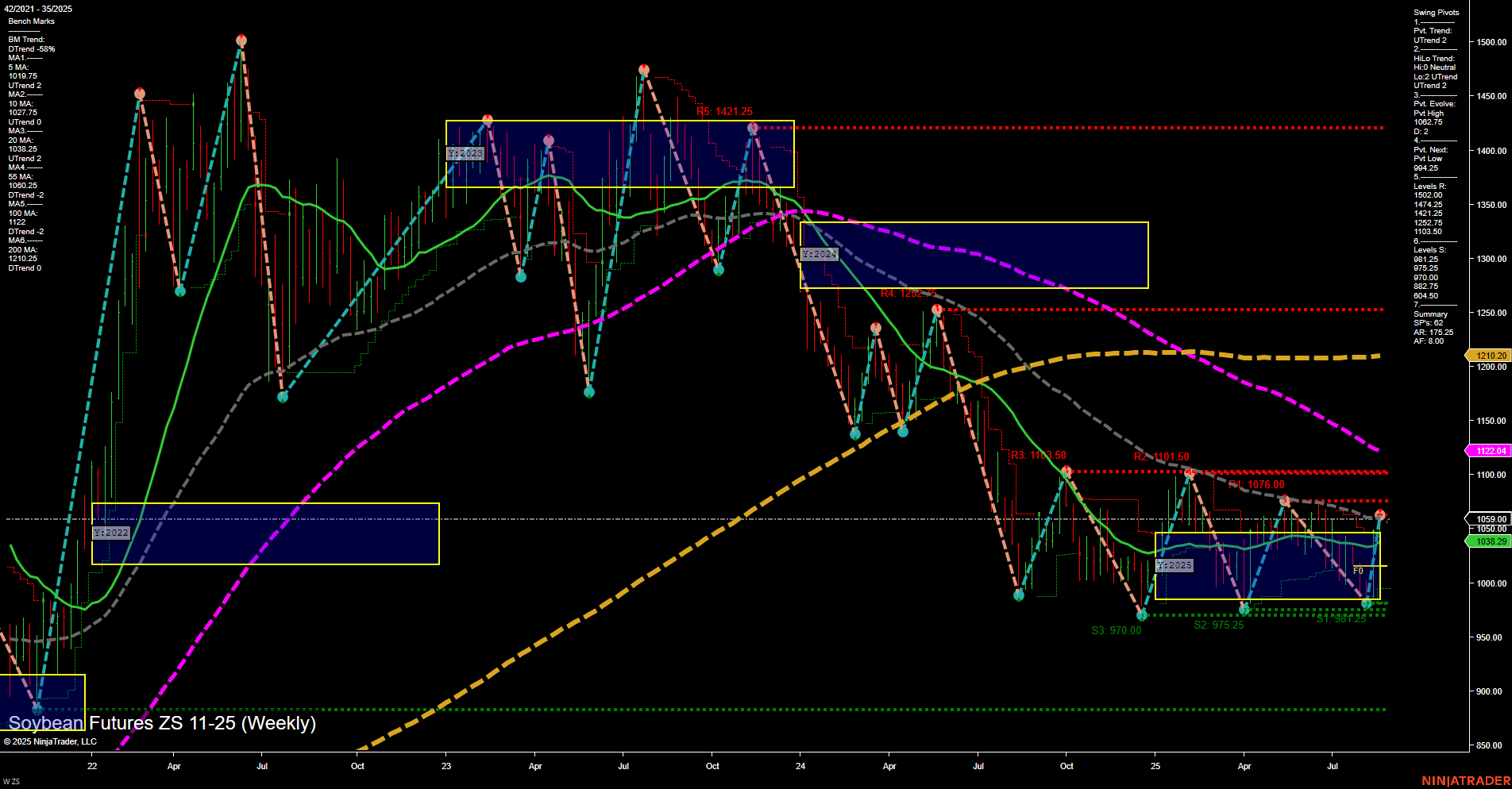

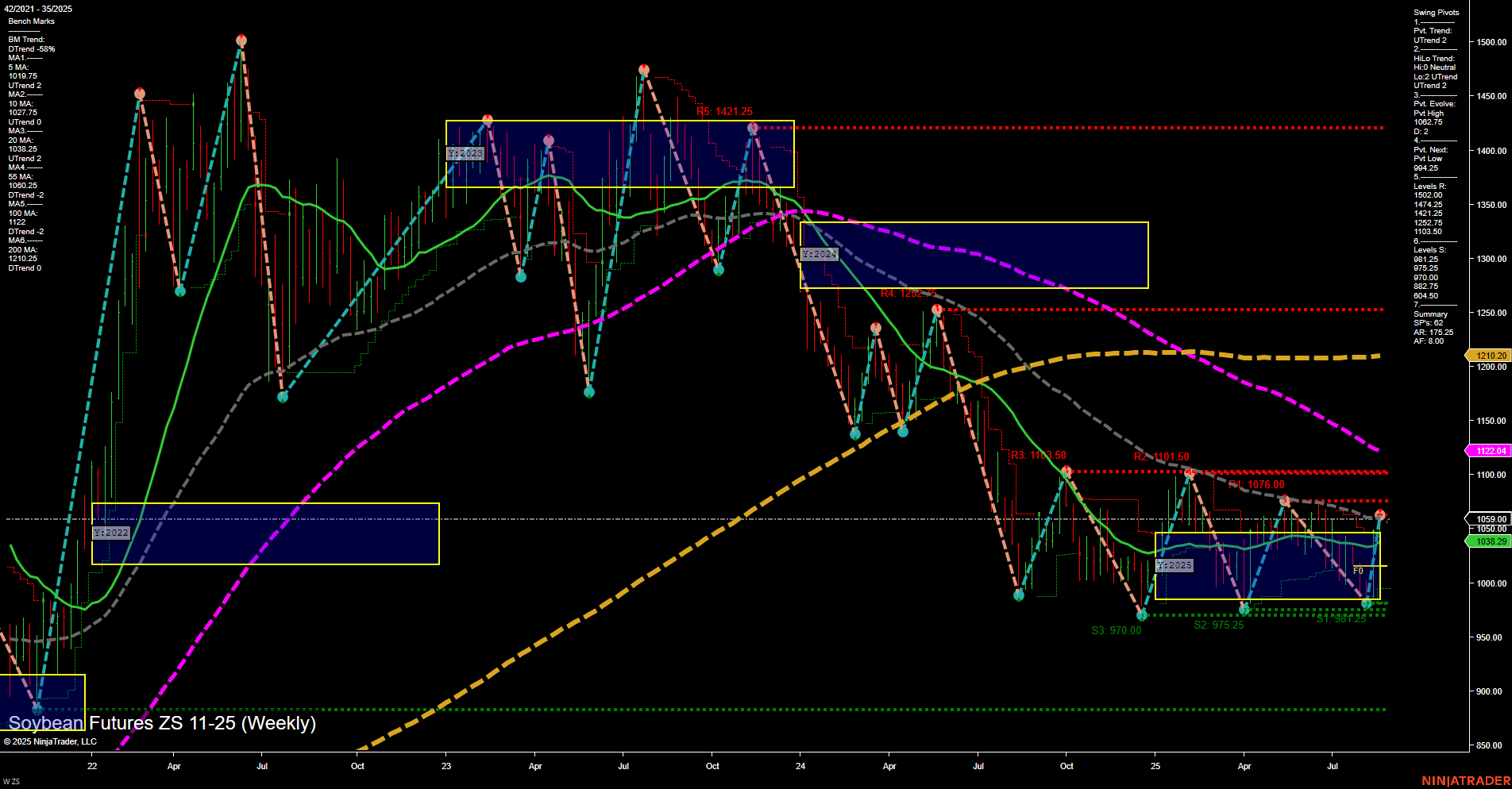

ZS Soybean Futures Weekly Chart Analysis: 2025-Aug-25 07:20 CT

Price Action

- Last: 1050.00,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 132%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1076.00,

- 4. Pvt. Next: Pvt low 987.25,

- 5. Levels R: 1400.00, 1421.25, 1262.25, 1203.75, 1101.50, 1076.00,

- 6. Levels S: 1015.25, 987.25, 975.25, 970.00, 862.75, 840.50, 675.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1047.75 Up Trend,

- (Intermediate-Term) 10 Week: 1050.25 Up Trend,

- (Long-Term) 20 Week: 1058.29 Down Trend,

- (Long-Term) 55 Week: 1122.04 Down Trend,

- (Long-Term) 100 Week: 1210.20 Down Trend,

- (Long-Term) 200 Week: 1220.25 Down Trend.

Recent Trade Signals

- 21 Aug 2025: Long ZS 11-25 @ 1049.25 Signals.USAR.TR120

- 21 Aug 2025: Long ZS 11-25 @ 1045.75 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures are showing a short-term bullish bias, with price action holding above the NTZ center and both the 5- and 10-week moving averages trending up. The WSFG and MSFG both indicate upward momentum, but the intermediate-term HiLo trend remains down, suggesting the market is still in a broader corrective phase. Long-term moving averages (20, 55, 100, 200 week) are all trending down, reflecting persistent overhead pressure and a bearish long-term structure. Recent trade signals confirm renewed short-term buying interest, but the market remains capped by significant resistance levels at 1076 and 1101.50, with support clustered near 987 and 970. The current environment is characterized by a potential base-building phase, with volatility compressing and price consolidating between major support and resistance. Swing traders will note the potential for a short-term rally continuation, but the overall structure still requires a decisive breakout above long-term resistance to shift the broader trend.

Chart Analysis ATS AI Generated: 2025-08-25 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.