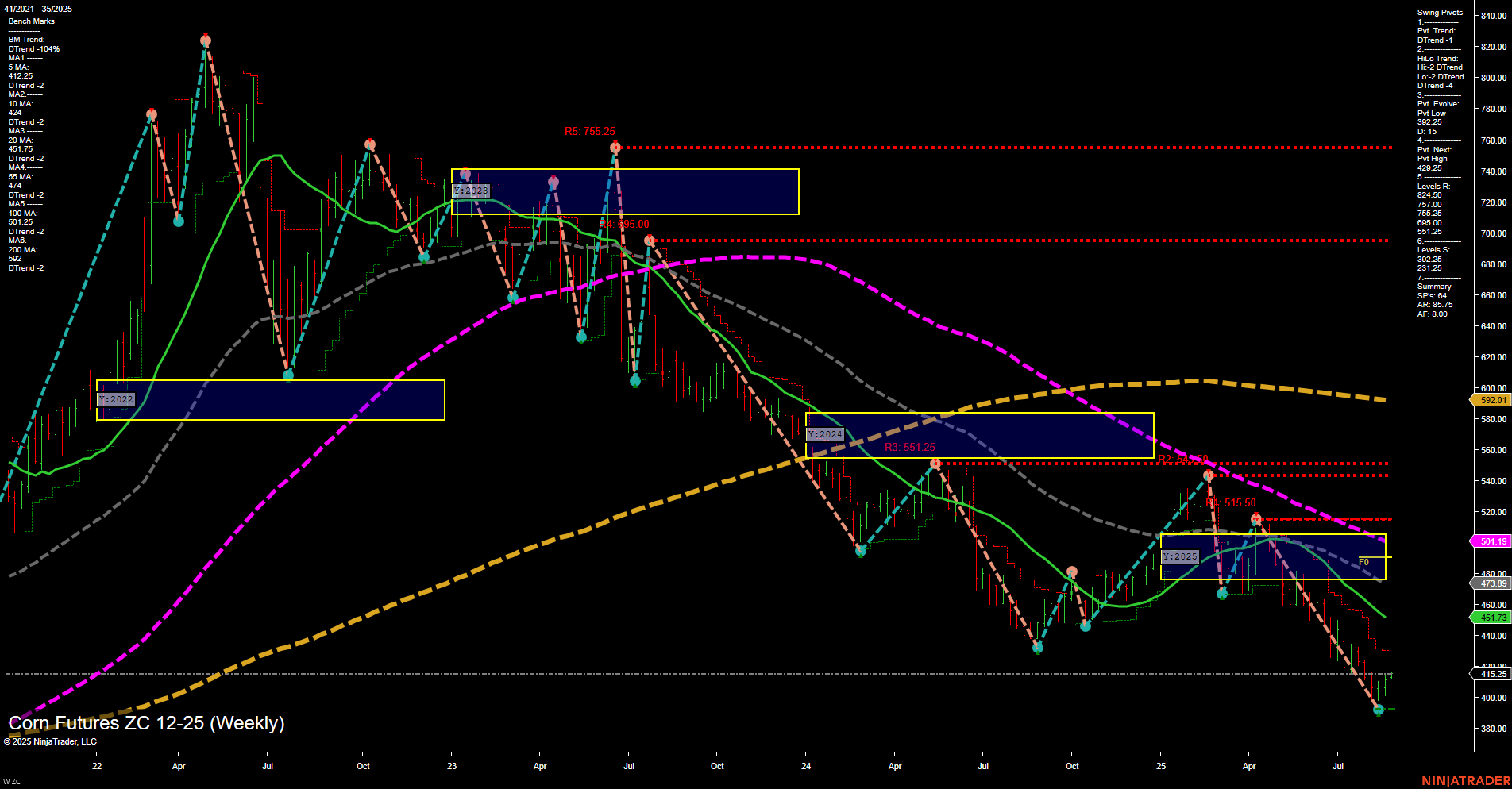

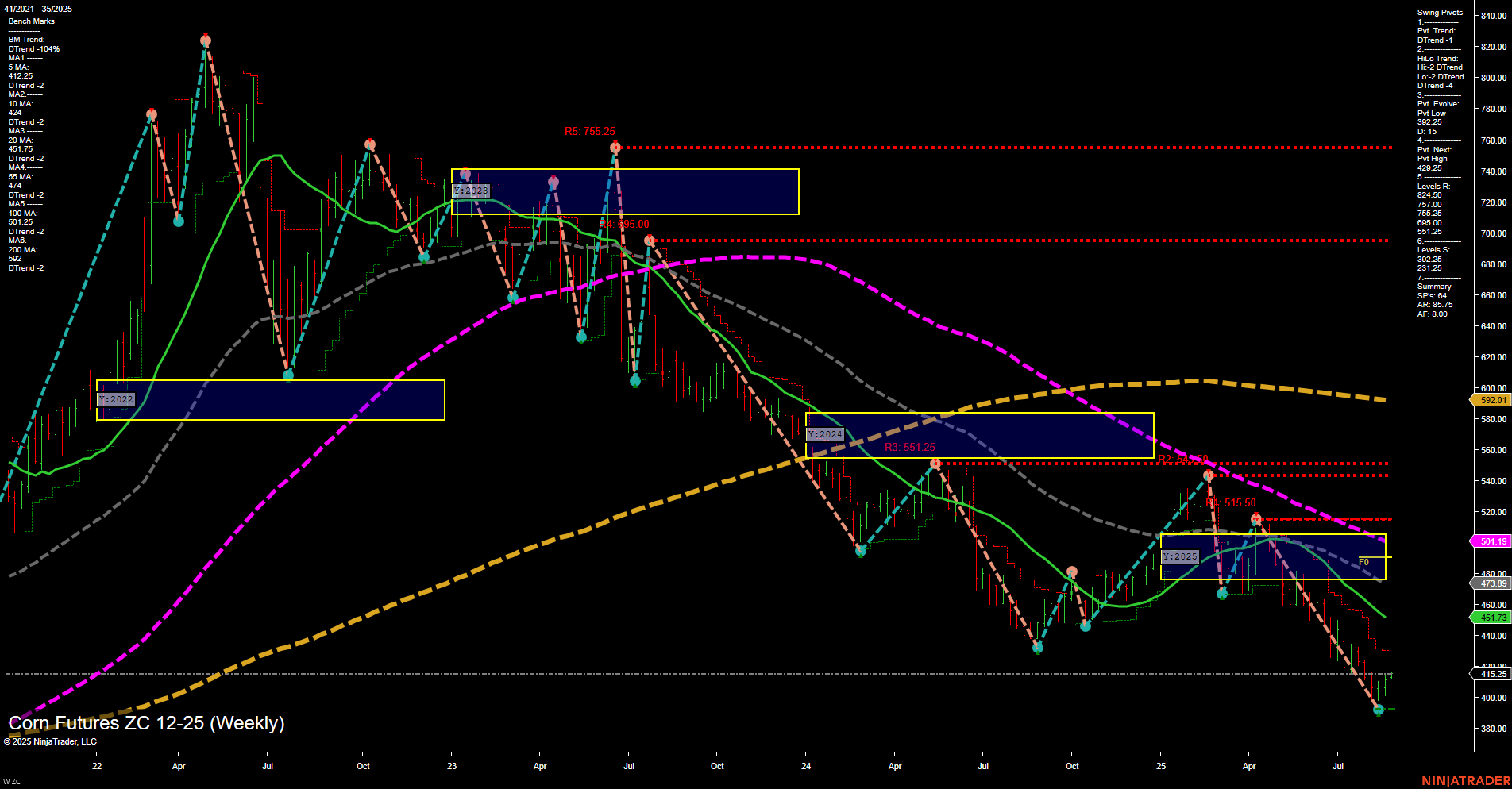

ZC Corn Futures Weekly Chart Analysis: 2025-Aug-25 07:19 CT

Price Action

- Last: 415.25,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -52%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 396.25,

- 4. Pvt. Next: Pvt high 520.48,

- 5. Levels R: 755.25, 705.00, 681.25, 551.25, 515.50,

- 6. Levels S: 396.25, 371.25, 231.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 451.73 Down Trend,

- (Intermediate-Term) 10 Week: 473.95 Down Trend,

- (Long-Term) 20 Week: 501.19 Down Trend,

- (Long-Term) 55 Week: 592.01 Down Trend,

- (Long-Term) 100 Week: 601.19 Down Trend,

- (Long-Term) 200 Week: 704.25 Down Trend.

Recent Trade Signals

- 21 Aug 2025: Long ZC 12-25 @ 408.5 Signals.USAR-WSFG

- 19 Aug 2025: Long ZC 12-25 @ 402.5 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures continue to exhibit a dominant long-term and intermediate-term downtrend, as confirmed by the negative YSFG and MSFG trends, and all major moving averages trending lower. The most recent price action shows a slow momentum bounce from a new swing low at 396.25, with price currently trading just above 415.25. Short-term, there is a slight upward bias as price is above the weekly session F0%/NTZ, but the overall structure remains weak with resistance levels stacked above and no significant break of trend yet. The recent long signals suggest a possible attempt at a short-term recovery or countertrend rally, but the prevailing trend context remains bearish. The market is in a corrective phase within a broader downtrend, with any rallies likely to face strong resistance at prior swing highs and major moving averages. Volatility remains moderate, and the chart structure suggests a market in the process of testing support and potentially forming a base, but confirmation of a sustained reversal is lacking at this stage.

Chart Analysis ATS AI Generated: 2025-08-25 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.