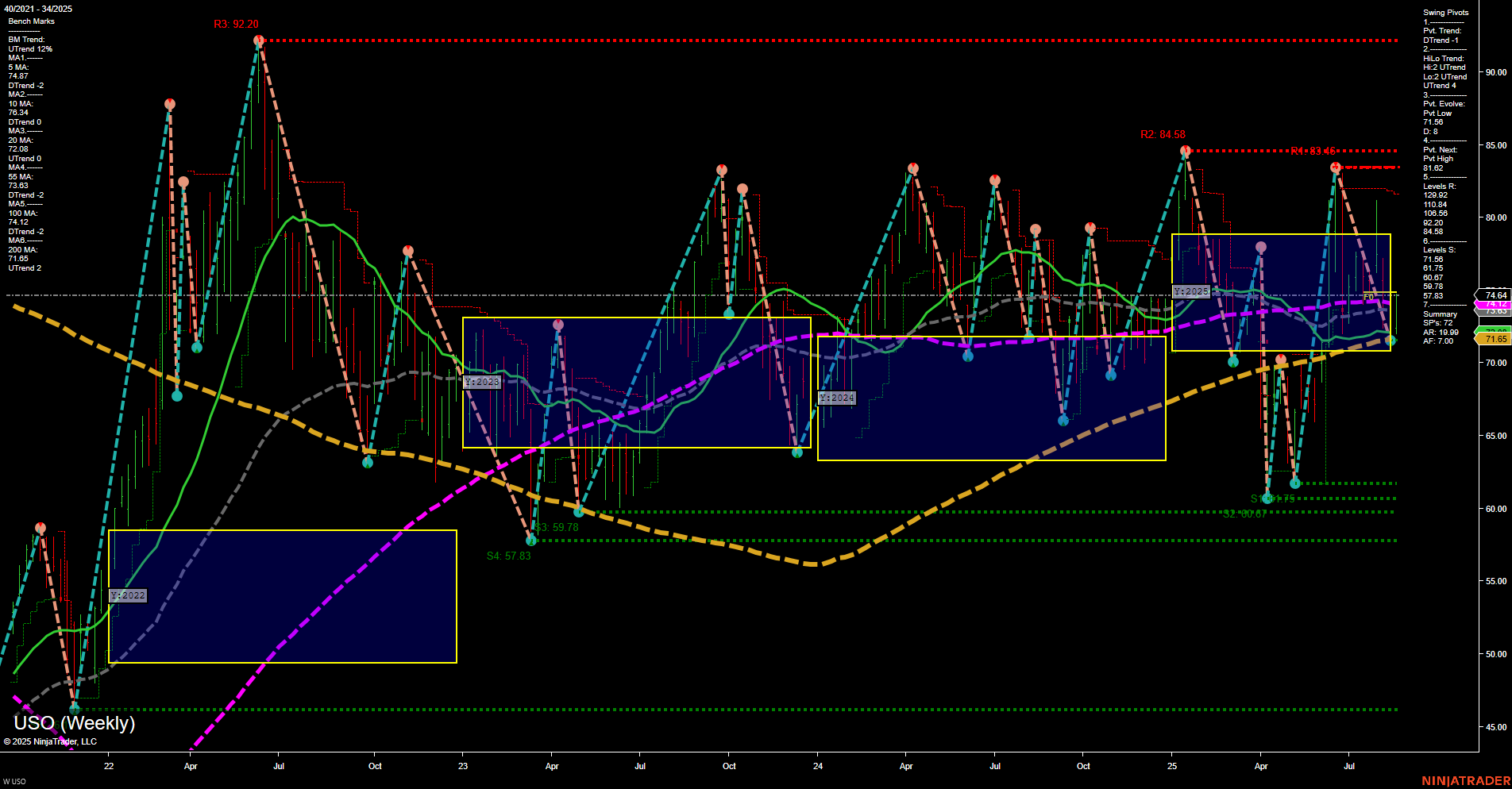

USO is currently trading in a medium-range bar environment with slow momentum, reflecting a period of consolidation after recent volatility. The short-term trend has shifted to the downside, as indicated by the swing pivot DTrend and both the 5- and 10-week moving averages trending lower. However, the intermediate-term HiLo trend remains upward, suggesting underlying support and a lack of decisive breakdown. Long-term moving averages (20, 55, 100, and 200 week) are all in uptrends, reinforcing a bullish structural bias over the longer horizon. The price is situated within the yearly NTZ (neutral zone), with no clear directional bias from the session fib grids, and is currently closer to support levels (notably 71.56 and 66.75) than to major resistance (81.42 and above). This technical setup points to a market in transition, with short-term weakness but longer-term resilience. The chart shows repeated tests and rejections at higher resistance, while higher lows on the long-term suggest buyers are still present on deeper pullbacks. The environment is choppy, with no clear breakout or breakdown, and the market is likely to remain range-bound unless a catalyst emerges to drive a sustained move beyond the NTZ boundaries.