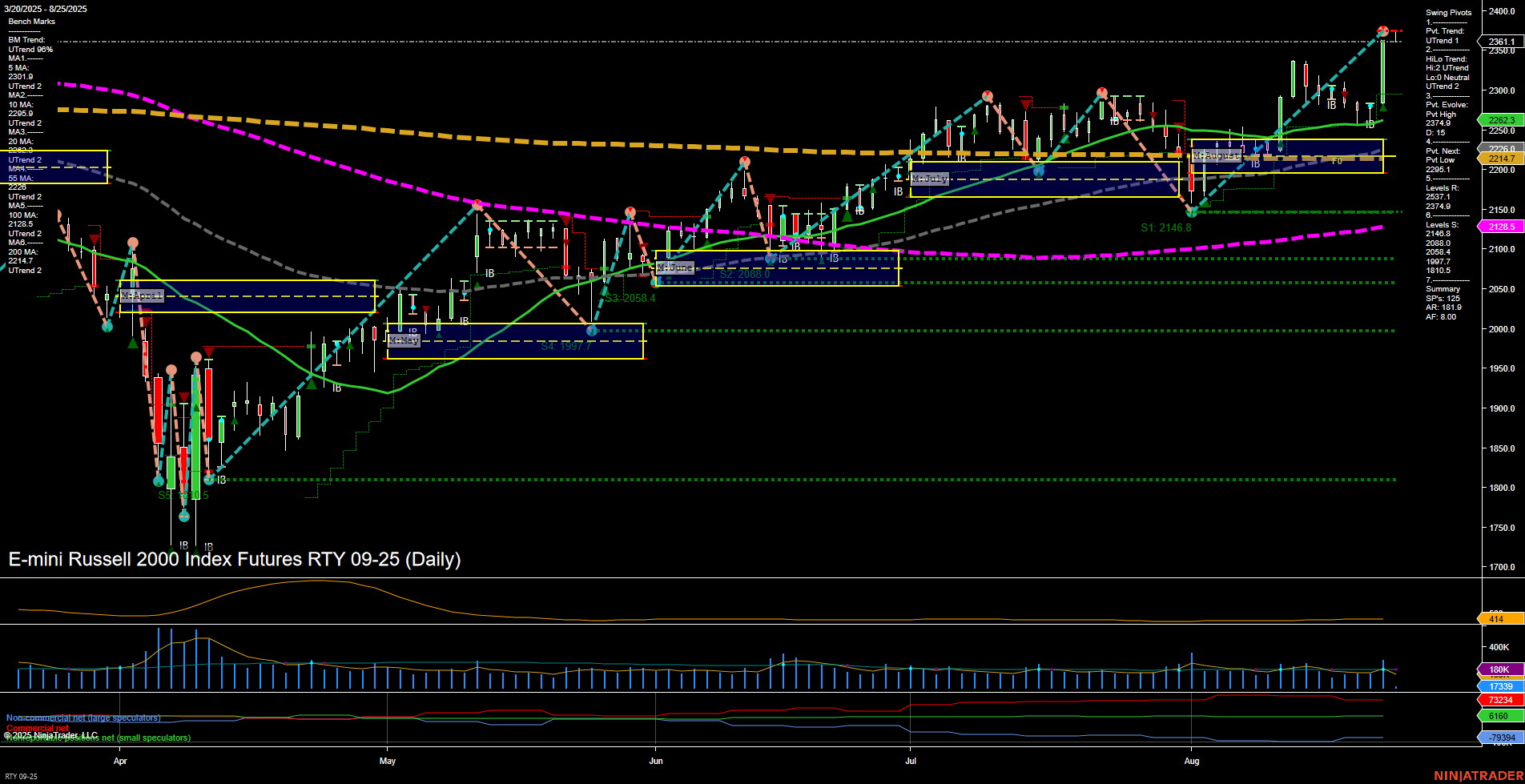

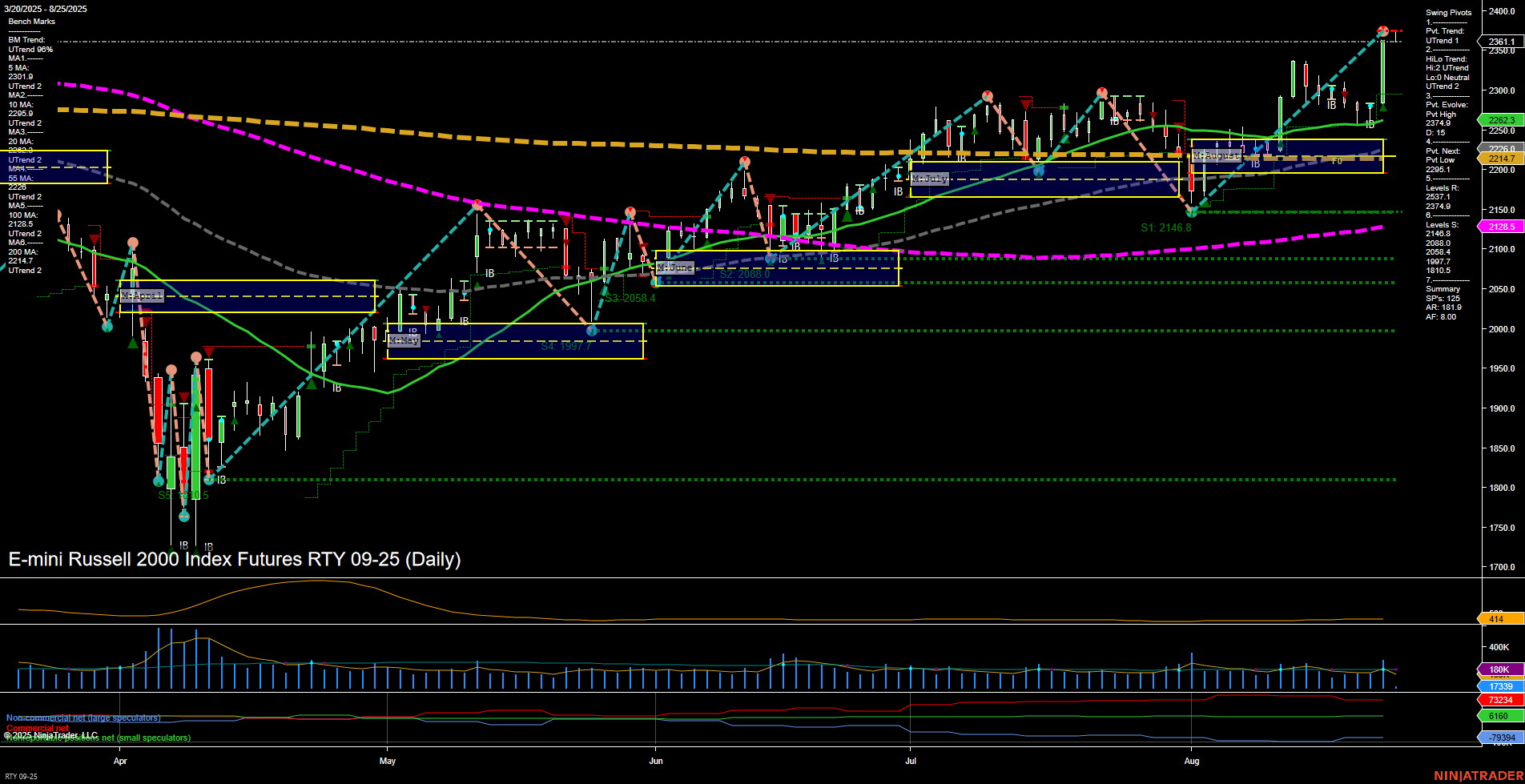

RTY E-mini Russell 2000 Index Futures Daily Chart Analysis: 2025-Aug-25 07:14 CT

Price Action

- Last: 2361.1,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: 113%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2361.1,

- 4. Pvt. Next: Pvt low 2241.7,

- 5. Levels R: 2374.9, 2361.1,

- 6. Levels S: 2241.7, 2146.8, 2088.4, 2068.0, 1801.5.

Daily Benchmarks

- (Short-Term) 5 Day: 2301.9 Up Trend,

- (Short-Term) 10 Day: 2268.8 Up Trend,

- (Intermediate-Term) 20 Day: 2269.6 Up Trend,

- (Intermediate-Term) 55 Day: 2217.8 Up Trend,

- (Long-Term) 100 Day: 2128.5 Up Trend,

- (Long-Term) 200 Day: 2247.4 Up Trend.

Additional Metrics

Recent Trade Signals

- 22 Aug 2025: Long RTY 09-25 @ 2291.2 Signals.USAR.TR120

- 21 Aug 2025: Short RTY 09-25 @ 2271.4 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 is exhibiting strong bullish momentum, with a large fast-moving bar pushing price to new swing highs at 2361.1. All benchmark moving averages across short, intermediate, and long-term timeframes are trending upward, confirming broad-based strength. The short-term swing pivot trend and intermediate HiLo trend are both in uptrends, with resistance now at 2374.9 and 2361.1, and key support levels well below current price, indicating a significant buffer before any major downside risk emerges. The ATR remains elevated, reflecting heightened volatility, while volume is robust, supporting the move. Recent trade signals have flipped from short to long, aligning with the current bullish structure. The price is above both the monthly and yearly session fib grid NTZs, reinforcing the intermediate and long-term uptrends, though the weekly grid shows a short-term pullback context. Overall, the technical landscape favors continued upside momentum, with the market in a strong trending phase and buyers in control.

Chart Analysis ATS AI Generated: 2025-08-25 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.