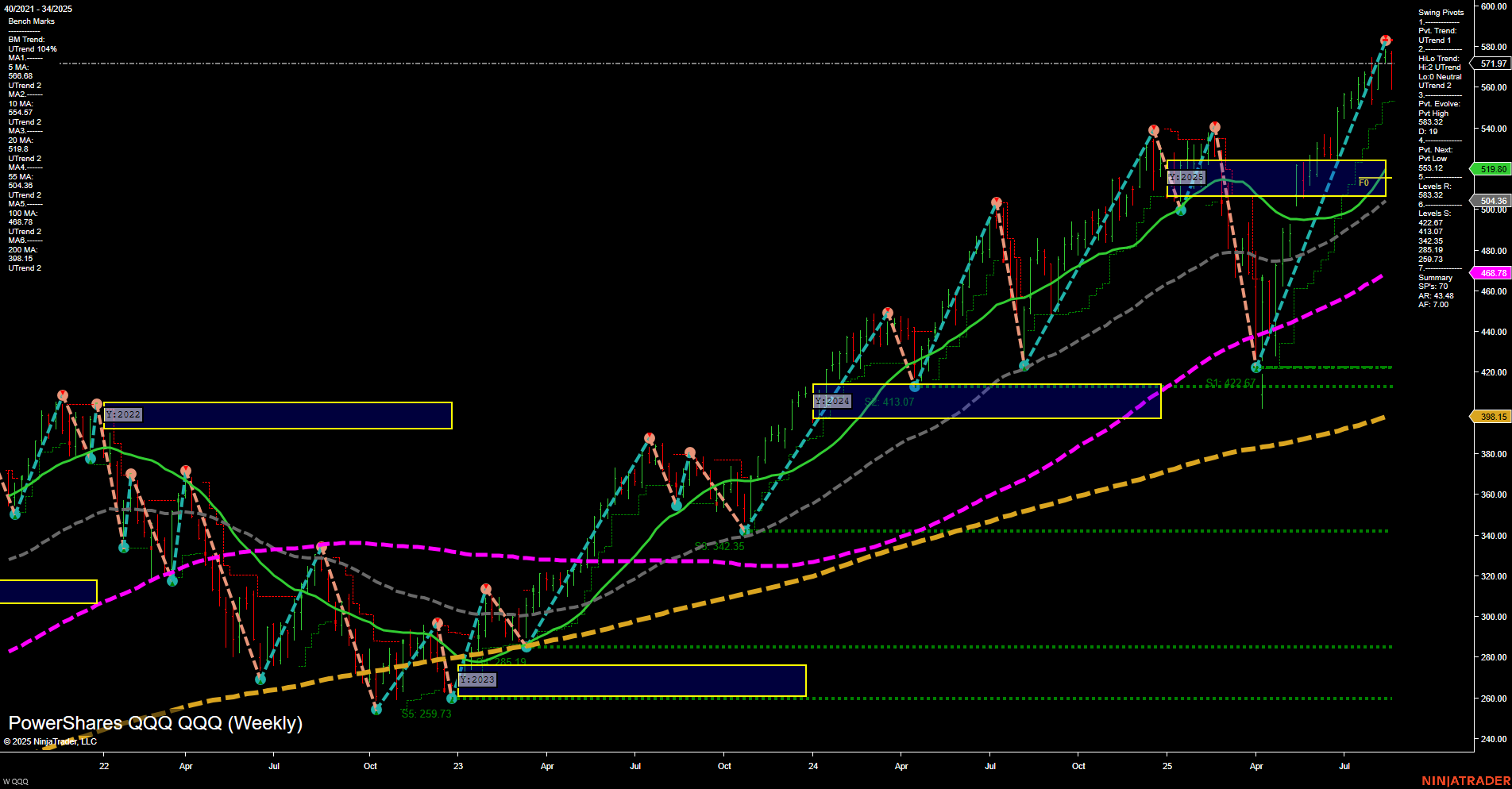

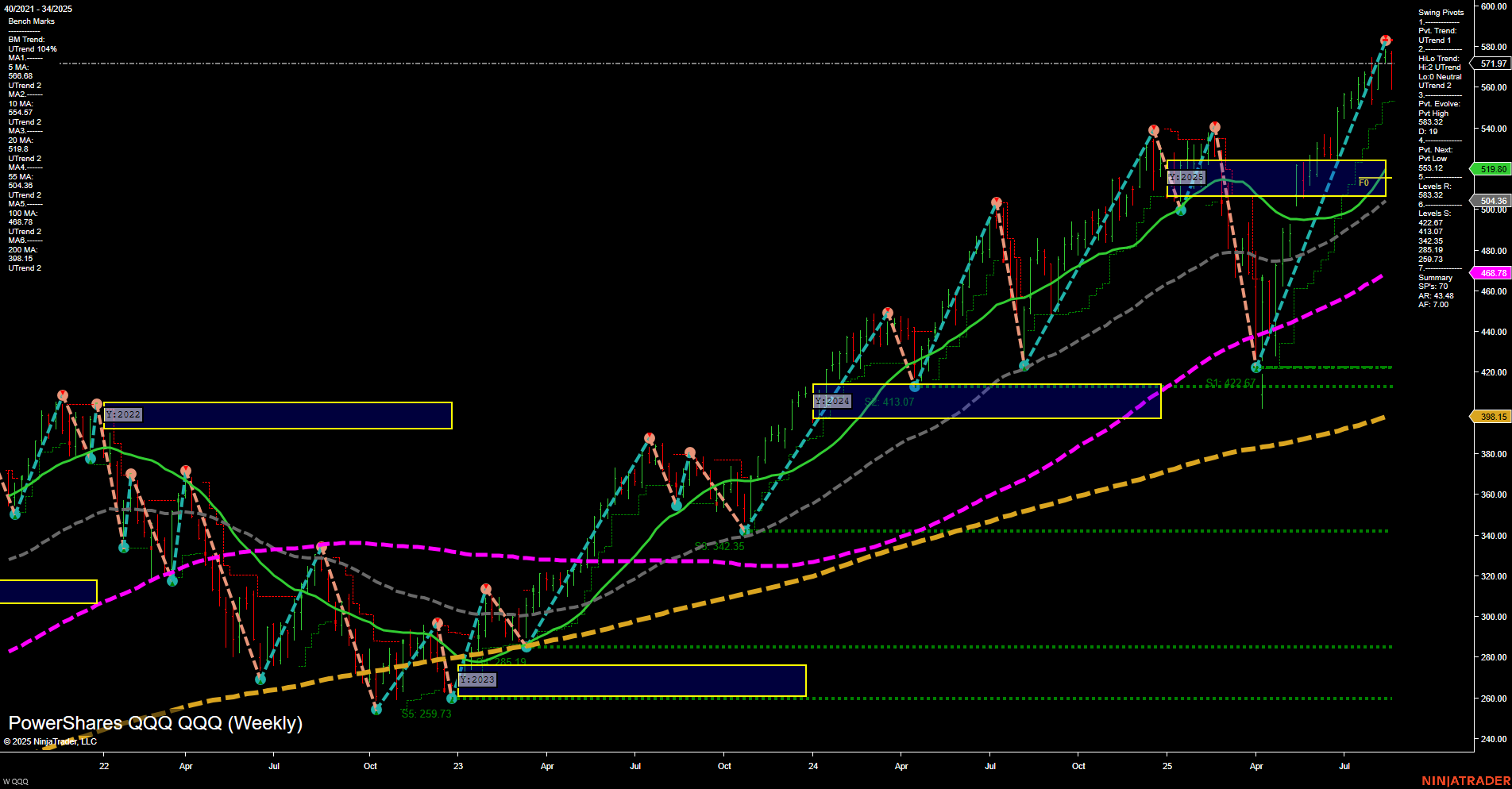

QQQ PowerShares QQQ Weekly Chart Analysis: 2025-Aug-25 07:13 CT

Price Action

- Last: 519.60,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 553.98,

- 4. Pvt. Next: Pvt low 519.60,

- 5. Levels R: 571.97, 553.98,

- 6. Levels S: 468.78, 413.07, 372.35, 322.67, 259.73, 259.19.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 506.68 Up Trend,

- (Intermediate-Term) 10 Week: 514.57 Up Trend,

- (Long-Term) 20 Week: 519.18 Up Trend,

- (Long-Term) 55 Week: 500.34 Up Trend,

- (Long-Term) 100 Week: 468.78 Up Trend,

- (Long-Term) 200 Week: 398.15 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ weekly chart reflects a strong bullish structure across all timeframes, with price action maintaining above all major moving averages and a clear uptrend in both short- and intermediate-term swing pivots. The most recent swing high at 553.98 and the current price near 519.60 suggest a healthy pullback within a broader uptrend, with support levels well below current price, indicating a wide margin for potential retracement before any structural damage to the trend. Resistance is defined at recent highs, while support is layered at prior swing lows and key moving averages. The neutral bias in the session fib grids suggests a period of consolidation or digestion after a strong rally, but the overall trend remains intact. Volatility appears moderate, and the absence of reversal signals or breakdowns in moving averages supports the ongoing bullish outlook. This environment is typical of a trending market with periodic pullbacks, offering swing traders opportunities to monitor for continuation or deeper retracement setups.

Chart Analysis ATS AI Generated: 2025-08-25 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.