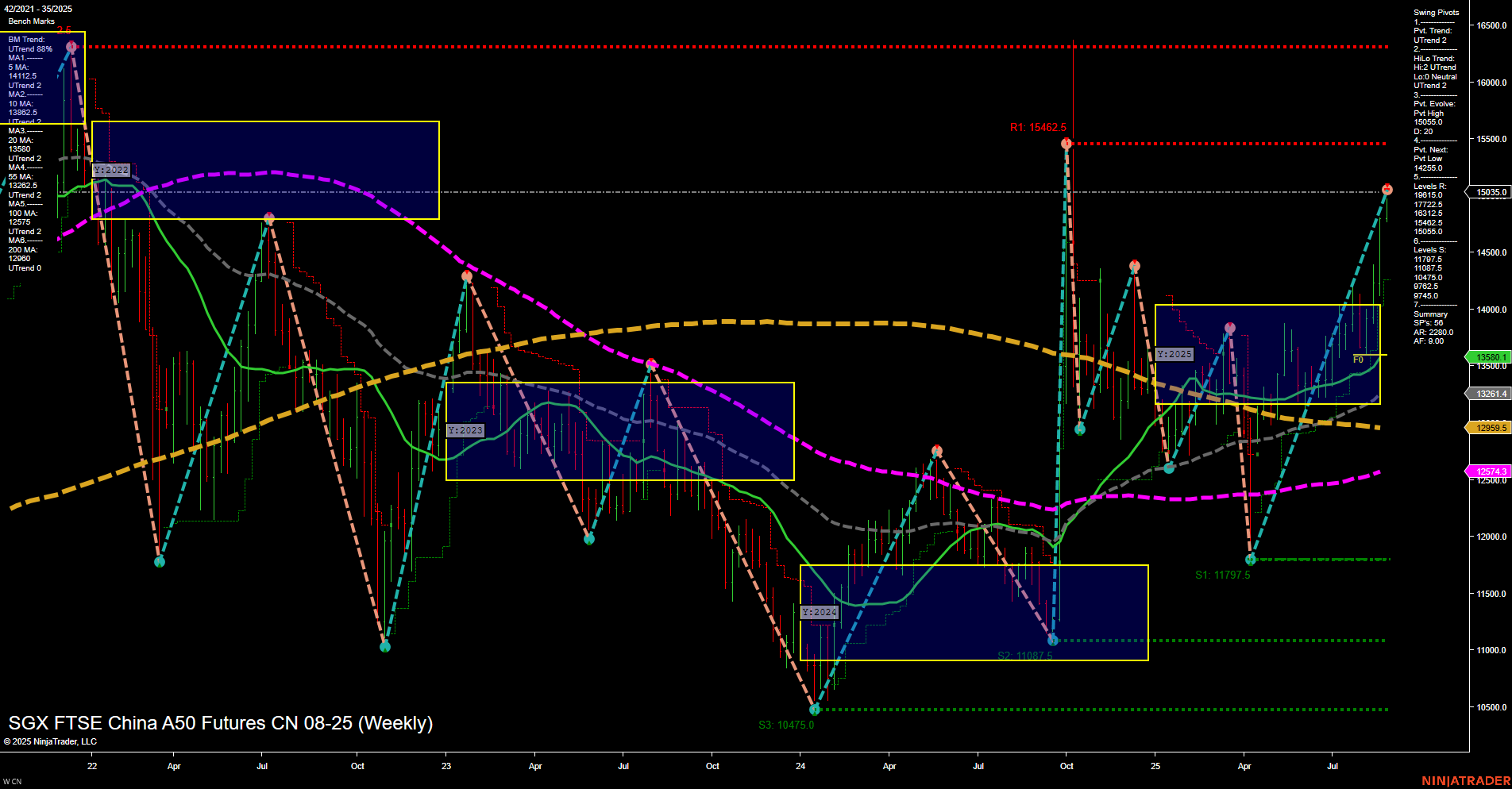

The CN SGX FTSE China A50 Futures weekly chart shows a strong upward momentum with large bullish bars and a fast pace, indicating robust buying interest. Both short-term and intermediate-term swing pivot trends are in an uptrend, with the most recent pivot high at 14,258.0 and the next significant pivot low at 12,000.0, suggesting a higher high pattern. Resistance levels are stacked above, with the major resistance at 15,462.5, while support is well below at 11,097.5 and 10,475.0, highlighting a wide trading range. All key weekly moving averages (5, 10, 20, 55 week) are trending up, reinforcing the bullish bias in the short and intermediate term, though the 100 and 200 week MAs remain in a downtrend, tempering the long-term outlook to neutral. The price is currently trading above all major moving averages, reflecting a strong recovery from previous lows and a potential shift in market sentiment. The overall structure suggests a transition from a prolonged consolidation and base-building phase into a possible new bullish cycle, with volatility and breakout potential remaining elevated. No clear directional bias is present in the Fib grid trends, indicating the market is not overextended in either direction. The technical landscape favors continued monitoring for trend continuation or signs of exhaustion as the market approaches key resistance levels.