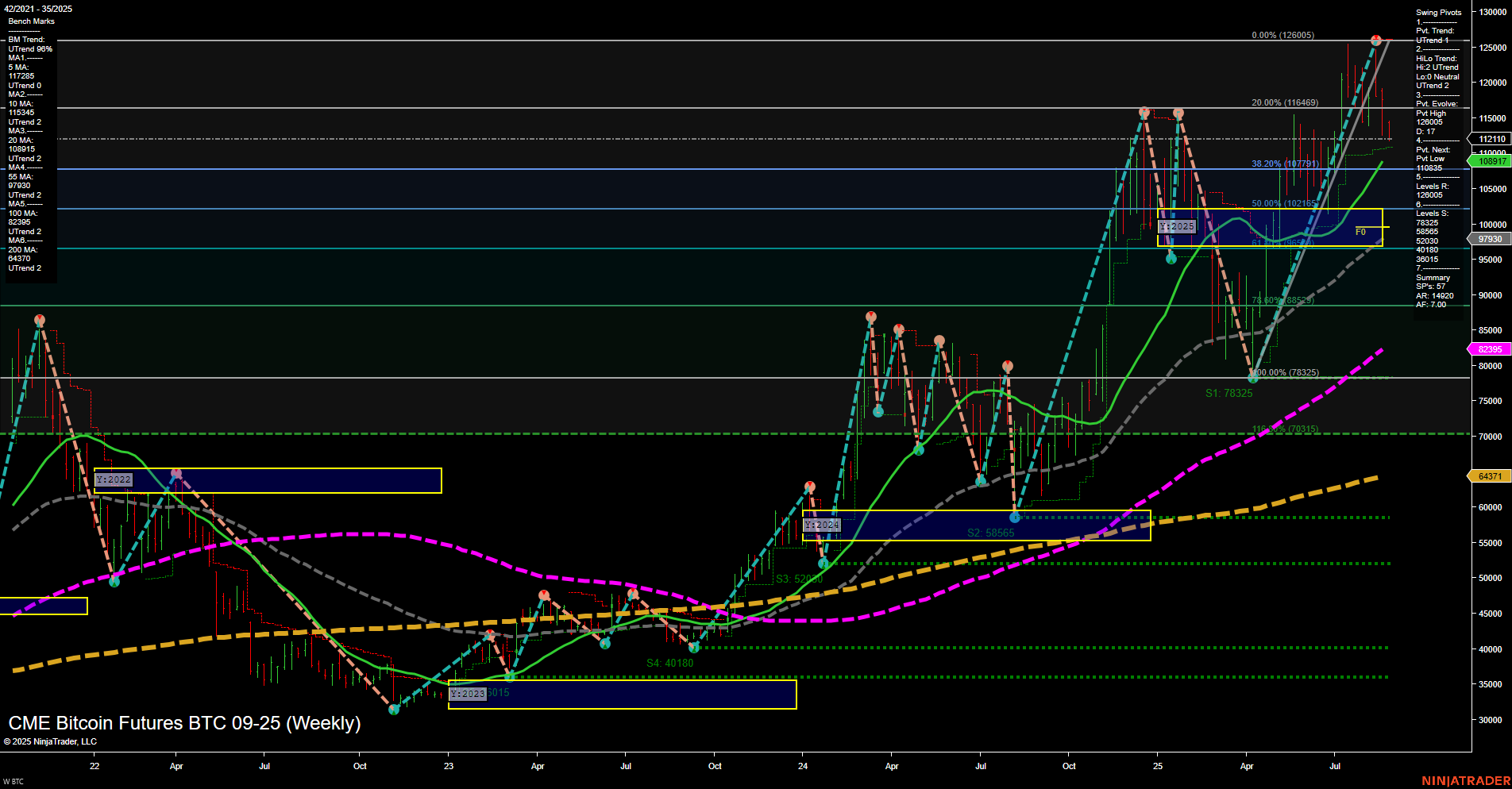

BTC CME Bitcoin Futures are showing a mixed environment for swing traders. Price action remains volatile with large bars and fast momentum, indicating heightened activity and potential for sharp moves. Short-term and intermediate-term Fib grid trends (WSFG, MSFG) are both down, with price below their respective NTZ/F0% levels, suggesting recent pullbacks or corrections. However, the long-term yearly grid (YSFG) remains up, with price well above the yearly NTZ/F0%, reflecting a strong underlying uptrend. Swing pivot analysis shows the current trend is up for both short and intermediate terms, with the most recent pivot high at 126005 and the next key support at 109817. Resistance levels are stacked above, with 126005 as the major swing high. Support levels are well-defined below, providing a clear structure for potential retracements. All benchmark moving averages from 5-week to 200-week are in uptrends, reinforcing the long-term bullish structure despite recent short-term weakness. Recent trade signals have been mixed, with both long and short entries triggered in the past week, highlighting the choppy and indecisive nature of the current market phase. Overall, the market is consolidating after a strong rally, with short- and intermediate-term trends pausing or correcting within a broader bullish context. Swing traders should note the potential for further volatility and range-bound action in the near term, while the long-term trend remains constructive.