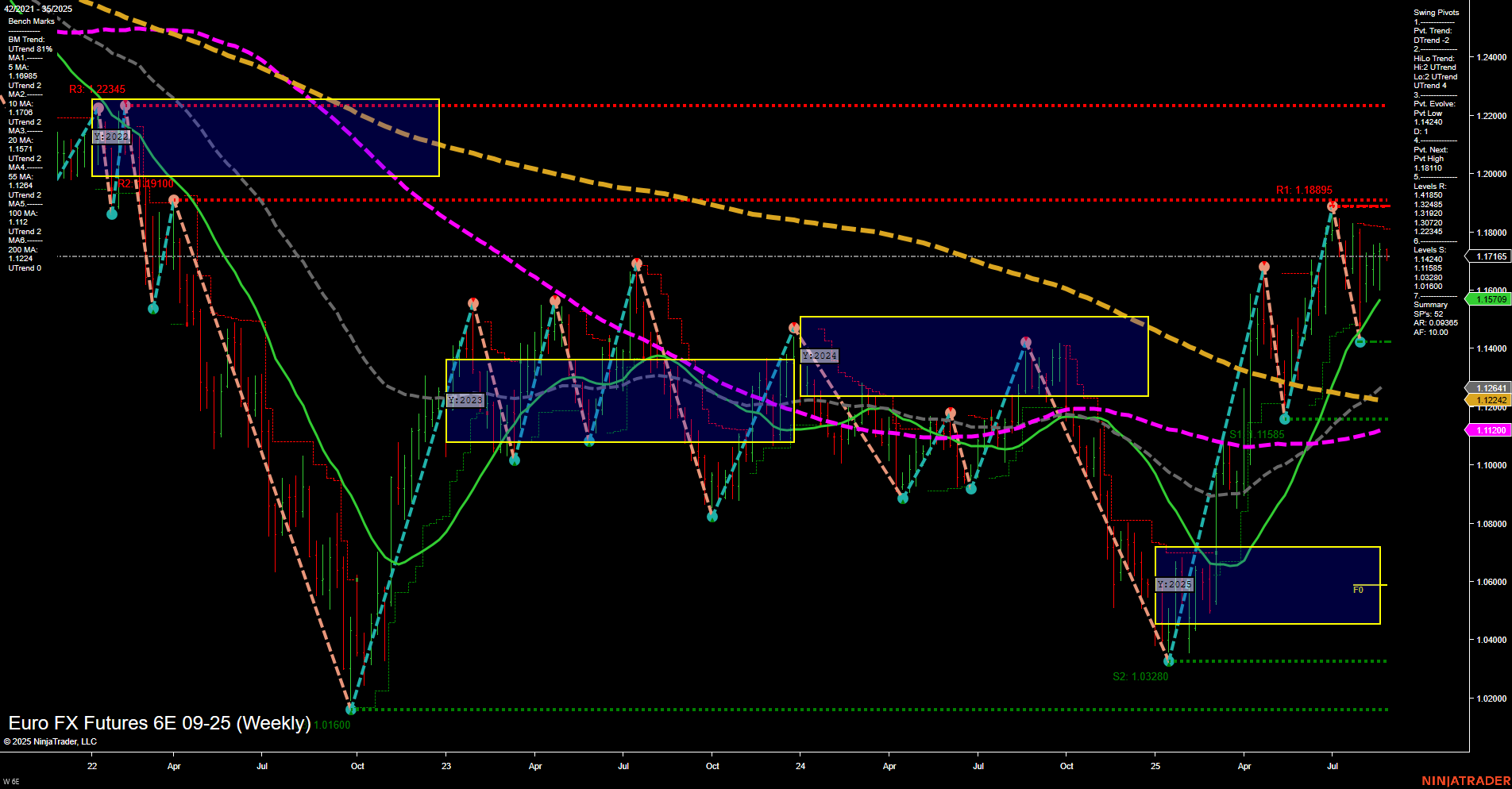

The 6E Euro FX Futures weekly chart shows a market transitioning from a period of consolidation and retracement into a more constructive uptrend, especially on the intermediate and long-term horizons. Price is currently trading above most key moving averages (5, 10, 20, 55, 100 week), all of which are in uptrends except the 200-week, which remains in a downtrend but is flattening. The short-term WSFG trend is down, with price just below the NTZ center, suggesting some near-term hesitation or pullback after a recent rally. However, both the monthly and yearly session fib grids are strongly up, with price well above their NTZ centers, indicating robust intermediate and long-term bullish structure. Swing pivot analysis confirms this, with both short-term and intermediate-term trends up, and the next key resistance at 1.18895. Support is layered below at 1.11585 and 1.03280, reflecting the market's recent higher low structure. Recent trade signals have triggered new long entries, aligning with the prevailing uptrend in the majority of benchmarks. Overall, the market is in a bullish phase on higher timeframes, with short-term consolidation or minor pullback possible before a potential continuation higher. The technical landscape favors trend continuation, with the next upside test at the recent swing high and resistance zone.