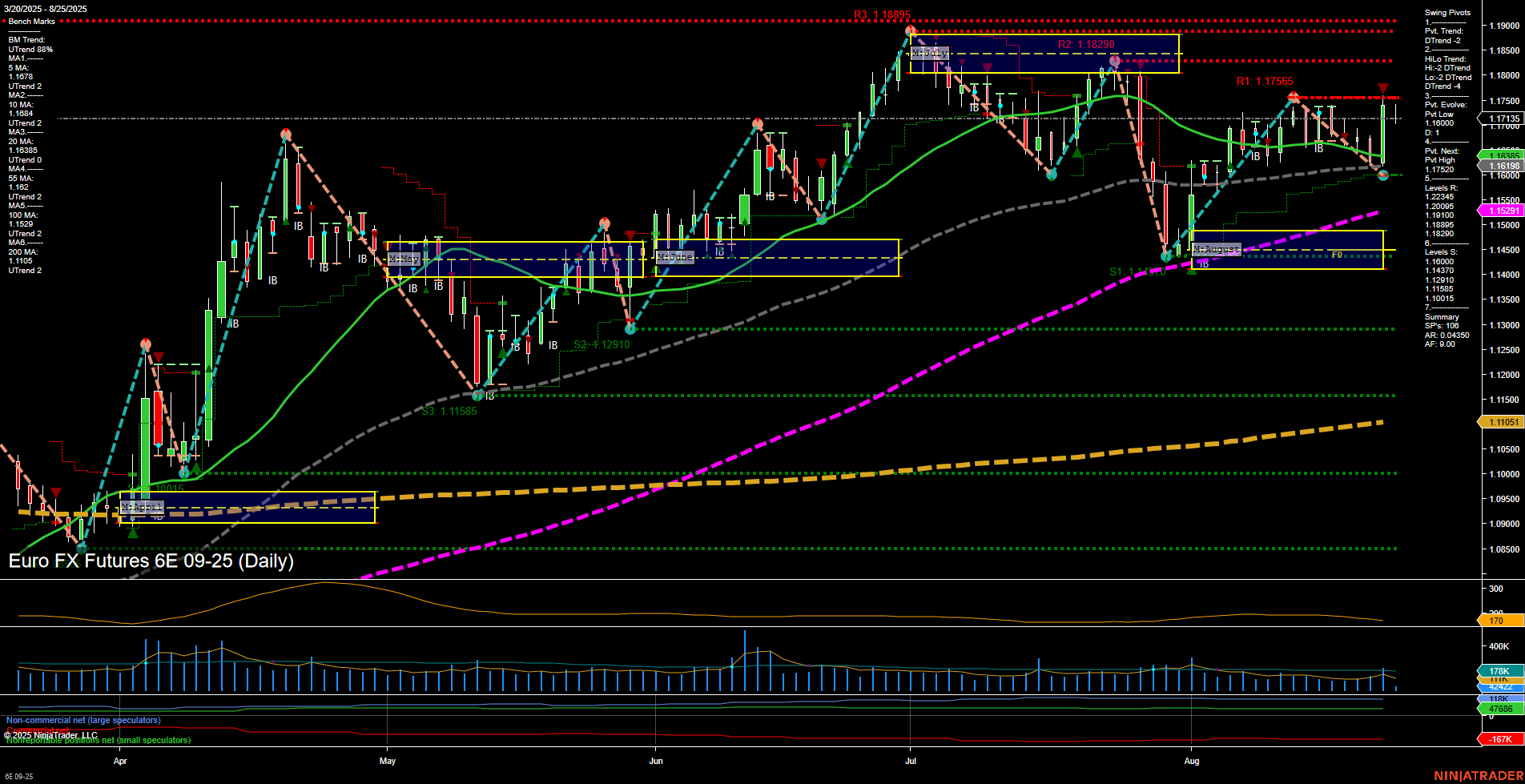

The 6E Euro FX Futures daily chart shows a market in transition. Price action is currently consolidating near 1.17520, with medium-sized bars and average momentum, suggesting a pause after recent movement. The short-term WSFG trend is down, with price below the weekly NTZ, indicating some near-term weakness or corrective action. However, both the monthly and yearly session fib grids show price well above their respective NTZs, with strong uptrends, reflecting underlying bullishness on intermediate and long-term horizons. Swing pivots confirm a short-term and intermediate-term downtrend, with the most recent pivot low at 1.17135 and the next potential pivot high at 1.17560. Resistance is layered above at 1.17565, 1.18290, and 1.19000, while support is well-defined below, starting at 1.17135 and extending down to 1.11051. Daily benchmarks show a mixed short-term picture: the 5-day MA is trending down, but the 10-day and all longer-term MAs are trending up, reinforcing the idea of a short-term pullback within a broader uptrend. ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals have triggered long entries, aligning with the intermediate and long-term bullish structure, despite the short-term consolidation. Overall, the market is in a corrective phase short-term, but the dominant trend remains upward, with the potential for further gains if resistance levels are overcome and the short-term trend re-aligns with the higher timeframes.